ESG

Disclosure in Line with TCFD Recommendations 2024

Disclosure in Line with TCFD Recommendations

SEGA SAMMY Group’s Efforts Towards the ‘Environment’

SEGA SAMMY HOLDINGS INC. (hereinafter referred to as the Company) has set forth its group mission to be “Constantly Creating, Forever Captivating – Making Life More Colorful” and is promoting sustainability management. As part of this effort, we have identified five materialities (important issues) and set ‘environment’ as one of them. The SEGA SAMMY Group (the Group) has been working on effectively using energy, reducing the environmental load from offices and production bases, and environmentally conscious design of products/services to prevent global warming. In May 2022, we set a quantitative target for reducing greenhouse gas (GHG) emissions. In Scopes 1 and 2, we aim to reduce group-wide emissions by more than 50% by 2030 based on the fiscal year ending March 2021 and achieve carbon neutrality by 2050. In Scope 3, SEGA CORPORATION and Sammy Corporation, the Group’s principal operating companies, aim to achieve a more than 22.5% reduction that meets the SBT* level by 2030. This target will be realized through engagement with suppliers through supplier surveys and collaboration to address climate change issues.

※ Based on the requirements of the Paris Agreement and scientific evidence, companies set greenhouse gas emission reduction targets for 5 to 10 years in the future.

The Purpose of Expressing Support for TCFD and Participating in the TCFD Consortium

The Group has started disclosing climate-related financial information based on the TCFD framework since May 2022.

In June of the same year, the Group announced its endorsement of the main points of the final report (TCFD Recommendations) of the Task Force on Climate-related Financial Disclosure (TCFD), which provides a framework for climate-related information disclosure and will be used as guidelines to verify the adequacy of the Group’s climate change-related measures.

In addition, through participation in the TCFD Consortium, which comprises companies and financial institutions that support the TCFD, we will exchange information with other supporting companies and financial institutions to ensure more effective information disclosure.

Information Disclosure Items Recommended by TCFD Recommendations

| Recommended Disclosure Items | Recommended Disclosure Content |

| Governance | (a) Board oversight of climate change-related risks and opportunities (b) Management’s role in assessing and managing climate change-related risks and opportunities |

| Strategy |

(a) Describe the short-, medium- and long-term climate change-related risks and opportunities identified by the organization |

| Risk Management |

(a) Describe the process by which the organization identifies and assesses climate change-related risks |

|

Indicators and Targets |

(a) Disclose the metrics used by the organization to assess climate change-related risks and opportunities in line with its strategy and risk management process |

(Source) Task Force on Climate-related Financial Disclosures, “Final Report: Recommendations of the Task Force on Climate-related Financial Disclosures,” June 2017

Recommended Disclosure Item: Governance

(a) Board Oversight of Climate Change-Related Risks and Opportunities

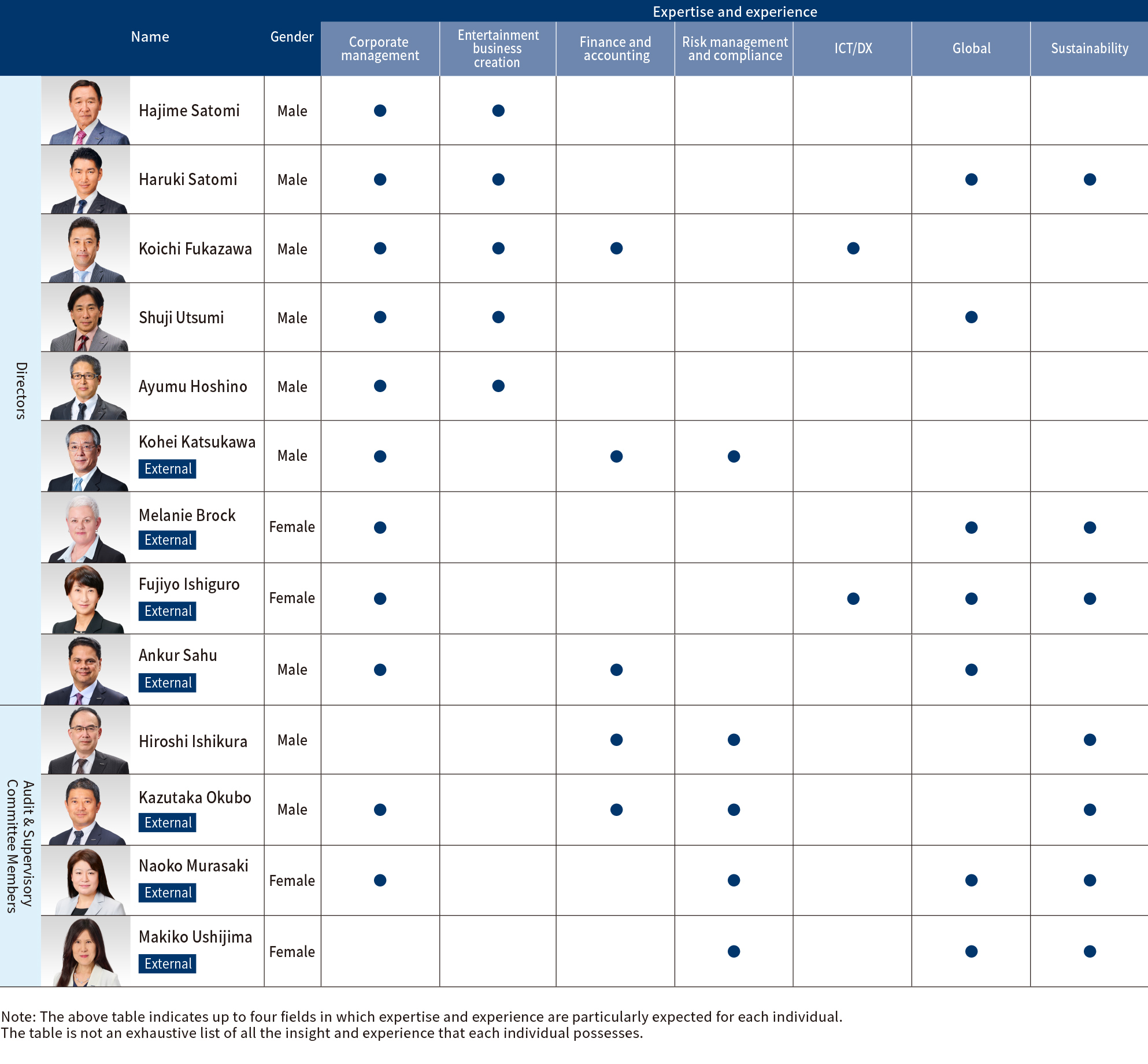

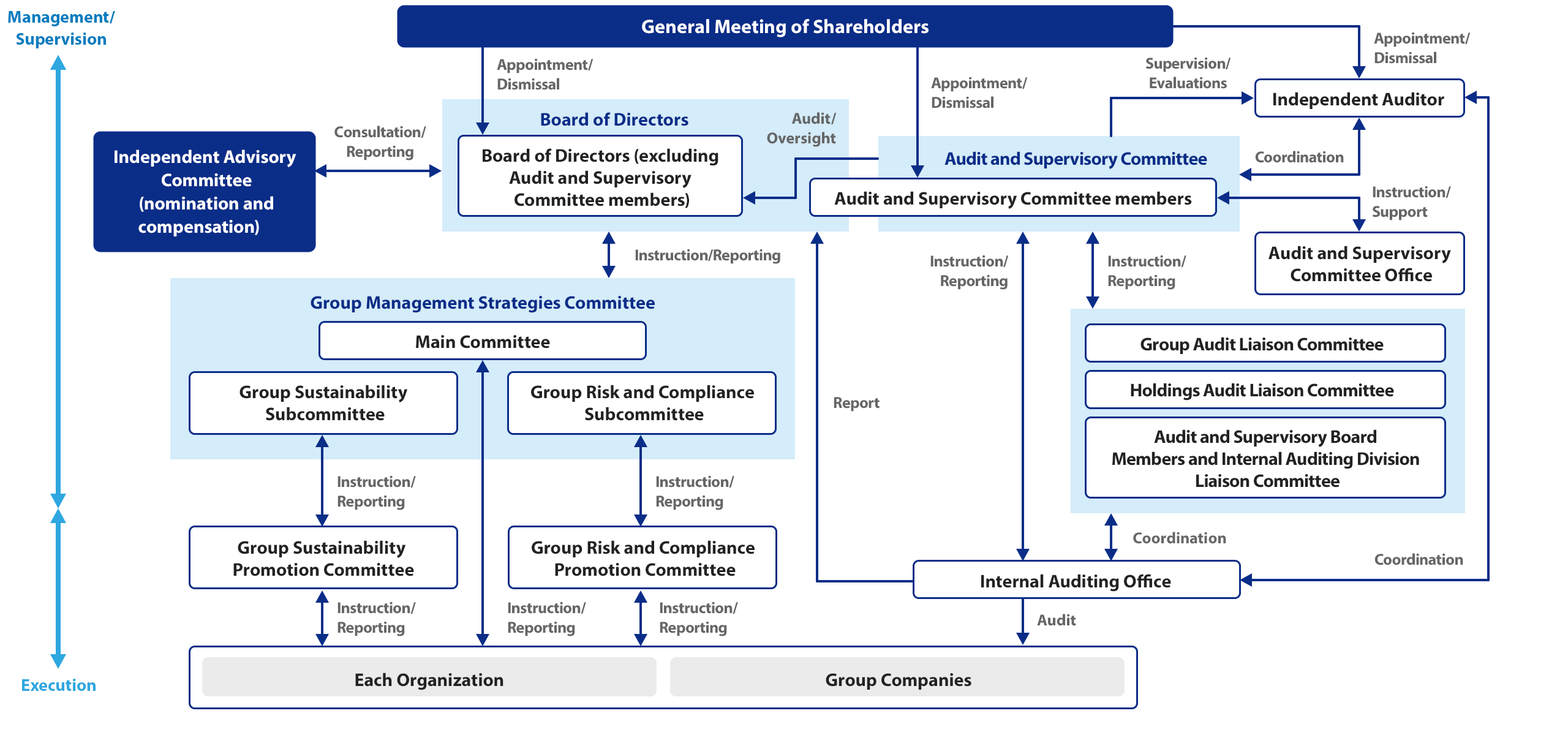

As an organization to discuss and deliberate on the basic policies and important matters related to the Group’s climate change, we established the Group Sustainability Subcommittee within the Group Management Committee, an optional committee, in April 2022. The Group Sustainability Subcommittee is composed of the President and Group CEO of the Company, as well as directors and members of the Board Audit Committee who are consistent with sustainability in the skills matrix of the Board of Directors and also includes the CFO of the Group from the perspective of disclosure by the TCFD. The company’s Sustainability Division handles the secretariat.

The Board of Directors receives reports on the policies and plans discussed in the Group Sustainability Subcommittee and approves them as appropriate. It also receives semi-annual reports on progress and provides oversight on the response to climate-related risks and opportunities. In addition, when deciding on business portfolios or making decisions on large-scale investments and financing, we check from a sustainability perspective, including climate change-related risks as one of the criteria.

[SEGA SAMMY Group Sustainability Governance System]

[Skill Matrix of SEGA SAMMY HOLDINGS INC. Board of Directors Members]

(b) Management’s Role in Assessing and Managing Climate Change-Related Risks and Opportunities

The President and Group CEO/Representative Director also serve as Chairman of the Group Sustainability Subcommittee, which has the highest responsibility for climate-related initiatives. The Subcommittee discusses general sustainability issues, policies, and plans for achieving sustainability goals and monitors the progress of the Group’s initiatives. Discussions by the Subcommittee are reported to and approved by the Board of Directors before proceeding with initiatives.

In addition, under the Group Sustainability Subcommittee, the Group Sustainability Promotion Meeting has been established as a forum for discussing, verifying, and sharing sustainability-related measures.

The Group Sustainability Promotion Meeting is held twice a year. It consists of executives in charge of sustainability at major Group companies, including SEGA CORPORATION and Sammy Corporation, which account for 90% of the Group’s sales. The General Manager of the Sustainability Division manages the meetings and monitors the status of the promotion of initiatives at each operating Company.

Under this system, the Group discloses its policies and manages the progress of each operating Company through its environmental policy. On the other hand, as a factor affecting the environment, we compile greenhouse gas emissions and disclose this information in our integrated report and on our corporate website. While compiling the disclosed information, the Group Sustainability Subcommittee meets to receive reports and instructions from management.

In this way, management’s monitoring of climate change issues effectively implements plans and monitors performance to achieve our goals.

■ SEGA SAMMY HOLDINGS INC. Integrated Report

https://www.segasammy.co.jp/ja/ir/library/printing_annual/

■ SEGA SAMMY HOLDINGS INC. Corporate Website Sustainability ESG Environment

https://www.segasammy.co.jp/ja/sustainability/esg/esgenvironment/

Recommended Disclosure Item: Strategy

(a) Climate Change-Related Risks and Opportunities Identified by the Organization in the Short, Medium, and Long Term

In order to understand the risks and opportunities that future climate change may have on our business activities and financial impact, we have conducted an analysis using scenario analysis methods and the framework proposed by TCFD to predict changes in the external environment.

We disclose the results of our scenario analysis based on three axes: short-term (within 2 years), medium-term (over 2 years to within 10 years), and long-term (over 10 years) for the timing of the emergence of climate change-related risks and opportunities that are expected to significantly impact the Group.

[Definition of the Timing of Emergence of Climate Change-Related Risks and Opportunities in the Sega Sammy Group]

|

Time Axis |

Timing |

Definition |

|

Short-term |

Within 2 years |

Execution period for business plans, etc. |

| Medium-term | Over 2 years to within 10 years |

Until around 2030 |

|

Long-term |

Over 10 years |

2030-2050 |

(b) The Impact of Climate Change-Related Risks and Opportunities on the Organization’s Business, Strategy, and Financial Planning

<Analysis Method and Assumptions>

Based on the requirements of the TCFD recommendations and with the advice of external experts, our Company conducted a scenario analysis for the following purposes:

・Understand the risks, opportunities, and impact of climate change on the Group

・The resilience of the Group’s strategy for the world between 2030 and 2050 and the need for further measures

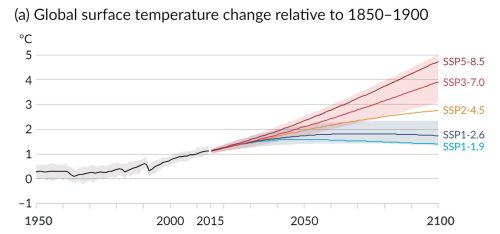

In our scenario analysis, we referred to multiple existing scenarios published by the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC). We assumed two worlds: one in which the goal of the Paris Agreement to limit the global average temperature rise to 1.5°C compared to pre-industrial levels is achieved (the “below 1.5°C scenario”), and another in which greenhouse gas emissions increase from current levels due to the absence of new policies and regulations and the achievement of existing policies and regulations (the “4°C scenario”).

Source: IPCC AR6 WG1 SYR Figure SPM.8

Scenarios referenced

1.5°C scenario: “Net Zero Emissions by 2050” (IEA (*1), 2022), “SSP1-1.9” (IPCC (*2), 2021)

4°C scenario: “Stated Policy Scenario (STEPs)” (IEA, 2022), “SSP5-8.5” (IPCC, 2021)

*1 IEA: The International Energy Agency is an autonomous organization established in 1974 within the framework of the OECD (Organization for Economic Cooperation and Development) after the first oil crisis. It provides information such as medium- to long-term supply and demand outlooks necessary for energy policy.

*2 IPCC: The Intergovernmental Panel on Climate Change is an intergovernmental organization established in 1988 by the World Meteorological Organization (WMO) and the United Nations Environment Programme (UNEP). It provides scientific information necessary for climate change policies of governments of various countries.

<Analysis Results>

From a scenario analysis assuming two worlds, we identified the risks and opportunities that climate change poses to our group and examined transition risks, such as the introduction of policies and regulations by governments, technology, and market changes, as well as physical risks, such as abnormal weather caused by climate change.

[Scenario Analysis Results (Risks/Opportunities, Financial Impact)]

| Large category | Middle category | Risks / Opportunities Items | Timing | Impact on the Group (Risk ● / Opportunity 〇) |

Impact |

| Transition risk・Opportunity |

Changes to policies and regulatory requirements |

Introduction of GHG emission regulations and carbon taxes |

Medium/Long-term |

● The carbon tax burden will increase if governments adopt more brutal climate change-related regulations and apply carbon taxes to greenhouse gas emissions. |

Minor |

|

Medium/Long-term |

● If regulations related to climate change are strengthened, and a carbon tax is introduced for greenhouse gas emissions, the carbon tax will be passed on to procurement prices, including plastics and so on, increasing procurement costs. |

Large |

|||

|

Resources Efficiency |

Reduction of parts, materials, and packaging through environment-focused changes to marketing formats |

Medium/Long-term |

〇 Transforming the sales of online games and game machines into environmentally conscious sales forms will decrease costs, such as reducing parts and packaging materials.

|

Large |

Short term: within 2 years, Medium term: over 2 years to within 10 years, Long term: over 10 years

[Carbon Pricing]

For carbon pricing, which can be quantitatively evaluated based on the third-party assurance of greenhouse gas emissions, we have calculated based on the following calculation.

In the future, we will continue to consider disclosing quantitative evaluations for items other than carbon pricing.

Greenhouse gas emissions (Scope 1 and 2) were calculated by multiplying the emission unit by the activity volume and multiplying it by the assumed carbon tax price for each 1.5°C scenario and 4°C scenario to calculate the impact of carbon pricing.

In 2030, it was found that the burden of the carbon tax would be 410 million yen in the 1.5°C scenario and 120 million yen in the 4°C scenario, and in 2050, it would be 740 million yen in the 1.5°C scenario and 260 million yen in the 4°C scenario. We will continue working towards reducing greenhouse gas emissions by more than 50% by 2030 and achieving carbon neutrality by 2050 as a group-wide goal.

|

Scenario |

2030 |

2050 |

|

1.5°C scenario |

▲410 million yen |

▲740 million yen |

|

4°C scenario |

▲120 million yen |

▲260 million yen |

Assumed carbon tax price: (1.5°C scenario) US$140/t-CO2 in 2030, US$250/t-CO2 in 2050, (4°C scenario) US$42/t-CO2 in 2030, US$89/t-CO2 in 2050 (quoted from IEA (World Energy Outlook 2023)), assuming an exchange rate of US $1=141 yen (adopting the AR at the time of our second quarter results for the fiscal year ending March 2024)

*Assuming that Scope 1 and 2 are targeted, greenhouse gas emissions are the same as in the fiscal year ending March 2023.

(c) Resilience of the Organization’s Strategy Based on Various Climate Change-Related Scenarios, including Scenarios below 2°C

In order to address the risks and opportunities identified in the two scenarios assuming 2030-2050, the Group will strengthen existing initiatives and develop new measures. We will ensure the resilience of our mid- to long-term strategy by working to minimize risks and maximize opportunities throughout the supply chain based on the impact on our business and finances.

[Countermeasures]

|

Impact on the Group |

Impact |

Countermeasure |

|

● The carbon tax burden will increase if governments adopt more brutal climate change-related regulations and apply carbon taxes to greenhouse gas emissions. |

Minor |

Switching to non-gasoline cars / Introducing raw green electricity / Purchasing green power certificates / Introducing solar power generation equipment services, etc. |

|

● If regulations related to climate change are strengthened, and a carbon tax is introduced for greenhouse gas emissions, the carbon tax will be passed on to procurement prices, including plastics and so on, increasing procurement costs. |

Large |

Working to reduce manufacturing costs, including procurement and disposal costs, by adopting alternative materials such as recycled plastic, promoting the reuse and recycling of used amusement machines and game machine parts, and changing housing design/ Continue to strengthen supplier engagement and support the reduction of greenhouse gas emissions |

|

〇 Transforming the sales of online games and game machines into environmentally conscious sales forms will decrease costs, such as reducing parts and packaging materials. |

Large |

Building partnerships with platformers that are working on environmental measures and work to reduce environmental impact / Reduce environmental impact by standardizing game machine parts and minimizing replacement to cut down materials to be used |

Recommended Disclosure Items: Risk Management

(a) The Process by Which the Organization Identifies and Assesses Climate Change-Related Risks

The Company has identified climate change-related risks that are expected to have a significant impact on the group as follows:

・Risks related to the “transition” to a low-carbon economy

Climate change policies, regulations, technological development, market trends, and evaluations.

・Risks related to “physical” changes caused by climate change

Acute or chronic damage caused by disasters brought about by climate change

In addition, for climate change-related risks that are expected to have a significant impact, we evaluate their importance based on the impact assessment criteria using internal indicators.

(b) The Process by which the Organization Manages Climate Change-Related Risks

The process for managing climate change-related risks in our group involves monitoring and discussing progress on countermeasures within the Group Sustainability Subcommittee, reporting, and obtaining approval from our Board of Directors.

In addition, the management content is shared with sustainability officers from each business company at the Group Sustainability Promotion Meeting under the Group Sustainability Subcommittee.

(c) Integration of the Organization’s Process for Identifying, Assessing, and Managing Climate Change-Related Risks

The Group has established a Group Risk and Compliance Subcommittee within the Group Management Committee as a forum for discussing, verifying, and sharing measures and information related to risk management and other topics.

The Group Risk and Compliance Subcommittee comprises directors and audit & supervisory board members who match risk management and compliance in the skill matrix of the Board of Directors.

For climate change-related risks, progress on countermeasures is monitored in the Group Sustainability Subcommittee and shared with the Group Risk and Compliance Subcommittee to be integrated into potential risks within the group. After verifying and evaluating significant risks, the results of discussions and verification of countermeasures are reported to the Board of Directors.

[Schematic Diagram of SEGA SAMMY Group’s Corporate Governance Structure]

Recommended Disclosure Item: Indicators and Targets

(a) Metrics Used by the Organization to Assess Climate Change-Related Risks and Opportunities in Line with its Strategy and Risk Management Process

The Group has established greenhouse gas emissions (Scope 1, 2, 3) as a metric for managing climate change-related risks and opportunities.

(b) Scope 1, Scope 2, and, if Applicable, Scope 3 Greenhouse Gas Emissions and Related Risks

The Group has been working on calculating the greenhouse gas emissions of the entire group since the fiscal year ending March 2015.

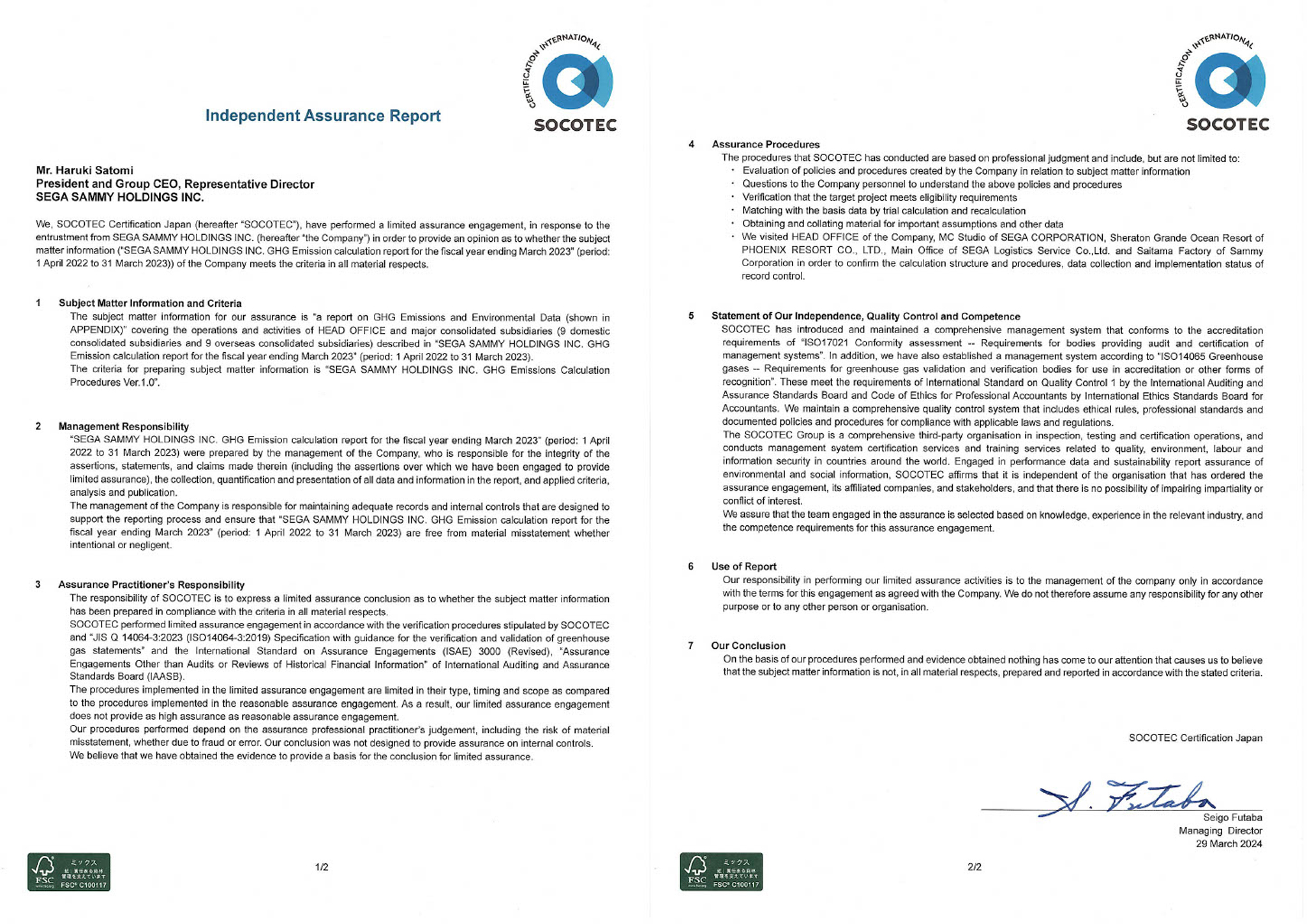

For the fiscal year ending March 2023, the Group has obtained third-party assurance from SOCOTEC Certification Japan for Scope 1, 2, and 3 greenhouse gas emissions.

[SEGA SAMMY Group Scope 1, 2, and 3 Greenhouse Gas Emissions Performance for the Fiscal Year Ending March 2023]

|

Category |

Emissions(t-CO2)*1 |

Share(%) |

|

Scope1 |

6,620 |

0.8 |

|

Scope2 |

14,469 |

1.8 |

|

Scope3 |

761,242 |

97.3 |

|

Total of Scope1, 2 and 3 |

782,331 |

100.0 |

*1 Third-party assurance obtained by SOCOTEC Certification Japan

[Third-Party Assurance Report by SOCOTEC Certification Japan for the Fiscal Year Ending March 2023]

(c) Goals and Performance against Goals Used by the Organization to Manage Climate Change-Related Risks and Opportunities

[Regarding Scope1 and 2]

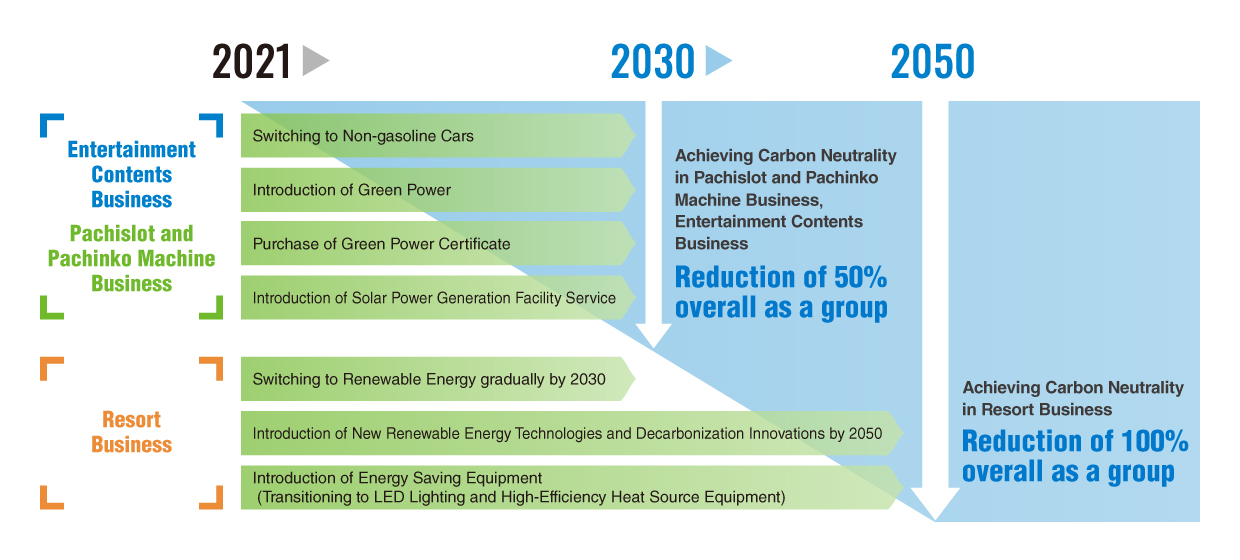

We are working towards achieving carbon neutrality by setting a deadline.

・Achieve carbon neutrality by 2030 in the Entertainment Content and Pachinko & Pachinko Machines businesses, our core businesses

・Achieve carbon neutrality by 2050 group-wide

SEGASAMMY Colorful Carbon Zero

“SEGASAMMY Colorful Carbon Zero” is the name of the Group’s action to promote efforts to reduce greenhouse gas emissions. The word “Colorful” implies achieving carbon zero through various measures.

[SEGA SAMMY Group Scope1, 2 Roadmap for Reducing Greenhouse Gas Emissions]

(As of March 31, 2024)

[SEGA SAMMY Group Scope1, 2 Greenhouse Gas Emissions Trend Graph]

(As of March 31, 2024)

[SEGA SAMMY Group Scope1, 2 Comparison Table of Greenhouse Gas Emissions Targets and Performance]

(As of March 31, 2024)

|

Category |

FYE Mar. 2021 (t-CO2) |

FYE Mar.2023 (t-CO2) |

2030(t-CO2) |

|

Entertainment Content Business (including SSHD) |

8,322 |

2,872 |

Group-wide reduction of around 50% (compared to the fiscal year ending March 2021)

|

|

Pachislot and Pachinko Machines Business |

4,762 |

2,739 |

|

|

Resort Business |

13,537 |

15,478 |

|

|

Total of Scope 1 and 2 |

26,621 |

21,089 |

<Examples of Initiatives>

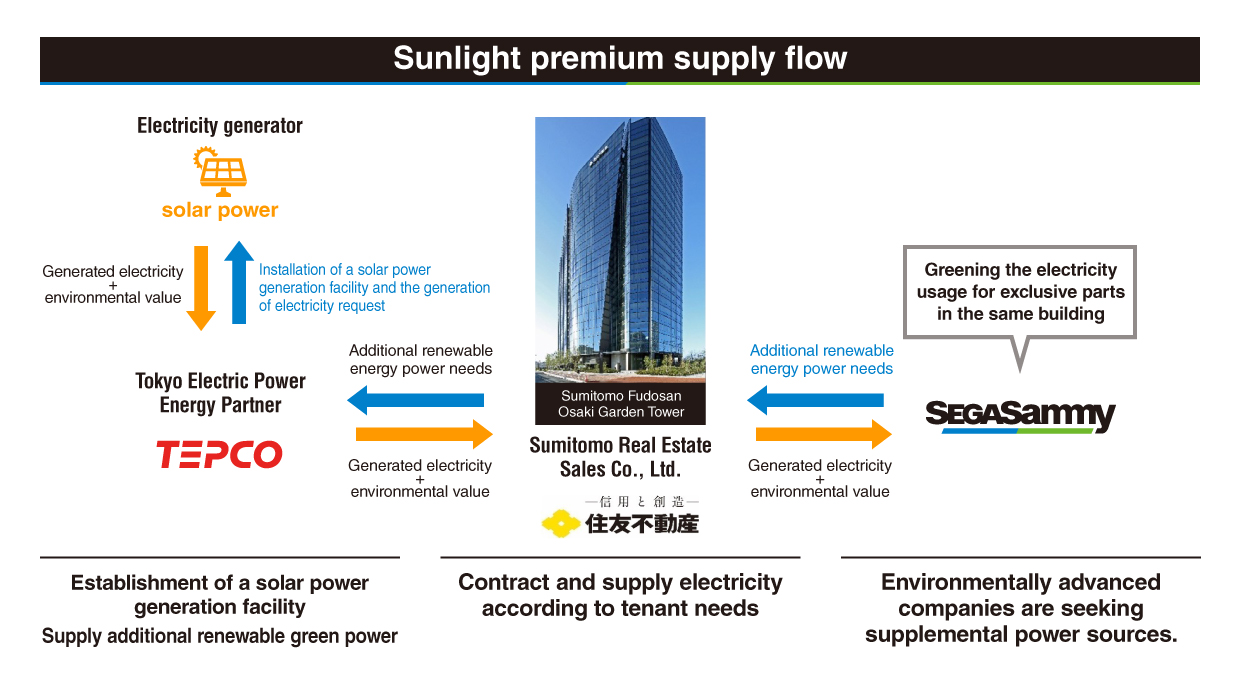

The Group has significantly reduced energy consumption through energy-saving initiatives and the consolidation of offices into high-environmental-performance buildings. To conserve the environment and further reduce CO2 emissions, we have established a scheme in cooperation with Sumitomo Real Estate Development Co., Ltd. and Tokyo Electric Power Energy Partners, Inc. to introduce raw green power “derived from newly constructed solar power plants” to the exclusive areas of tenants in our office buildings, which will directly contribute to increasing the total amount of renewable energy sources in Japan. The scheme has been in place since December 2021 in the exclusive areas of the Group’s head office.

In addition, by utilizing non-fossil certificates for the nighttime hours when solar power generation is not available, the Group can convert virtually 100% of the electricity used at its head office to green power.

[About Scope 3]

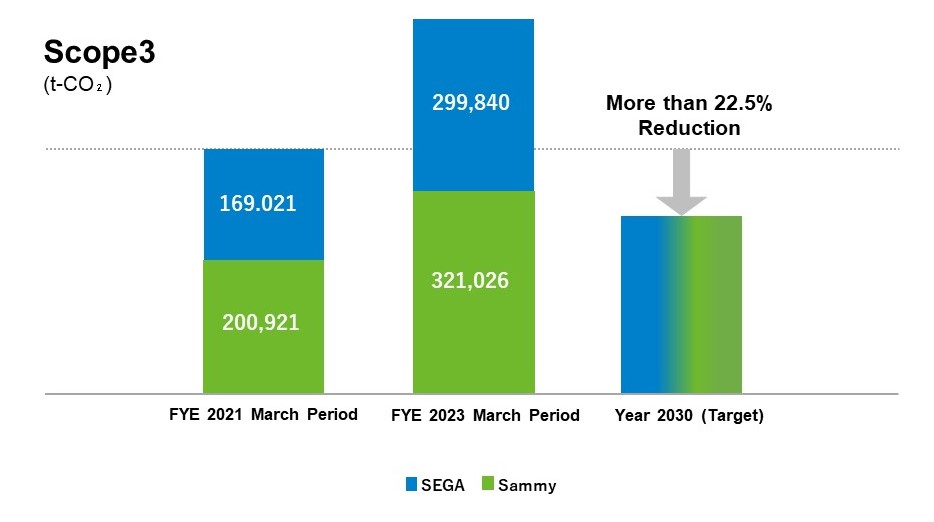

SEGA CORPORATION and Sammy Corporation, the Group’s leading operating companies, aim to achieve a reduction of approximately 22.5% or more, which meets the SBT level, by 2030, and are implementing initiatives such as increasing engagement with suppliers through supplier surveys and other means.

[SEGA SAMMY Group Scope 3 Greenhouse Gas Emission Volume Trend Graph]

Note: The 2030 target includes figures for SEGA FAVE Corporation’s AM business, which was split off from SEGA CORPORATION on April 1, 2024.

[SEGA SAMMY Group Scope3 Comparison Table of Greenhouse Gas Emissions Targets and Performance]

|

Category |

FYE Mar. 2021 (t-CO2) |

FYE Mar. 2023 (t-CO2) |

2030(t-CO2) |

|

SEGA |

169,021 |

299,840 |

Reduction of approx. 22.5% or more (compared to the fiscal year ending March 2021) |

|

Sammy |

200,921 |

321,026 |

|

|

Scope3 Total |

369,942 |

620,867 |

Note: The 2030 target includes figures for SEGA FAVE Corporation’s AM business, which was split off from SEGA CORPORATION on April 1, 2024

<Examples of Initiatives>

[Supplier Surveys]

The Group aims to reduce Scope 3 greenhouse gas emissions and, as part of this effort, has been conducting surveys since the fiscal year ending March 2022 for suppliers that have a significant impact on greenhouse gas emission reductions in order to compile greenhouse gas emission data, set reduction targets, and ascertain the status of reduction activities. In addition to increasing engagement with suppliers, the results obtained are used to reduce greenhouse gas emissions in the supply chain. In the fiscal year ending March 2024, the suppliers surveyed are expanded to 59 companies.

[Number of Suppliers Surveyed]

|

|

FYE Mar. 2022 |

FYE Mar. 2023 |

FYE Mar. 2024 |

|

Number of suppliers surveyed |

24 companies |

41 companies |

59 companies |

[Briefing on Supplier Survey]

The Group held a hybrid briefing, which involved both online and in-person attendees, on the supplier survey in the fiscal year ending March 2024, with 53 companies participating. At the briefing, we explained the importance of the survey and the calculation status of individual companies so that everyone, from companies that are new to the survey to companies that have conducted the survey multiple times, could deepen their understanding of the survey content.

[Sustainability Workshops for Suppliers]

In order to promote climate change-related measures in cooperation with suppliers, workshops and question-and-answer sessions were held for suppliers with which surveys were conducted on the Group’s de-carbonization policy on climate change and case studies, and business and human rights as risks in the supply chain. In the fiscal year ending March 2024, 53 suppliers participated in the workshop.

[Individual Meeting with Suppliers]

In the fiscal year ending March 2024, the Group began individual meetings with its suppliers to promote efforts to reduce greenhouse gas emissions through interactive communication. Face-to-face, direct communication on greenhouse gas emissions calculation methods and issues related to reduction measures promoted mutual understanding. We will continue this communication in the future.

[Number of Briefings, Workshops, and Individual Meetings Held with Suppliers]

|

|

FYE Mar. 2024 |

|

Suppliers participated in the briefings (including online participants) |

53 companies |

|

Suppliers participated in the workshops (including online participants) |

5 companies |

|

Number of suppliers with direct communication (Face to face) |

1 company |