The Spirit within Our Mission

Provide Society with Positives That Outweigh Negatives

The entertainment industry has both positive and negative effects on society. One example was our experience following the Great East Japan Earthquake in March 2011. At the time, criticism was directed at pachinko halls, amusement centers, and other entertainment facilities based on the large amounts of electricity they were consuming while planned power outages were being implemented due to electricity shortages. This brought the reason for the existence of entertainment into question. Many of our employees were distressed and felt helpless, some of them even questioned the propriety of continuing to operate amusement centers during such a crisis. I recall the chairman sent out the message that we should do what we could do to lift people’s spirits precisely because we were in such circumstances. Hearing this boosted the morale of employees who had begun to feel despondent. Of course, providing the utilities and goods essential for daily life is the first priority in a disaster. For true restoration, however, “vitality for tomorrow” is essential, and I believe that this is something entertainment can provide. Meanwhile, the entertainment industry must tackle potentially negative aspects head on. These include the influence of video games on children and addiction to playing pachinko and pachislot machines. I am convinced that society will continue to value us if we continue delivering positive excitement that outweighs such negative aspects. The subtitle of the mission, making life more colorful, includes this belief. I want our employees to always take pride in providing society with bright colors that outshine black, gray, and other dark colors.

Fiscal 2018 Performance Report

Progressed Steadily under Road to 2020 Despite Missing Targets

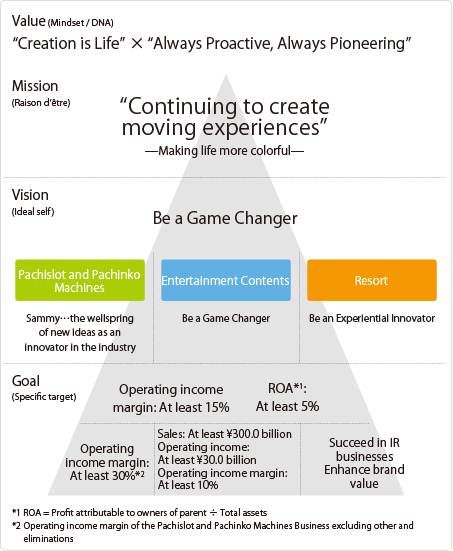

Road to 2020 sets targets of at least 15% for the operating income margin and at least 5% for ROA in its final fiscal year, fiscal 2020. Also, the initiative calls for a steep increase in earnings in its third year, and we are steadily taking measures aimed at realizing these targets.

In fiscal 2018, the year ended March 31, 2018, and the initiative’s first fiscal year, we fell short of initial targets and recorded year-on-year declines of 11% in net sales and 40% in operating income.

In the Pachislot and Pachinko Machines Business, unit sales decreased due to major changes in the sales schedules of multiple titles in response to the enforcement of Rules for Partial Revision of Ordinance for Act on Control and Improvement of Amusement Business, etc., and Regulations for the Verification of Licenses, Formats, and Other Aspects of Pachislot and Pachinko Machines (regulatory revision) in February 2018.

Further, the Entertainment Contents Business marketed fewer titles than initially expected as a result of postponing the introduction of certain titles to the digital games area to fiscal 2019. On the other hand, the packaged games, amusement machine sales, and amusement center operations areas performed well, enabling the Entertainment Contents Business to surpass initial targets by a large margin.

Although lower revenues and earnings from the Pachislot and Pachinko Machines Business resulted in a disappointing performance relative to targets, my overall evaluation of fiscal 2018 is that we made steady progress in relation to Road to 2020. Here, I would like to explain the basis of this evaluation.

Progress under Road to 2020

Strategic Revision of the Release Schedule

In the pachinko and pachislot machine industry, the regulatory revision enforced in February 2018 greatly reduced the gambling element of pachinko and pachislot machines, which is their distinctive feature. Meanwhile, in response to the regulatory revision industry, bodies changed their voluntary regulations. Particularly for pachislot machines, although the changes in the voluntary regulations have significantly lowered overall gambling element, the changes have also broadened the scope for gameplay. Consequently, we believe the potential exists to offer appealing pachislot machines.

Therefore, we determined that strategically revamping our pachislot machines based on the new regulations would allow us to offer products that match market demand going forward. As a result, we significantly revised our second-half release schedule. Thus, our product strategy in the second half of fiscal 2018 was based on a larger medium-term strategy.

The Entertainment Contents Business outperformed initial targets and recorded earnings growth for the third consecutive fiscal year. In particular, we were in the black for the second straight fiscal year across all business areas and regions (Japan, other parts of Asia, North America, and Europe) for the first time, including the era of the former SEGA CORPORATION.

I feel confident that our businesses are beginning to transition toward a favorable cycle based on a highly sustainable earnings structure that stably generates income without being dependent on one major hit product.

The substantial growth of the packaged games area reflects increased sales in the global market as well as the progress of efforts under Road to 2020 aimed at creating a structure that advances global rollouts. Repeat sales of older titles have been rising robustly. For example, cumulative sales of Persona5, which we launched in April 2017, have surpassed 2.2 million units in Japan, North America, and Europe. This growth is proof that the product quality of our games is satisfying players worldwide and is, of course, a driver of profit margin improvement.

The amusement machine sales and amusement center operations areas, which have seen an ongoing recovery in the scales of their markets for two consecutive fiscal years, are showing solid results. The amusement machine sales area is realizing adequate profitability thanks to brisk sales of prize game machines and to the introduction of a revenue-sharing business model, which provides continuous revenues. Also, the amusement center operations area is reaping the benefits of tireless efforts to strengthen operations.

The revision of the release schedule in the digital games area also resulted from giving priority to improvement of product quality rather than to the fiscal year’s sales figures. As I will explain later, our strategies will be more aggressive in this area in fiscal 2019.

As for the Resort Business, April 2017 saw the opening of the first stage of phase 1 development of PARADISE CITY, South Korea’s first integrated resort.

PARADISE CITY is proving extremely popular, with more guests visiting from Japan than anticipated.

On the other hand, some issues remain. An issue that applies to all of our businesses and business areas is the “probability of success.” If we breakdown results by title, hit titles are compensating for titles that do not meet targets. By repeatedly testing hypotheses, we intend to heighten the likelihood of success. Further, I view PHOENIX RESORT CO., LTD., which continues to recognize operating losses, as an important issue.

Fiscal 2019 Targets

Outperform Targets through the Pachislot and Pachinko Machines Business

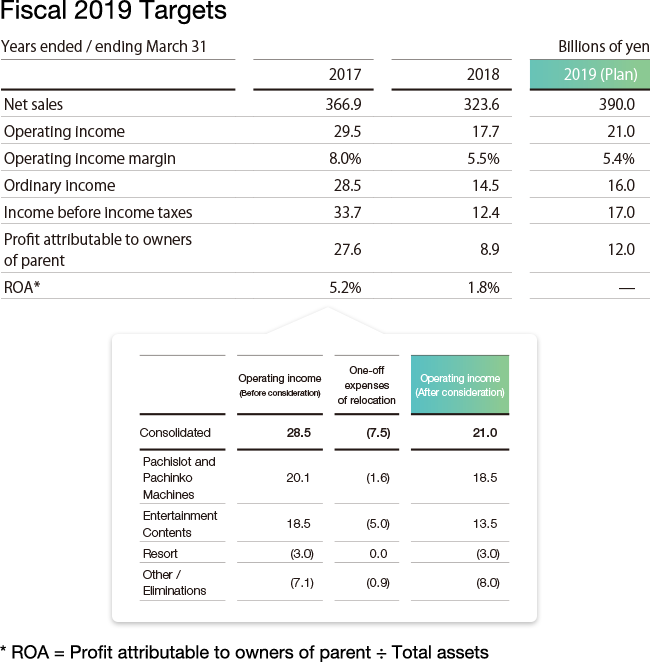

In fiscal 2019, the year ending March 31, 2019, we are targeting year-on-year increases of 20% in net sales, to ¥390 billion, and 18% in operating income, to ¥21 billion. We expect an operating income margin of 5.4%, essentially unchanged year on year.

Also, we are planning to appropriate ¥7.5 billion for transfer expenses likely to arise from the consolidation of the head office functions of respective Group companies in stages beginning from August 2018. Excluding the effect of these one-off expenses, the actual target for operating income is year-on-year growth of 61%, to ¥28.5 billion. In the current fiscal year, mainly through contributions from the Pachislot and Pachinko Machines Business, we want to go beyond our targets.

The Pachislot and Pachinko Machines Business aims to increase revenues 15% and earnings 55% year on year. We plan to steadily market new-format pachislot machines from the second half of the current fiscal year through fiscal 2020. I am very optimistic about the new-format pachislot machines. While curbing gambling elements in accordance with the essence of the regulatory revision, we will be able to broaden the scope of development based on the changes in voluntary regulations. Until now, it has required five or six hours to fully enjoy playing a pachislot machine. Competing for customers’ time with other forms of entertainment, playing time comparable with the time normally spent at a theme park has been a considerable disadvantage for pachislot machines. Going forward, however, it will become possible to get enough entertainment by playing pachislot machines for about two hours—roughly the time needed for such pastimes as karaoke, movies, and bowling. As a result, pachislot machines will once again become a local, convenient form of entertainment, enabling us to capture demand for entertainment that occupies short periods of free time.

Entertainment Contents Business Strategy

Maximize IP Value and Accelerate Global Rollouts

In the Entertainment Contents Business, we expect a 24% rise in revenues and a 9% decline in earnings year on year. The growth of earnings will be expected in the digital games area, which plans to launch 12 long-awaited titles. Similarly, the packaged games area is likely to see higher earnings thanks to increases in sales of new titles, sales in overseas markets, and repeat sales. Meanwhile, earnings from the amusement machine sales area, which will recognize the advance investment expenses of the casino machine area, and from the amusement center operations area will probably edge down. In the animation and toys area, we anticipate essentially unchanged earnings levels.

Through multi-channel rollouts in the global market, the Entertainment Contents Business will focus on maximizing the value of its IP portfolio, including new IP, huge amount of existing, and dormant IP, and third-party IP.

In the digital games area, April 2018 saw the release of SEGA Pocket Club Manager (commonly known in Japan as Sakatsuku), a new app for iOS and Android™ that recreates for smartphones the excitement of SEGA’s highly popular Sakatsuku soccer game. As of August 2018, the app had surpassed 1 million downloads. Also, we will launch a series of new titles, including the latest offering from multiple hit producer f4samurai, Inc., WONDER GRAVITY —BEST BUDDY: PINO & GRAVITOR—, and a PlayStation®4 version of BORDER BREAK, which has been developing a large fan base as a network-enabled amusement machine since 2010.

In the packaged games area, our introduction of the latest installment in the Ryu ga Gotoku series to the U.S. market is part of initiatives to “fatten” existing IP through lateral rollouts. Further, we are reviving dormant IP that still have many highly enthusiastic fans. Specifically, this year we re-released Shenmue I&II, a revival of Shenmue, which debuted in 1999, and Shenmue II. And, a project is underway to revive the Sakura Wars series, which first appeared in 1996. We are also proactively incorporating third-party IP.For example, we will begin providing an amusement machine version of the highly popular Fate/Grand Order Arcade smartphone app.

Resort Business Strategy

Leverage New Nevada Licenses as a Major Advantage

The Resort Business is expected to record operating loss of ¥3 billion due to advance investment aimed at realizing a domestic IR business. However, we intend to move PHOENIX RESORT into the black by improving its profitability. In Incheon, South Korea, the second stage of phase 1 development of PARADISE CITY is proceeding well, and the staged opening of entertainment and commercial facilities will make it a true integrated resort.

The SEGA SAMMY Group acquired licenses for the manufacture and sale of gaming machines in the U.S. State of Nevada in December 2017. As well as securing a sales channel in a third market—together with our sales channels in Macau and the Philippines, where we already have licenses—the acquisition of these licenses has great strategic significance.

In acquiring the license, the Group underwent multifaceted inspections of information relating to governance, compliance, financials, and taxes. Further, individual Group executives were scrutinized. Official recognition of conformity with the world’s most exacting gaming-related standards will be advantageous not only when seeking IR licenses in Japan but also when collaborating with overseas partners.

As the only domestic corporate group on an equal footing with world-famous IR operators, the Group will express a strong determination to participate in the IR industry and steadily move forward with preparations. We have further increased the number of personnel sent to PARADISE CITY to accumulate know-how to approximately 60 employees. Moreover, we are ahead of other companies in taking steps toward the establishment of commercial operations. These efforts include identifying and conducting value chain analysis based on more than 118 key components of casino operations.

Long-Term Management Stance

Always Choose the Long-Term Rather Than the Short-Term Approach

Currently, we are conducting “Satomi Cram Schools” to instill the Group’s founding principles in mid-ranking managers and above. I believe that passing on the founding principles is indispensable for sustaining the Group’s development. The most important principle is that of favoring a sound, far-sighted approach. This business management philosophy reflects the belief that favoring a sound, far-sighted approach—even if it means taking a roundabout route—leads to success more certainly than taking shortcuts in pursuit of short-term gains or acting in ways that leave us open to criticism. Based on this management philosophy, the Group has rigorously adhered to a long-term stance in conducting business management.

In fact, when I have to choose between long-term and short-term gains, without hesitation I give priority to long-term gains. For example, if an additional few months of development is going to produce a better product, I give instructions not to compromise and to further improve the product, even though we may go over budget. Adopting this approach earns the endorsement of end users and heightens brand value. Even when we fail, rather than making excuses, employees in frontline operations can learn lessons from such experiences if we analyze the reasons correctly. Instead of simply responding to situations in an ad hoc manner,

I believe that rigorously adhering to a sound, far-sighted approach is important for sustaining our development.

Personnel as the Foundations of Sustained Growth

Encourage Pride and Confidence among All Employees

Among all stakeholders, I give the highest priority to personnel because without talented personnel we cannot satisfy customers, and without customer satisfaction we cannot provide shareholder value.

In personnel development to date, we have taken a range of measures to allow employees to realize their capabilities to the utmost. Focusing on work-style reforms, we have thoroughly implemented reforms such as reducing working hours, reducing the number and length of meetings significantly, and diversifying work styles. In April 2018, we became the first company in the industry to introduce a Job Plus side job system. We introduced this system with a view to enhancing the capabilities of individuals and facilitating self-realization by respecting the autonomy of employees and enabling them to have experiences that would not be possible within the Group. We hope that this will result in employees making even greater contributions to the Group’s corporate value. The culmination of work style reforms will be the consolidation of the Group’s head office functions, which will mark a transition from a phase of work style reforms to a phase of work style improvements.

In managing the Group, we focus on balancing “centrifugal force” and “centripetal force.” “Centrifugal force” refers to delegating authority to Group companies to expedite management decision making and seeking maximized performance in line with brands and business formats. Meanwhile, the consolidation of head office functions is representative of “centripetal force.”

The medium-to-long-term benefits of the consolidation will include enhancement of management efficiency, vitalization of personnel exchanges and operational coordination among operating companies, the realization of innovation with venture companies invited to use co-working spaces in the new office, and reductions in expenses arising from the Ordinary General Meeting of Shareholders and various other types of meetings.

One of my particular aims is to develop a Group culture through the consolidation. I want to combine the various cultures of operating companies to foster a SEGA SAMMY Group culture. Our revision of the Group’s brand logo stems from the same mind-set. The new logo, in which all of letters are joined, symbolizes our commitment to continue growing based on solidarity among Group companies.

I want all employees to be able to take pride in and feel confident about the SEGA SAMMY Group. This may seem an indirect way of proceeding, however, I feel that fostering among our employees pride in and confidence about their work and the Group is the best way of cultivating awareness of compliance and governance. Moreover, I am convinced that this is a sound, far-sighted approach that will enable us to execute the measures of Road to 2020 without fail, realize sustained growth in corporate value, and meet the expectations of shareholders and all other stakeholders.

As we pursue a long-term approach, I would like to ask our stakeholders for their continued support of the SEGA SAMMY Group.

August 2018

Haruki Satomi

President and Group COO (Representative Director)

SEGA SAMMY HOLDINGS INC.