News Release

Notice regarding the Determination of Details of the “Stock-granting ESOP Trust” and Disposal of Treasury Stock by Third-Party Allotment

- IR

2024/08/07

Link to see PDF ver.

(Translation)

Dear all,

Name of Company: SEGA SAMMY HOLDINGS INC.

Name of Representative: Haruki Satomi,

President and Group CEO, Representative Director

(Code No. 6460, Tokyo Stock Exchange Prime)

Further Inquiry: Makoto Takahashi,

Executive Vice President, Executive Officer,

Managing Director of Corporate Planning Division

(TEL: 03-6864-2400)

Notice regarding the Determination of Details of the “Stock-granting ESOP Trust”

and Disposal of Treasury Stock by Third-Party Allotment

SEGA SAMMY HOLDINGS INC. (the “Company”) has resolved to introduce an employee incentive plan “Stock-granting ESOP Trust” (“System”) targeting for employees of the Company at the Board of Directors meeting on May 10, 2024, and it hereby notifies that it determined the details of the System, including the total amount of shares to be acquired under the System at the Board of Directors meeting held today. In conjunction with this, the Company has also resolved the disposal of treasury stock by third-party allotment (the “Treasury Stock Disposal”), as described below.

Description

- Overview of Disposal

|

(1) Date of disposal |

August 30, 2024 |

|

(2) Type and number of shares to be disposed |

2,000,000 shares of Company’s common stock |

|

(3) Disposal amount |

2,181 yen per share |

|

(4) Total disposal amount |

4,362,000,000 yen |

|

(5) Planned Allottee |

i) The Master Trust Bank of Japan, Ltd. (Officer’s compensation BIP Trust Account) 50,000 shares (109,050,000 yen) ii) The Master Trust Bank of Japan, Ltd. (Stock-granting ESOP Trust account) 1,950,000 shares (4,252,950,000 yen) |

|

(6) Other |

The Treasury Stock Disposal stock is subject to the effectiveness of securities registration statements filed under the Financial Instruments and Exchange Act. |

- Purpose and Reason for Disposal

The Company resolved to introduce the System targeting for eligible employees at the Board of Directors meeting on May 10, 2024 with the aim of raising the awareness of the eligible employees to participate in the management of the Company to improve its corporate value over the medium to long-term, as well as to further enhance the sharing of value with shareholders and to further increase morale and willingness to contribute to performance improvement. In addition, some of our group companies have obtained approval at their respective general meetings of shareholders to introduce the officer’s compensation BIP trust (the “BIP Trust”), an incentive plan for officers similar to the Stock-granting ESOP (Employee Stock Ownership Plan) Trust (the “ESOP Trust”), not only for employees of the group companies, but also for directors (Together with the eligible employees, the “System Participants”.)

The Treasury Stock Disposal is conducted through a third-party allotment of treasury stock to The Master Trust Bank of Japan, Ltd. as co-trustee of the officer’s compensation BIP Trust Agreement and the Stock-granting ESOP Trust Agreement, which the Company has entered into with Mitsubishi UFJ Trust and Banking Corporation. in accordance with the introduction of the BIP Trust and ESOP Trust.

The number of shares to be disposed of is the number of shares expected to be granted to System Participants during the trust period in accordance with the share grant regulations, and the scale of the dilution will be 0.83% (rounded to the second decimal place; Percentage of total voting rights of 2,148,827 as of March 31, 2024: 0.93%) of the total number of shares outstanding as of March 31, 2024 (241,229,476 shares).

Since the Company’s shares allocated through the Treasury Stock Disposal will be delivered to the System Participants in accordance with the share grant regulations and the shares from the Treasury Stock Disposal are not expected to flow out to the stock market at any one time, he Company has judged that the impact on the stock market with this matter will be minimal and that the scale of the shares disposed of and the dilution are reasonable.

【Details of each trust agreement】

|

Types of trusts |

Monetary trusts other than specified solely managed monetary trusts (other-benefit trusts) |

|

Purpose of the trust |

(BIP Trust) To grant incentives to directors of the Company’s group companies (ESOP Trust) To grant incentives to the eligible employees |

|

Consignor |

The Company |

|

Trustee |

Mitsubishi UFJ Trust and Banking Corporation (Co-Trustee: The Master Trust Bank of Japan, Ltd.) |

|

Beneficiaries |

System Participants who meet the requirements for Beneficiaries |

|

Trust Administrator |

A third party that does not have any interest in the Company |

|

Trust agreement date |

August 2024 (Plan) |

|

Duration of the trust |

August 2024 (Plan) ~ September 2027 (Plan) |

|

Start date of the System |

September 2024 (Plan) |

|

Exercise of voting rights |

(BIP Trust) Will not exercise (ESOP Trust) The Trustee will exercise the voting rights of the Company’s shares in accordance with the instructions of the Trust Administrator reflecting the voting status of the candidate of Beneficiaries. |

|

Type of shares to be acquired |

The Company’s common stock |

|

Total amount of shares to be acquired |

4,362,000,000yen |

|

Method of acquisition of shares |

Will be acquired from the Company (treasury stock disposal) |

|

Holder of vested rights |

The Company |

|

Residual assets |

Residual assets that can be received by the Company, as the holder of the vested rights, shall be within the extent of the trust expense reserve, which is the trust fund minus the funds for share acquisition. |

- Bases of Calculation of Disposal Amount and its details

The disposal amount is set at ¥2,181, the closing price of the Company’s shares on Tokyo Stock Exchange, Inc. on the business day preceding the resolution at the Board of Directors meeting on the Treasury Stock Disposal (August 6, 2024) to eliminate arbitrariness considering the recent share price trends. The reason we decided to use the closing price of the Company’s shares on the business day immediately prior to the Board of Directors meeting is that it is the market value of the Company immediately prior to the Board of Directors meeting resolution, and we believe that it is highly objective and reasonable basis for the calculation.

The Audit & Supervisory Committee expressed the opinion that the above disposal amount does not constitute a particularly favorable disposal amount.

- Procedures under the Corporate Code of Conduct

Since the dilution ratio of the shares in this matter is less than 25% and there is no change in controlling shareholder, it is not necessary to obtain an opinion from an independent third party or to confirm the intent of shareholders as stipulated in Rule 432 of the Securities Listing Regulations established by Tokyo Stock Exchange, Inc.

|

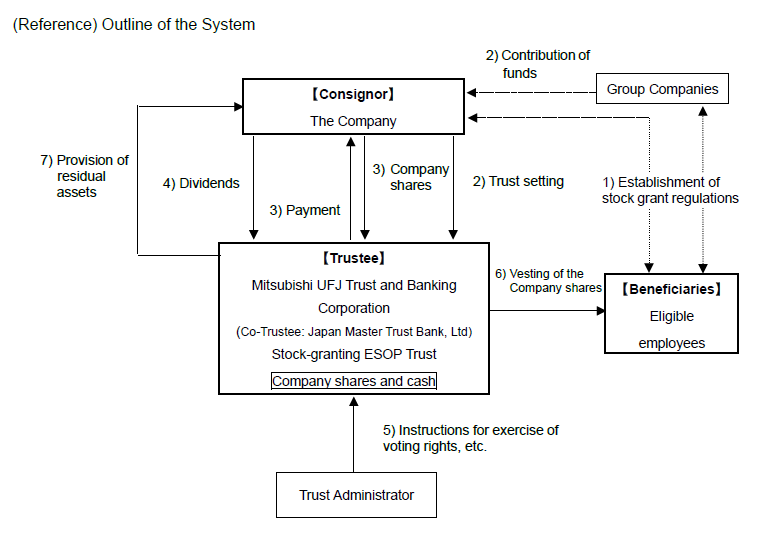

1) The Company and group companies of the Company will establish share grant regulations at the time of the introduction of the System. 2) The Company will set up the ESOP Trust, whose Beneficiaries will be eligible employees of the Company who satisfy the requirements for Beneficiaries by placing the money in trust together with money contributed by the group companies. 3) ESOP Trust will acquire the number of the Company’s shares expected to be vested to the Beneficiaries from the Company (the Treasury stock disposal), using the money contributed in (2) above as the source of funds, in accordance with the instructions of the Trust Manager. 4) Dividends are paid to the Company’s shares in the ESOP Trust in the same manner as other Company shares. 5) With respect to the Company’s shares in the ESOP Trust, the Trust Administrator will provide instructions for the exercise of voting rights and other rights as a shareholder throughout the trust period, and the ESOP Trust will exercise its rights as a shareholder in accordance with such instructions. 6) During the trust period, a certain number of points will be granted to the eligible employees in accordance with the share grant regulations, based on the degree of achievement of the performance targets set forth in the medium-term plan over the eligible period of three years. In addition, eligible employees who fulfill certain requirements will, in principle, receive a grant of shares of the Company’s stock equivalent to a certain percentage of such points after the end of the eligible period of three years and the Company shares corresponding to the remaining points will be converted into cash within the ESOP Trust in accordance with the provisions of the trust agreement, and will receive a cash payment equivalent to the amount of the conversion price. 7) Upon termination of the ESOP Trust, the residual assets after distribution to the Beneficiaries will belong to the Company to the extent of the trust expense reserve, which is the trust fund minus the funds for stock acquisition. |

(Note) During the trust period, if there is a possibility that the number of shares in the ESOP Trust may fall short of the number of shares corresponding to the accumulated points granted to eligible employees, or that the money in the trust assets may be insufficient to pay trust fees and trust expenses, additional money may be placed in the ESOP Trust.

-End-