- HOME>

- Magnagement Message [Aiming to Grow Corporate Value Continuously]

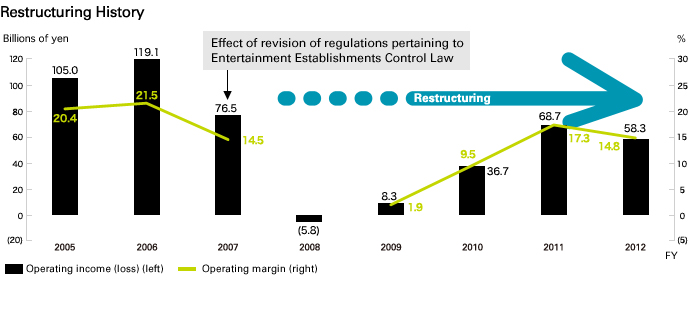

After peaking in fiscal 2006, which was the fiscal year following the management integration of SEGA and Sammy, the Company's business results trended downward. This was related to two factors. First, the July 2004 revision of regulations pertaining to the Entertainment Establishments Control Law marked the beginning of a steady deterioration in business conditions for our earnings driver, the Pachislot and Pachinko Machine Business segment. Secondly, the profitability of SEGA's Consumer Business segment and the Amusement Center Operations segment emerged as a problem. From fiscal 2008, when the Group incurred an operating loss, the SEGA SAMMY Group restructured all of its businesses decisively.

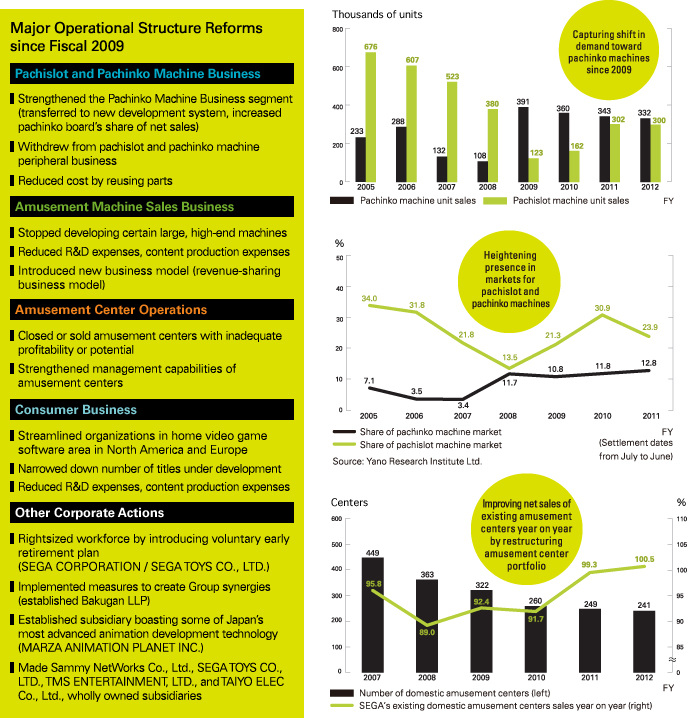

As the mainstay of the Pachislot and Pachinko Machine Business segment, Sammy set out the management goal of “building a system that can generate stable profi ts, no matter what the changes in the operating environment” and launched a range of reforms that included changing employees' mindsets. As part of these efforts, Sammy strengthened its development system not only for pachislot machines-which have consistently claimed the No. 1 market share-but also with a view to expanding the market share of pachinko machines. While bolstering competitiveness of products, we strengthened our profi tability by rigorously improving cost structure through the reuse of components and withdrawing from the unprofi table pachislot and pachinko machine peripheral business. As a result of these initiatives, the operating margin of the Pachislot and Pachinko Machine

Business segment, having fallen to 5.8% for fiscal 2008, rose to 33.5% for fiscal 2012. This dramatic turnaround testifies to our success in building a robust earnings structure able to withstand volatile business conditions. Furthermore, our presence in the pachinko machine market has been growing steadily. Development, production, and sales-working as one toward the common goal of improving earnings-has greatly enhanced our organizational power, and in this respect we are confident that we are unsurpassed among competitors.

In the Amusement Machine Sales Business segment, the Amusement Center Operations segment, and the Consumer Business segment, we have streamlined cost structures to match the scale of their earnings. These efforts have included continuously closing or selling amusement centers of the Amusement Center Operations segment that did not show sufficient profitability or potential. Consequently, we have reduced our network from 477 amusement centers at the end of fiscal 2005 to 241 at the end of fiscal 2012. At the same time, we have reinforced operations through employee training. This has built an organization that generates earnings even when facing tough market conditions. In other initiatives, the Group made a listed subsidiary a wholly owned subsidiary in order to develop the Group's business management system with a view to creating synergies through

intensified collaboration related to intellectual properties and content.

Since fiscal 2008's operating loss, our uncompromising advancement of this series of reforms has steadily improved earnings, enabling operating income to reach its current level of around ¥60 billion. Our business results for fiscal 2012 demonstrate the benefi ts of these reforms.

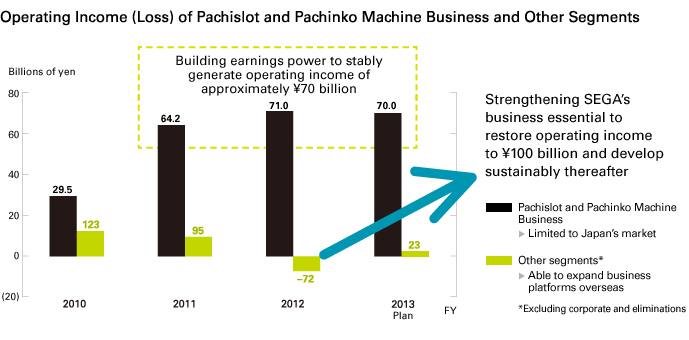

That said, we are by no means satisfied with our current earnings level. There is still a considerable gap between our operating income directly after management integration, which was above ¥100 billion, and its current level. Therefore, our fi rst priority is to restore operating income to its former level as soon as possible. To this end, the Group will not let up in reform efforts as it makes a concerted effort to forge ahead.

The Pachislot and Pachinko Machine Business segment has yet to reach the target of capturing a leading share of the pachinko machine market. For the current fi scal year, with our sights set on claiming 20% of the market, we want to realize our unit sales target and join the group of top manufacturers. By redoubling efforts to refine marketing and fortify development capabilities, we will provide the market with pachislot and pachinko machines that win the support of a wide range of age groups.

With the Pachislot and Pachinko Machine Business segment, centered on Sammy, now having built up the strength to reliably generate earnings in the region of ¥70 billion, SEGA is the key to elevating operating income to the ¥100 billion level. In the past, SEGA has posted earnings of more than ¥20 billion. Furthermore, SEGA is able to take advantage of business opportunities around the world, differentiating its business format from Sammy's.

In Japan, the Amusement Machine Sales Business segment will offer products that lead the way in revitalizing Japan's market. Overseas, the segment will deepen collaboration with local partners to speed up the building of operational foundations. Furthermore, in the Amusement Center Operations segment we intend to strengthen earnings power by further improving profi tability and by continuing to bolster the operational management capabilities of existing amusement centers while advancing a scrap-and-build strategy. In addition, we will ensure the success of new theme park-type amusement centers in Japan. We also plan to use the operational know-how gained from these efforts to expand our licensing business overseas.

Regarding measures for SEGA's Consumer Business segment-which are our most significant task-as mentioned we intend to streamline packaged game software businesses in North America and Europe while shifting the deployment of management resources towards the digital business. Going forward, we intend to monitor changes in market conditions carefully and strengthen the segment's earnings structure.

Also, in a full-fledged effort to maximize earnings by creating synergies, we will create businesses that make optimal use of powerful intellectual properties within the Group, including a wide range of such Group companies as those that are engaged in the toy business and the animation business.

Leveraging our expertise in providing people with enjoyment as a comprehensive entertainment company, we will venture into new business areas if they promise to increase earnings through synergy benefi ts with our existing businesses. For such initiatives, we will decide on initial and additional investments based on careful analysis of returns, keep risk within certain limits, and avoid creating a bloated balance sheet.

A specifi c example of one such initiative is the resort complex business. From RHJ International S.A., we assumed the shares of Phoenix Resort Co., Ltd., which manages one of Japan's premier resort facilities, Phoenix Seagaia Resort, and made it a subsidiary in March 2012. In rebuilding the operations of this new subsidiary, we will focus on enriching the family entertainment that the resort provides. Based on our unique perspective as an entertainment company, we will begin by drawing on our assets and expertise to develop features that promise to attract families. We will decide whether or not to make additional investments based on careful analysis of return on investment.

In the medium term, we will consider using the resort as a base for nurturing and disseminating content. We also want to use this venture to accumulate know-how for the operational management of large-scale facilities, which we can capitalize on to realize our future goal of developing and managing the operations of resort complexes centered on casinos.

From a medium-to-long-term perspective, we view the casino business as a new opportunity to generate earnings. If Japan enacts laws permitting casinos, and they become recognized as a legitimate business, the economic benefi ts would be immeasurable. As well as creating employment, it would enhance Japan's competitiveness in the international tourism market. If creating a casino business becomes feasible, we want to exploit our know-how as a comprehensive entertainment company to launch forays into this business area. When entering this area, however, we will explore developing operations through business collaborations with major overseas partners that have strong track records in casino management. This will enable us to curb risk and draw on each other's expertise.

In July 2012, with the Paradise Group we established a joint venture tasked with planning, developing, and operating a resort complex that includes a casino in the Incheon area of South Korea.

With a 45% stake making us the second-largest shareholder in the joint venture, we will participate in management. As well as aiming to secure earnings reliably, we intend to garner know-how and experience in casino management in preparation for future entry into the casino business in Japan.

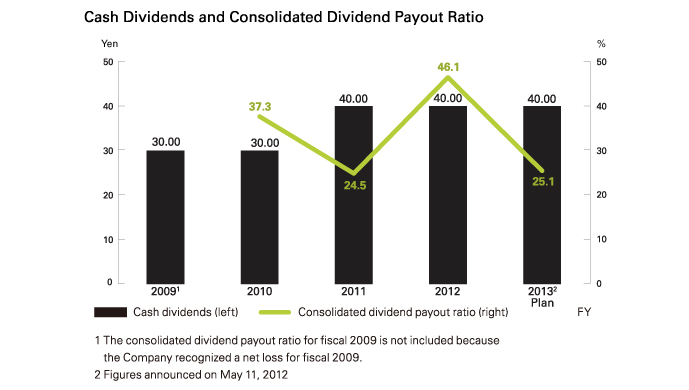

The SEGA SAMMY Group's policy is to heighten corporate value by implementing growth strategies that increase earnings and by directly returning profi t to shareholders through stable dividends.

As explained above, the SEGA SAMMY Group will foster businesses in growth areas with a view to continuously enhancing corporate value. Furthermore, if the Group is able to enter the casino business, this is expected to require large-scale investment. To enable bold decisions on investments in promising, carefully selected projects, we plan to build up retained earnings by generating net income each fiscal year, targeting a net cash position of ¥150 billion to ¥200 billion.

Regarding returning profit to shareholders, we aim to pay out approximately 20% to 30% of post-tax income as dividends. Each fiscal year, we determine returns to shareholders flexibly in light of maintaining a balance with investment in growth fields.