Cost Structure Reform and Business Structure Reform

Fiscal 2016 Overall Evaluation

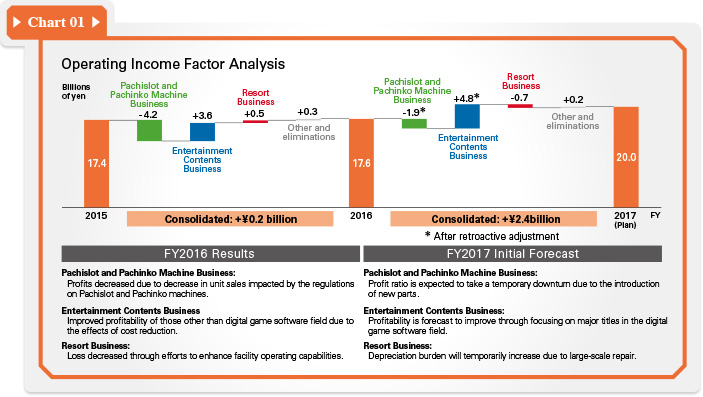

Fiscal 2016 results were disappointing because, although we secured roughly the same level of operating income as in the previous fiscal year, we did not meet initial targets for net sales and respective earnings classifications. This underperformance was mainly attributable to the fact that in the digital game area, which we have positioned as a driver of earnings growth, PC online games rolled out in overseas markets and long-awaited new titles for smartphones released in Japan did not become as popular as we had hoped.

Meanwhile, despite facing challenging business conditions, the Pachislot and Pachinko Machine Business segment fulfilled its role as the Group's earnings pillar. Further, in the Entertainment Contents Business segment, each business area, with the exception of the digital game area, improved profitability significantly, testifying to the concrete benefits of cost structure reform implemented in fiscal 2015.

Steady Improvement in the Cost Structure

The markets our businesses cater to are shrinking because of the rapid spread of smartphones and stricter regulation of the pachinko and pachislot machine market. To continue investment in the digital game area and the Resort Business segment and to sustain growth, we urgently need to realize radical improvement in the profitability of each business, thereby establishing a robust earnings structure that will give us a stable revenue base.

With this in mind, we took decisive reform measures to strengthen cost structures in fiscal 2015. To eliminate overlaps among business areas, bolster collaboration among businesses, and clarify core businesses, we reorganized business segments into the Pachislot and Pachinko Machine Business, Entertainment Contents Business, and Resort Business segments. Then, we sought to accelerate decision making and clarify management responsibility by establishing separate companies for each business. These efforts laid the foundations for strengthening management of our business portfolio. In addition, we adjusted employee numbers, optimized personnel deployment to reflect earnings levels, and concentrated resources on core businesses. These reform measures reduced annual fixed costs by approximately ¥6.0 billion. With this leaner cost structure as a base, the amusement center operations area successfully strengthened operational capabilities to achieve year-on-year growth of more than 3% in sales at existing amusement centers in fiscal 2016—one of the best performances in the amusement center industry. Further, having recorded an operating loss for the past two fiscal years, the amusement machine sales area has improved profitability to the verge of realizing operating income. The packaged game software area's simultaneous move into the black in Japan, the United States, and Europe is also praiseworthy. And, the toy sales area, which alternated between profit and loss, has built a structure capable of generating profits consistently. In preparation for our next stage, we continued reform aimed at establishing capabilities.

Clarification of the Business Portfolio Strategy through Business Structure Reform

Focusing on Efficiency and Our Long-Term StrategyIn fiscal 2016, business structure reform clarified a new business portfolio strategy. Given that many of our existing businesses operate in mature markets, for the whole business portfolio we established a clear strategy focused on profit margin rather than scale. Accordingly, we set raising the operating margin from fiscal 2016's 5.1% to 15% in fiscal 2020 as a target.

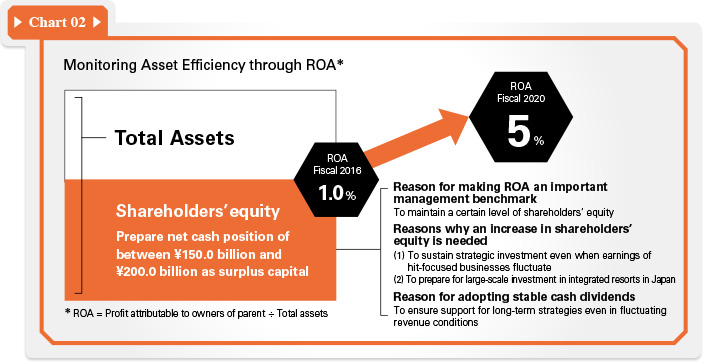

In addition, with a view to achieving ROA of 5.0% by fiscal 2020, we will pursue efficiency in the business portfolio by optimizing the allocation of management resources. The SEGA SAMMY Group is proceeding with advance investment to ensure long-term, sustained progress. In particular, if we achieve entry into the integrated resort business in Japan, we will have to embark upon large-scale investment. To ensure that we are able to make strategic investments stably and flexibly—even amid the inevitable earnings fluctuations that businesses focused on creating hit products experience—we aim to establish a net cash position of between ¥150.0 billion and ¥200.0 billion as surplus capital and maintain a certain level of shareholders' equity. To this end, rather than ROE, in which shareholders' equity is the denominator, we have set out ROA as an important management benchmark for monitoring efficiency. By clarifying the criteria for implementing or withdrawing investments, we will focus on investment efficiency and avoid increasing assets in an undisciplined manner. Also, to ensure support from shareholders for this long-term investment strategy, we have adopted a policy on returns to shareholders that will enable the payment of stable cash dividends even amid fluctuating earnings.

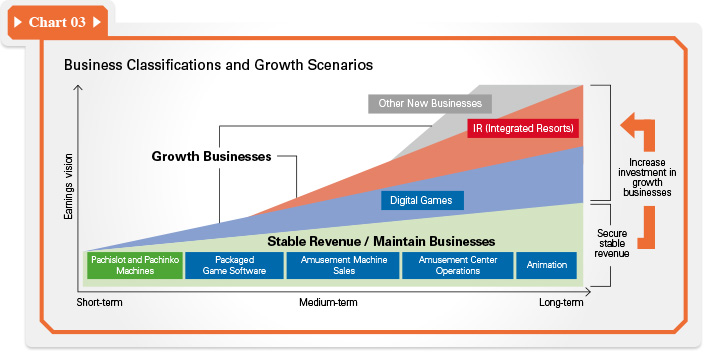

Classifying Businesses to Lay the Foundations for Strategy ImplementationWith our sights set on enhancing the profit margin, a priority in the whole business portfolio, we classified businesses as growth businesses, stable revenue / maintain businesses, or withdraw/downsize businesses by taking into account three attributes: market growth potential, profitability and room for improvement, and competitive advantage. Then, we clearly defined specific missions for each type of business. Stable revenue / maintain businesses will improve profit margins while generating stable cash flows, from which we will invest in growth businesses to establish a positive cycle.

We have classified as stable revenue / maintain businesses the Pachislot and Pachinko Machine Business segment, the packaged game software area, the amusement machine sales area, the amusement center operations area, and the animation area. In our assessment, these businesses have established solid positions in mature markets and have the potential to leverage competitive advantages to enjoy the benefits of being industry survivors. In these businesses, we intend to take uncompromising measures to reform business processes.

We classified the digital game area as a growth business. In contrast to the intense competitive conditions that the digital game area faces in Japan, significant scope for growth remains overseas. We have also classified the Resort Business segment as a growth business and aim to develop it into a third pillar of earnings. Furthermore, we will examine new areas with a view to establishing a fourth earnings pillar. In such efforts, we will stringently select entertainment-related investees whose corporate value we can boost by exploiting our management resources, and we will thoroughly analyze the rationality of acquisition prices. Meanwhile, we withdrew from the contents and solutions business and dining and darts bar business because their strategic significance had lessened.

With its business portfolio realigned in this way, the Group has been transitioning into a strategy implementation phase since the beginning of fiscal 2017.

![]()

- Fiscal 2016 Performance Report

- Cost Structure Reform and

Business Structure Reform - Toward the Implementation

Phase of Growth Strategies

![]()

![]()