A MESSAGE FROM THE CFO

Our financial strategies will provide powerful support for Road to 2020 measures.

My Mission as CFO

I will enhance corporate value by maintaining financial discipline while supporting business strategies.

SEGA SAMMY HOLDINGS INC. has redefined its role as a holding company. Previously, it coordinated the strategies of operating companies. Now, however, the Company is unifying Groupwide values and playing a central role in planning. Accordingly, the Company has announced its first medium-to-long-term business strategy: Road to 2020.

As CFO, I want to enhance corporate value by preparing financial strategies that add impetus to business strategies while acting as a “goalkeeper” who maintains financial discipline. SEGA SAMMY HOLDINGS is the only listed company in the Group and as such will be responsible for communicating with capital markets and financial institutions.

I intend to carefully explain the Group’s short-term performance in the context of the Group’s long-term vision and the medium-term strategies designed to realize it.

Road to 2020?Key Financial and Capital Strategies

Preparing to participate in the integrated resort business in Japan, we will advance financial strategies from a medium-term viewpoint.

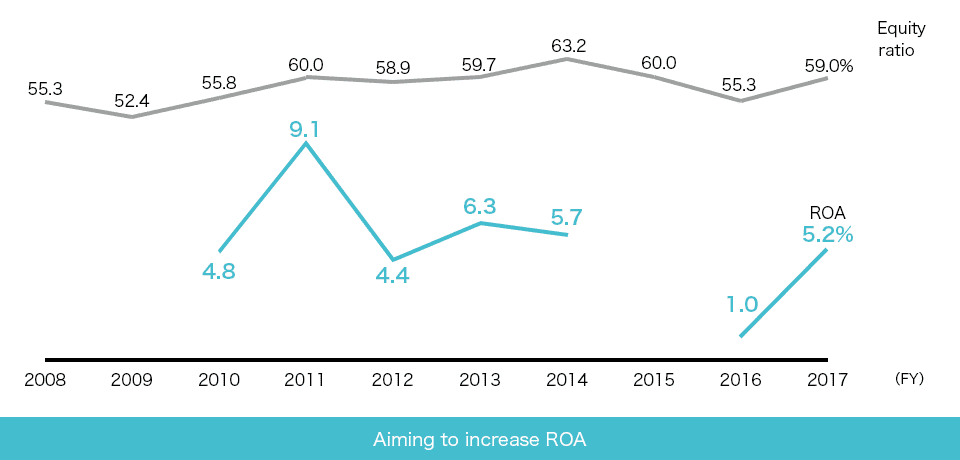

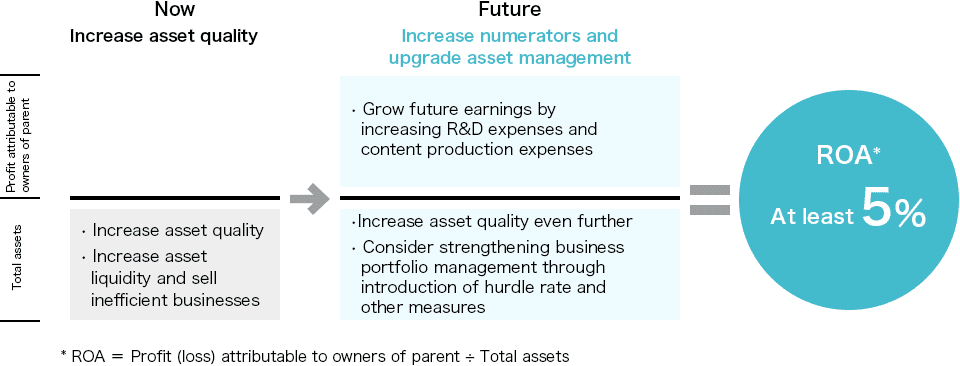

In May 2014, the SEGA SAMMY Group established the Group Structure Reform Division, which achieved clear benefits by implementation of cost structure reform in existing businesses. This reform established foundations upon which we can prepare forward-looking strategies. Following on from these efforts, in fiscal 2016 we implemented business structure reform, which entailed strengthening business portfolio management and then reorganizing and reclassifying businesses. In fiscal 2017, we shifted to a phase of steady implementation, selling “withdraw/downsize” businesses and investing in growth businesses. While strengthening foundations in this way, the Group launched Road to 2020 under new leadership. This initiative sets an operating margin of 15% and ROA of 5% as management targets and?by establishing specific strategies and measures for each business?clearly explains to internal and external stakeholders how the Group will reach these targets. Meanwhile, on the opposite side of the same coin from business strategies, our financial strategies will complement business strategies by establishing the financial discipline needed to secure adequate capital provision.

In growth areas, we will enable proactive investment in research and development, content production, and advertising. These efforts will focus on the digital game area and the realization of our major task in this area: creating titles that become global hits. Also, rather than viewing mainstay businesses as operations that are to remain unchanged, we have positioned them as core businesses that will play a pivotal role in the success of the Group’s growth strategies. Therefore, we intend to invest actively in the Pachislot and Pachinko Machine Business and other mainstay businesses. In fiscal 2018, of the \71.0 billion we plan to invest in research, development, and content production, we have earmarked \19.3 billion for investment in the Pachislot and Pachinko Machine Business. We expect that these investments will produce medium-term benefits by building the product lineup for fiscal 2019 and fiscal 2020.

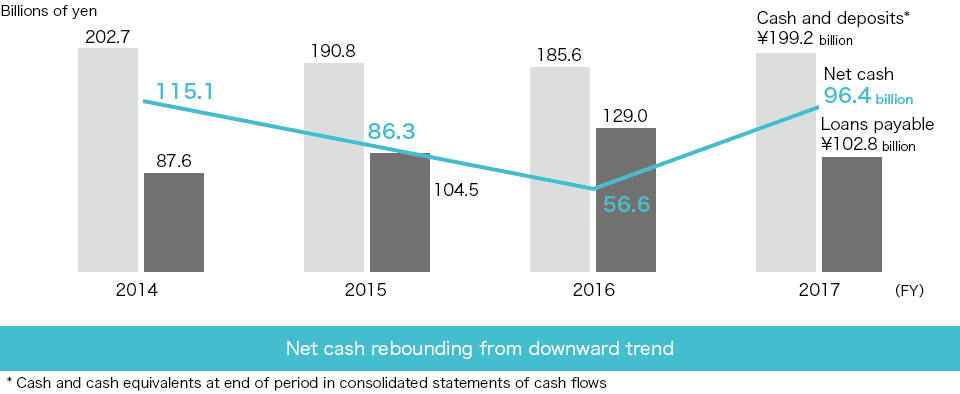

The pillar of the Group’s long-term business strategy is participation in the integrated resort business in Japan. We cannot predict the type of structure this business will assume because an IR implementation bill has yet to be enacted. When the Group enters the integrated resort business in Japan, establishing a robust financial position that allows the Group to match competitors and increasing the flexibility of fund-raising so that the Group can source a variety of financing formats will be extremely important tasks. Maintaining an awareness of credit ratings and taking into consideration the volatility of our businesses, at this stage we are giving priority to maintaining a net cash position. In fiscal 2017, net cash of \96.4 billion reflected the high level of net cash provided by operating activities, which reached \59.1 billion. While reducing interestbearing debt and curbing costs, we increased the flexibility of fund-raising by establishing commitment lines to add to our options.

In addition, the Group has begun integrated control of fund-raising and management based on a framework that it has been developing for the past several years. Going forward, I want to use this framework effectively to increase the precision of cash flow forecasts and to enhance capital efficiency, thereby heightening the profitability of businesses.

Strengthening of Business Portfolio Management

While increasing the profitability of businesses, we will improve asset quality to heighten asset efficiency.

We have chosen ROA rather than ROE as a key performance indicator for the same reason that we are focusing on net cash. In preparation for participation in the integrated resort business in Japan, we are securing a high level of shareholders’ equity on the one hand while curbing leverage on the other. In addition, we decided that using ROA as a key performance indicator is more in keeping with the strategic direction of operating companies than using ROE would be, which can encourage reductions in shareholders’ equity. Moreover, using ROA will be an effective way of making the Group more cohesive. In conjunction with efforts to increase the profitability of businesses, we will rebalance assets to improve asset efficiency. In fiscal 2017, we acquired the game developer Amplitude Studios SAS to strengthen the PC game businesses in the United States and Europe. Meanwhile, we discontinued the development of a resort complex in Busan, South Korea; sold an amusement center in Shinsaibashi, Osaka; and sold most of our stake in the subsidiary that manages JOYPOLIS indoor theme parks.

Since SEGA SAMMY HOLDINGS assumed a central role in planning, the steady increase in the sophistication of the Group’s portfolio management has been palpable. However, I always have a sense of crisis because complacency leads to regression. Rather than simply pursuing an absolute earnings amount, I want to focus strongly on the cost of capital on both a holding company and an operating company basis. I intend to strengthen business portfolio management even further so that we can increase the equity spread and thereby enhance corporate value. As part of these efforts, we will consider the option of setting a hurdle rate.

Reasons for Making ROA an Important KPI

(1) Need for high level of shareholders’ equity and reduced leverage

- To secure funds in hand in preparation for participation in the integrated resort business in Japan

- To enable steady investment for growth amid the volatile business results that characterize our business formats

(2) Strong possibility that investment will shift toward fixed assets

- Amusement center operations area and the Resort Business

(3) Establishment of measures acceptable to operating companies

- Easy to promote understanding of measures introduced to operating companies