Decreasing Patronage of Existing Entertainment

Decreasing Patronage of Existing Entertainment

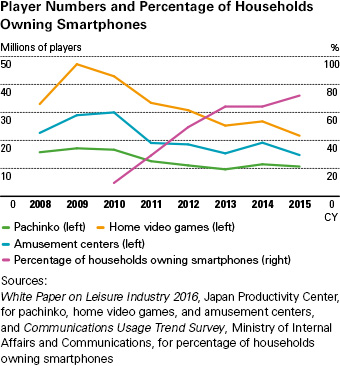

Pachinko, home video games, and amusement centers had become Japan's national pastimes by the 2000s. Since 2010, however, they have seen a downward trend in player numbers. This decrease mainly reflects lackluster consumer spending, the aging population, and the diversifying ways in which the young generation, who are the core players, spend leisure time as smartphones become increasingly popular. Competition to monopolize the young generation's leisure time is transcending boundaries of the entertainment industry to include social networking services (SNS) and a wide range of other industries. Further, for entertainment companies, stimulating the market by developing middle-aged and elderly people, women, and the young generation as customer groups has become an important task.

Emerging Oligopoly in the Pachinko and Pachislot Machine Market

Emerging Oligopoly in the Pachinko and Pachislot Machine Market

Due to Regulations and Decrease in Player Population

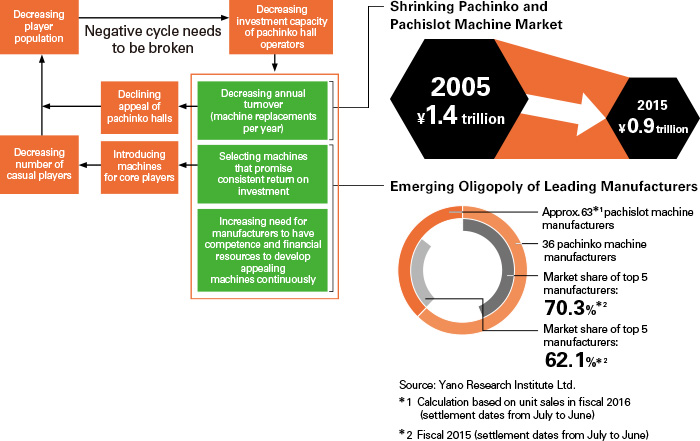

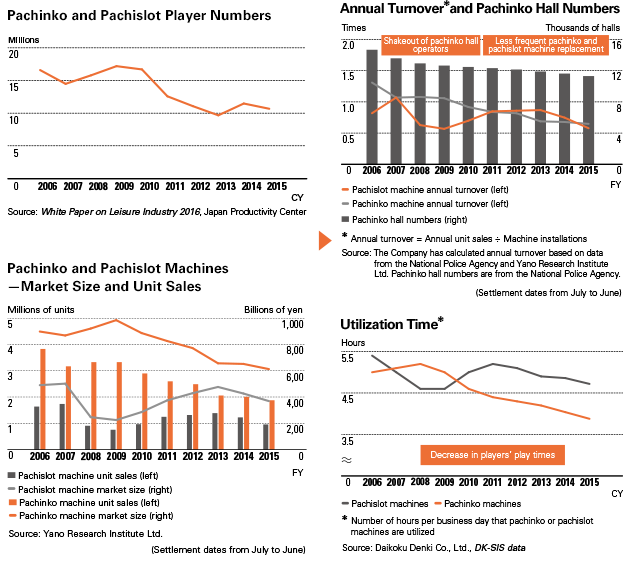

Long-term decline in the pachinko and pachislot player population has reduced pachinko hall operators' investment capacity, encouraging a bias in demand toward pachinko and pachislot machine manufacturers with machines able to provide reliable returns on investment. In addition, the introduction of stricter regulations in recent years has made the specifications for pachinko and pachislot machines more demanding. Consequently, the contrast between winners and losers is becoming even more pronounced due to differences in companies' ability to develop and manufacture advanced, high-quality products.

Continuing Effect of Regulations

Continuing Effect of Regulations

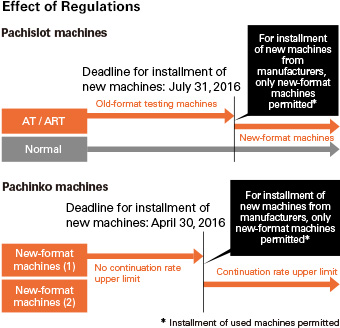

Since September 2014, the pachinko and pachislot machine market has seen the gradual implementation of voluntary regulations. As a result, fewer new pachinko and pachislot machine titles have been released. Companies' ability to create durable, high-quality machines that comply with the new regulations while retaining appealing gameplay is likely to become a differentiating factor that widens the gap among companies even further.

Pachinko and Pachislot Machine Market's Regulatory Process

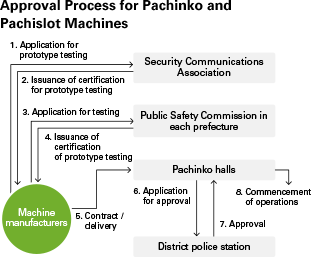

Before launching new products, pachinko and pachislot machine manufacturers have to proceed through various approval processes based on the Entertainment Establishments Control Law. These approval processes inspect products to determine whether their materials, functions, and gameplay conform to the specifications that current regulations set. Not receiving certification can severely affect sales plans. Also, regulatory revision can affect gameplay.

Long-Term Market Trends

In the pachinko and pachislot machine market, the player population continues to decrease. Focused on controlling excessive gambling elements, the regulatory revision of July 2004 rapidly changed pachislot machines' gameplay and accelerated the decrease in the player population centered on casual players. Also, the price of pachinko machines rose. The resulting downturn in sales and higher investment burden worsened pachinko hall operators' business results. This demand-side situation affected competitive conditions for pachinko and pachislot machine manufacturers. Moreover, the introduction of new regulations from 2014 has changed conditions in the pachinko and pachislot machine market again.

→ Market 3, Continuing Effect of Regulations

Softening Growth in Japan's Digital Game Market

Softening Growth in Japan's Digital Game Market

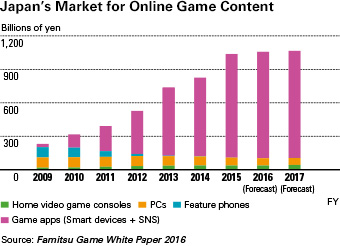

Smartphone apps have spurred phenomenal growth in online games. In particular, business models based on Free-to-Play (F2P) games for smartphones have made it easier for players to participate, thereby widening the range of players covered. In Japan, the pace of growth in the app market has been slowing steadily as the spread of smartphones reaches the end of a cycle.

Increasing Sophistication of Apps and

Increasing Sophistication of Apps and

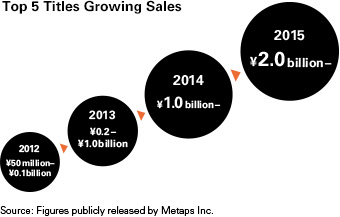

Growing Focus on Market-Leading Apps

In the smartphone app market, the focus of demand on popular apps is becoming marked as titles at the top of sales rankings become more dominant each year. Further, the emergence of high-performance smart devices is encouraging the development of increasingly high-end game apps. As a result, a market is forming in which companies with the competence and funds to develop such apps will survive.

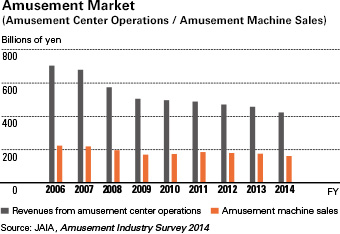

Focusing on Revitalization of the Amusement Market

Focusing on Revitalization of the Amusement Market

In the amusement center operations market, the player population is trending toward long-term decline. Further, a consumption tax increase and deterioration in the financial positions of amusement center operators have directly affected the amusement machine sales market. To revitalize the amusement market, the amusement machine sales and amusement center operations industries are taking a range of concerted measures, which include offering new business models, pursuing broader marketing that targets families' three generations, and stepping up business collaborations.