Management Policy

Message from Management

Message from CEO

Aiming to Further Enhance Corporate Value under the New Medium-Term Plan “Welcome to the Next Level”

President and Group CEO, Representative Director

In the fiscal year ended March 2024, the final year of the medium-term plan, sales increased significantly from the previous fiscal year due to strong sales in the Pachislot and Pachinko Machines Business, steady performance in the Consumer area mainly in Japan and other Asian regions, as well as Rovio Entertainment Corporation’s new entry into the group. As a result, operating income and ordinary income also showed significant increases from the previous fiscal year.

On the other hand, extraordinary losses of approximately 19.2 billion yen were recorded due to the decision to implement structural reform in the Consumer area in response to the deteriorating business environment, particularly in the European studios. As a result, profit attributable to owners of parent decreased from the previous fiscal year, but we believe that this structural reform has paved the way for future improvements in profitability.

Regarding shareholder returns, we paid a dividend of 50 yen per share for FY2023/3 in accordance with our basic policy. In addition, in order to accelerate initiatives for further growth and enhancement of our corporate value, we have also decided to buy back treasury stocks worth 10.0 billion yen, comparing the future business growth forecast based on the new medium-term plan announced this time and the current stock price level. As a result, the amount of shareholder return for FY2024/3 was approximately 20.9 billion yen and the total return ratio was 63.3%.

Under the “Beyond the Status Quo”, medium-term plan from FY2022/3 to FY2024/3, we were able to achieve the profit target, far exceeding the initial plan. Thus, we believe that the previous medium-term plan was successful in reaching “beyond the status quo” and demonstrating that we are once again on a growth trajectory. Given this situation, for the new medium-term plan starting from FY2025/3, we have adopted the slogan “WELCOME TO THE NEXT LEVEL!” expressing our intention to move up to the next level after having reached “beyond the status quo” in the previous medium-term plan.

Under the new medium-term plan, we established the “Gaming Business” as a new segment with the aim of establishing it as the third pillar of our business. In addition, the “Amusement Machine” and “Toys” areas in the Entertainment Contents Business have been combined and renamed “AM & TOY” associated with the establishment of SEGA FAVE Corporation. Furthermore, the “Animation” area, which is positioned as our new growth area, was changed to an independent subsegment. We have also changed our key management indicator from ordinary income to adjusted EBITDA since the latter is easier to compare with global companies and is an appropriate indicator to measure substantial business profitability.

Our goal is to achieve an “Adjusted EBITDA of over 230.0 billion yen” over a cumulative three-year period from FY2025/3 to FY2027/3, and a “ROE of over 10%” on average during the same period. Under the new medium-term plan, we will enhance our business portfolio and further clarify the positioning of each business. We will use the cash flow generated from the Pachislot and Pachinko Machines Business to invest in the growing Consumer area and in the Gaming Business to build a new pillar of our business, thereby enhancing our corporate value.

Regarding the initiatives for sustainability, we have identified “human resources” as the first issue to be addressed and have set the four key indicators of “development of culturally diverse human resources,” “active career opportunities for women,” “development of core human resources,” and “maintenance of work environment.” We are making good progress in all four indicators, and will continuously aim to achieve our goals for 2030 to develop human resources that support the creation of even more sustainable and captivating experiences.

Going forward, we will continue to work toward the long-term and sustainable growth of the SEGA SAMMY Group based on our mission, “Constantly Creating, Forever Captivating — Making Life More Colorful.”

Message from CFO

Committed to an optimal capital structure, we will pursue proactive investment and expand the equity spread

Senior Executive Vice President and Group CFO, Director of the Board

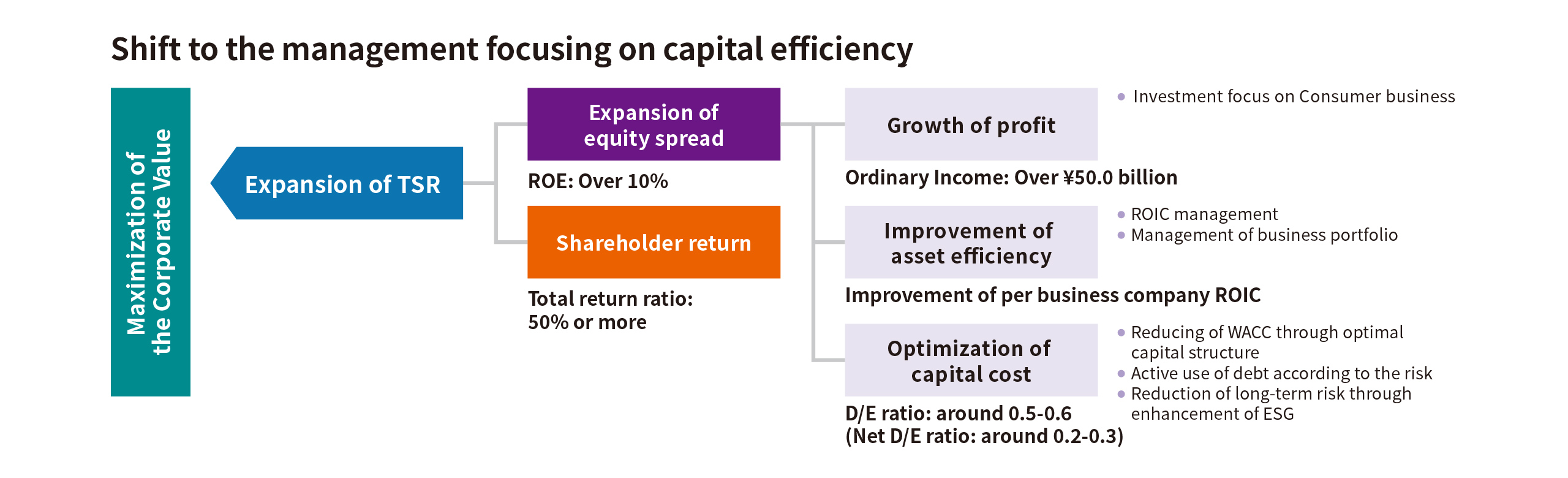

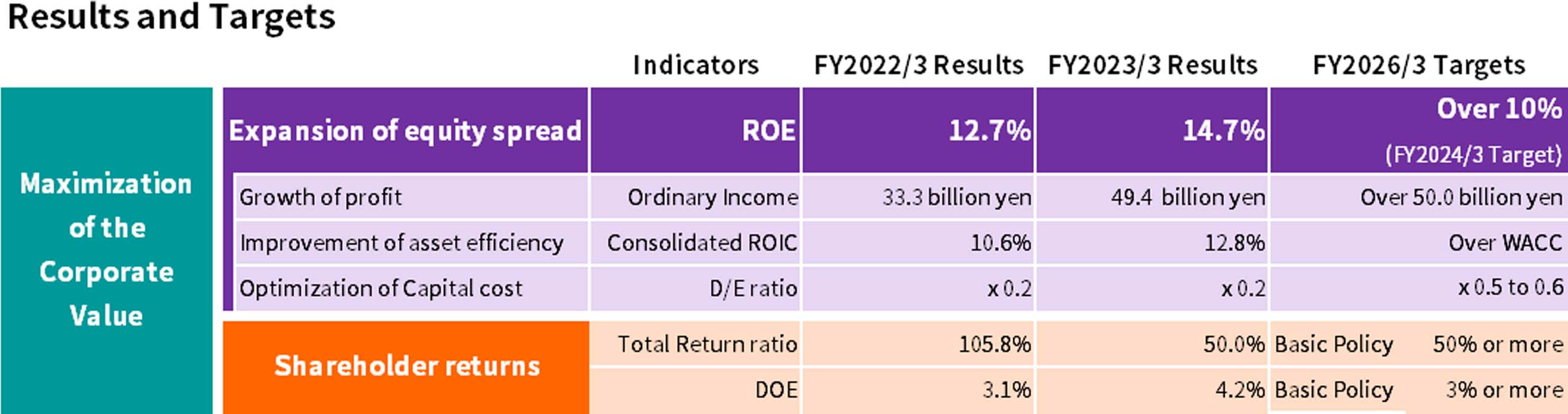

Based on a management framework focusing on capital efficiency with the objective of maximizing corporate value we introduced in fiscal year ended March 2022, we are working on expanding total shareholder return (TSR) by expanding the equity spread and proactively returning capital to shareholders. There are three elements involved in widening the equity spread: growth of profit, improvement of asset efficiency, and the optimization of capital cost. I believe my role as CFO is to allocate management resources and profits and take effective steps to effect improvements in each of these elements.

We expect to make steady headway in growing profits by maintaining the expansion of profit in the Group’s main businesses. In Consumer area of Entertainment Contents business, we aim to establish a framework for stable profit growth through the global branding of existing IPs, along with continuing to expand earnings by investing aggressively to prepare for future changes in the business environment. Meanwhile in Pachislot and Pachinko Machine business, we will build a stable earnings structure by increasing market share through the introduction of products with a competitive advantage in response to the regulatory review while improving business efficiency. We are seeking to improve asset efficiency by introducing ROIC as a management index for each business division, with the aim to engender a strong management focus on asset efficiency and cash earnings in each business division. Also, we intend to optimize the capital cost by reducing WACC through an optimal capital structure, raising debt to fund investment in growth businesses, and reducing long-term risks by strengthening ESG.

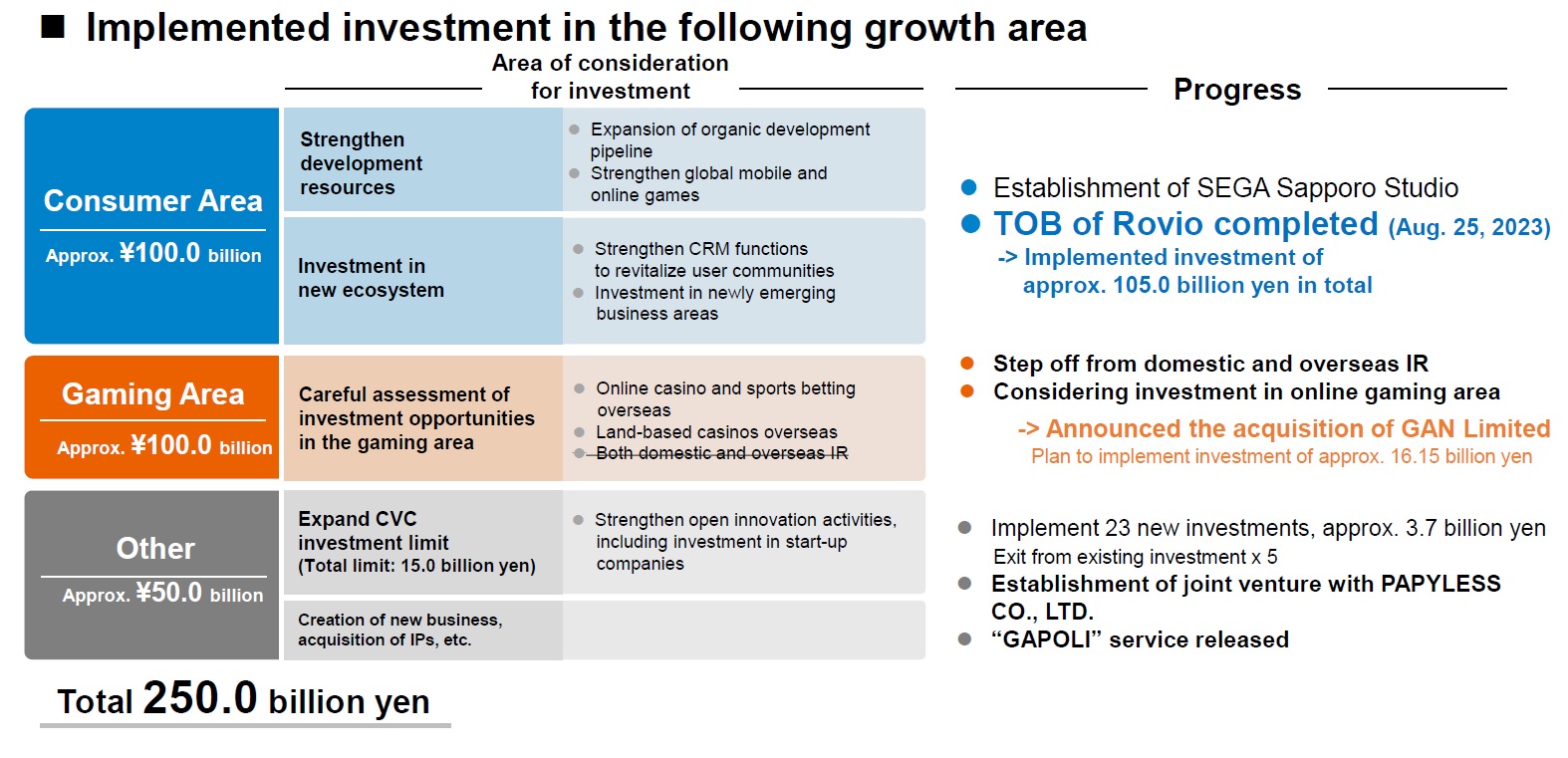

As for investment, we plan to invest a total of ¥250.0 billion in the Consumer area, Gaming area, and other growth areas by the fiscal year ending March 2026. In the Consumer area, we will invest aggressively to the enhancement of development pipeline and etc. to achieve organic growth. In addition, we will consider the acquisition of portfolio companies that fit our strategies. For gGaming area, we will keep exploring entry into integrated resort projects in Japan and overseas as well as overseas land-based casinos. We will also explore investments that eye overseas online casinos, sports betting, and other gaming ventures. Our thinking, in positioning the Gaming area as the third driver of earnings, goes along these lines: Because the Gaming area has high barriers to entry and the potential for hefty profit margins, substantial growth in this area will put the Group on a solid standing for the future.

I want to aggressively implement an audacious, forward-thinking financial strategy to capitalize while emphasizing capital efficiency and fiscal discipline in line with the approaches I’ve explained. The Group, which has stepped out boldly into an era of change, will meet the expectations of investors by continuing to embrace challenges.