Our Basic Stance on Financial Strategies

We will support business strategies through financial strategies.

Based on Road to 2020, which covers the period through fiscal 2020, the SEGA SAMMY Group is advancing medium-term business strategies with its sights set on an operating income margin of at least 15% and ROA of at least 5% as management targets. Meanwhile, we are supporting business strategies by establishing medium-term financial strategies—which are on the opposite side of the same coin from the medium-term business strategies—and advancing measures in a planned manner.

In fiscal 2018, we completed a framework for the integrated control of the Group’s domestic fund-raising and fund management, which we built over approximately two years. We have begun full-fledged fund management aimed at increasing the precision of cash flow forecasts, enhancing capital efficiency, and heightening the profitability of businesses. The next step is to establish global initiatives and risk exposure as financial themes.

At present, overseas sales only account for about 10% of the Group’s revenues. However, given that the effect on Japan’s market of the long-term decline in the birth rate is unavoidable, senior management views expanding overseas businesses centered on the digital games and packaged games areas as an important management task. Anticipating this management vision, we will begin by managing exchange rate exposure for overseas business transactions. Then, we want to extend the scope of our efforts to manage the interest rate sensitivity of fund-raising and the Group’s overall financial risk with respect to the global market. Looking further ahead, we hope to realize integrated control of fund-raising and fund management on a global basis.

Road to 2020 Financial and Capital Strategies and Fiscal 2019 Strategie

We will support investment in growth areas.

As a medium-term strategy, Road to 2020 calls for proactive investment in growth areas, centered on the digital games area, to create titles that become global hits. We will support such business strategies by securing adequate capital provision while paying close attention to financial discipline.

In fiscal 2019, accelerated marketing of new titles in the digital games area is expected to result in year-on-year increases of ¥11.3 billion in R&D expenses and content production expenses, to ¥73.3 billion, and ¥6.7 billion in advertising expenses, to ¥22.1 billion. Beginning in August 2018, we plan to transfer and consolidate the head office functions of respective Group companies in stages. As a result, we expect to record one-time transfer expenses of ¥7.5 billion. I want to maximize the benefits of this investment not only by strengthening coordination among businesses and creating synergies but also by actively standardizing and integrating corporate management functions and introducing common infrastructure.

Preparation for Participation in the IR Business

We are giving priority to maintaining robust financial foundations and a net cash position.

At this juncture, we are not sure about the future operational structure and finance format of integrated resorts in Japan, which we see as the pillar of long-term business strategy. However, we need to secure a high level of shareholders’ equity as a risk buffer and maneuverable, flexible fund-raising. This will enable us to be responsive if corporate finance becomes the key factor in seizing the initiative in the IR industry as the only domestic corporate group on an equal footing with the major resort operators that have announced their intention to participate in Japan’s IR industry. For these reasons, the Group is giving priority to maintaining a net cash position.

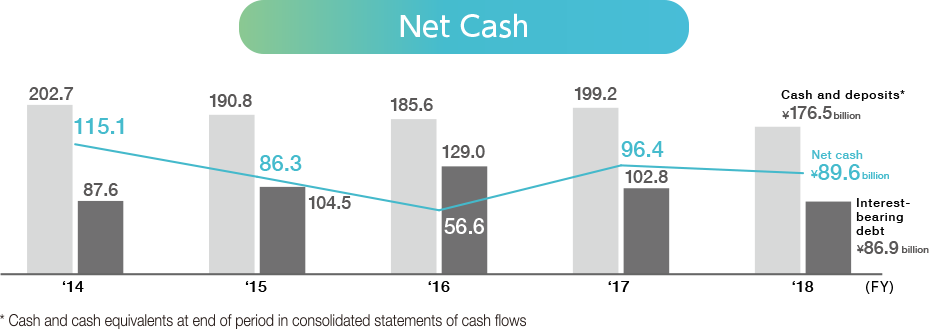

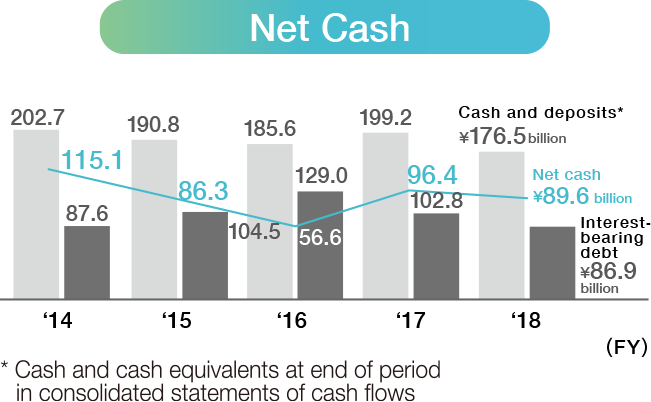

In fiscal 2018, we reduced interest-bearing debt, even though we expected the Pachislot and Pachinko Machines Business, which is our cash cow, to generate lower gross cash flows due to regulatory revision. As a result, interest-bearing debt was ¥86.9 billion, down ¥15.9 billion from the previous fiscal year-end, and net cash was ¥89.6 billion. Meanwhile, I want to continuously broaden our flexible fund-raising options by securing such facilities as commitment line agreements (approximately ¥55.0 billion) and overdraft agreements (approximately ¥75.4 billion).

Business Portfolio Management

Never complacent about our current standing, we will stringently monitor asset efficiency.

In preparing for future participation in the IR business in Japan, as well as being in a phase of securing a high level of shareholders’ equity, we are currently using ROA rather than ROE as an important index because ROA is a target that the SEGA SAMMY Group can advance toward cohesively.

To a certain extent, the rebalancing of assets that we implemented in fiscal 2017 improved the quality of assets. However, we are by no means completely satisfied with our current status. We constantly remain aware of capital cost as we rigorously evaluate businesses and strengthen management of the business portfolio with a view to realizing ROA of at least 5%.

Despite the fact that the business is presently in an advance investment phase, we view the performance of the Resort Business as an important issue. In particular, I am aware of the need to strengthen the earnings model of PHOENIX RESORT CO., LTD. As well as setting a strict investment hurdle rate, I think that we must innovate to meet consumers’ needs and foster our brand rather than relying on additional investment. Given that the Resort Business is positioned as the Group’s third pillar and that the business aims to participate in the IR business in Japan in the near future, we are bracing ourselves to take on more-challenging goals and thereby heighten investment efficiency.

Until now, we have primarily used profit and loss as a uniform benchmark for evaluating businesses. Going forward, however, we will conduct multifaceted evaluations that better reflect the characteristics of businesses by incorporating non-financial key performance indicators, such as labor productivity and corporate vitality, in addition to financial key performance indicators, such as the cash base and asset efficiency. Based on these multifaceted evaluations, we intend to enhance the precision of planning and realize even stricter management of investment efficiency.