- HOME >

- A Message from the President and CEO [Fiscal 2014 Business Results]

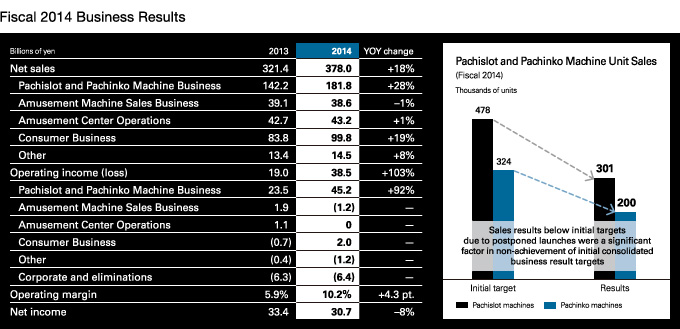

In fiscal 2014, ended March 31, 2014, SEGA SAMMY HOLDINGS INC. grew revenues and earnings, posting year-on-year increases of 18% in net sales, to ¥378.0 billion, and 103% in operating income, to ¥38.5 billion. Net income declined 8% year on year, to ¥30.7 billion.

Net Sales

Net sales rose mainly because of an increase in revenues from the Pachislot and Pachinko Machine Business and the Consumer Business segments. In the Pachislot and Pachinko Machine Business segment, solid performances by multiple mainstay titles resulted in higher revenues from the pachislot machine business. However, the pachinko machine business saw revenues decline due to lackluster performances by non-mainstay titles that reflected tough market conditions. Consequently, the segment's revenues rose 28% year on year. The Amusement Machine Sales Business segment recorded a 1% year-on-year decline in revenues as amusement center operators curbed investment. Regarding the Amusement Center Operations segment, although existing amusement centers' sales were sluggish, the opening of new theme park-type amusement centers contributed to a 1% rise in revenues compared with those of the previous fiscal year. Furthermore, the Consumer Business segment posted a 19% year-on-year increase in revenues thanks to higher earnings in the digital game area.

Operating Income

The Pachislot and Pachinko Machine Business segment's earnings were up 92% year on year, while the Amusement Machine Sales Business segment recognized an operating loss of ¥1.2 billion, compared with the previous fiscal year's operating income of ¥1.9 billion. The Amusement Center Operations segment saw earnings decline. The Consumer Business segment moved into the black, achieving operating income of ¥2.0 billion, compared with the previous fiscal year's operating loss of ¥0.7 billion, thanks to higher earnings from the digital game area. As a result, the operating margin improved 4.3 percentage points, to 10.2%.

Net Income

The Group recorded a ¥11.9 billion gain on sales of investment securities and a ¥6.6 billion loss on liquidation of subsidiaries and affiliates accompanying a reversal of foreign currency translation adjustment due to the liquidation of certain U.S. subsidiaries. Furthermore, reflecting the absence of fiscal 2013's deferred tax assets for the amount expected to be deductible from taxable income in relation to a tax loss—which arose from the completion of liquidation of the U.S. subsidiaries—net income decreased 8% year on year, to ¥30.7 billion.

R&D Expenses, Content Production Expenses, and Capital Expenditures

R&D expenses and content production expenses were up year on year due to a strengthening of developmental capabilities aimed at increasing the Pachislot and Pachinko Machine Business segment's market share and initiatives to bolster the digital game area of the Consumer Business segment. Furthermore, as of fiscal 2014 the Group included the amortization cost of digital game titles in R&D expenses and content production expenses. Capital expenditures grew 16% compared with those of the previous fiscal year due to the acquisition of land in Busan, South Korea. Depreciation decreased year on year because it did not include the amortization cost of digital game titles of the Consumer Business segment as of fiscal 2014.

Cash Dividends

For fiscal 2014, we paid interim cash dividends of ¥20.00 per share and year-end cash dividends of ¥20.00 per share, giving full-year cash dividends of ¥40.00 per share, the same amount as we paid for the previous fiscal year. As a result, the consolidated dividend payout ratio was 31.6%.

![]()

- Fiscal 2014 Business Results

- General Evaluation

- Review of Progress since

Management Integration - Improvement of Asset Efficiency

through Optimal Management

Resource Deployment - Reform of Developmental

System and Businesses with

Sluggish Performance - Competitive Advantages of the

Digital Game Area - Growth roadmap for the Short,

Medium, and Long Term - Integrated Resort Business as a

Future Mainstay - Capital Policy

- Conclusion

![]()