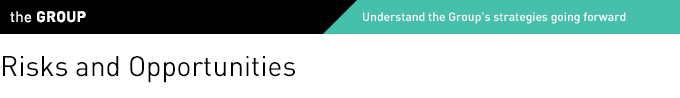

The SEGA SAMMY Group has businesses across a broad range of entertainment areas. Because the business characteristics, competitive conditions, and related laws and regulations differ, each business area has unique risks and opportunities. This section explains the risks and opportunities that are articularly important for the Group as it implements business restructuring and advances medium-to-long-term strategies.

-

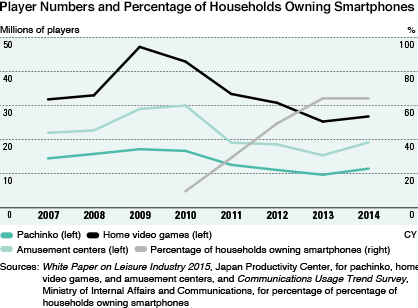

Having become national pastimes, pachinko, home video games, and amusement centers have seen a downward trend in player numbers since 2010. This decrease reflects the young generation's diversifying ways of spending leisure time as smartphones have become increasingly popular. In the entertainment industry, competition to attract players is transcending industry boundaries.

-

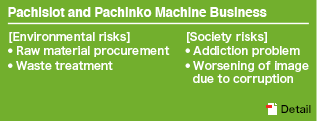

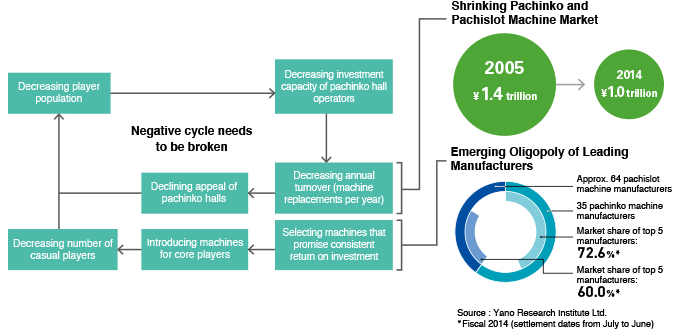

A long-term decline in the pachinko and pachislot player population has reduced pachinko hall operators' investment capacity, encouraging a bias in demand toward pachinko and pachislot machine manufacturers with intellectual properties and machines able to provide reliable returns on investment. Having learned a lesson from the reduction in players that followed the introduction of machines designed to generate rapid return on investment, the industry is focusing on the development of machines offering new gameplay that a wide range of players can enjoy.

-

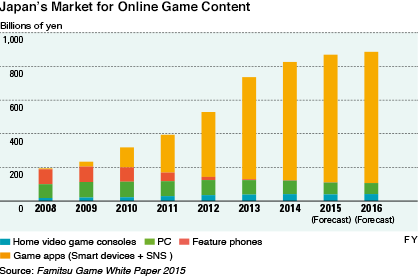

Smartphone apps have spurred phenomenal growth in online games. In particular, business models based on free-to-play (F2P) games for smartphones have made it easier for players to participate, thereby widening the range of players covered. The growth of digital games is expected to soften steadily. At the same time, the emergence of high-performance smart devices is likely to encourage the development of increasingly high-end game apps. Consequently, the ability to develop absorbing apps with high-quality graphics will be a key factor in winning out against competitors.

-

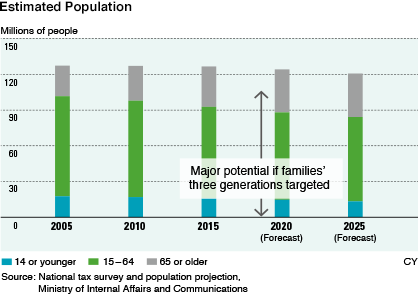

The decline in the player populations of the amusement center and amusement machine sales markets continues unabated. Looking beyond traditional markets, however, families and the "three generations" represent large potential markets.