Stock Information

Information on Outstanding Shares

Basic Stock Information

(As of September 30, 2024)

| Company name | SEGA SAMMY HOLDINGS INC. | |

| Established | 1-Oct-04 | |

| Stock Code | 6460 | |

| Capital | 29,900 million yen | |

| Stock Exchange | Tokyo Stock Exchange | |

| the details of the shares it issues | Common Stock | |

| Number of shares authorized for issue |

800,000,000 | |

| Total shares issued and outstanding |

241,229,476 | |

| Round Lot | 100 shares | |

| Number of Shareholders | 57,799 | |

| Fiscal Year-End | March 31 | |

| Ordinary General Meeting of Shareholders |

June | |

| Record Date | Ordinary General Meeting of Shareholders | March 31 |

| Record for Dividends | ||

| (fiscal year) | March 31 | |

| (Interim) | September 30 | |

| Advance public notice is given when required for other dividend payments. | ||

| Administrative Office of Transfer Agent |

Mitsubishi UFJ Trust and Banking Corporation branches in Japan | |

| Securities Agent Department, Mitsubishi UFJ Trust and Banking Corporation 7-10-11, Higashisuna, Koto-ku, Toyko 137-8081, Japan Phone: +81-3-5683-5111 | ||

| Agency | Mitsubishi UFJ Trust and Banking Corporation branches in Japan The website of Mitsubishi UFJ Trust and Banking Corporation, the Company’s transfer agent, provides information on share registration, purchase or additional purchase of shares in fractional lots, and other stock-related procedures. If using the storage transfer system for share certificates, etc., please contact the securities company that handles the transaction. Mitsubishi UFJ Trust and Banking Corporation website: http://www.tr.mufg.jp/daikou/ |

|

| Special Benefit Plan for Shareholders | We are not implemented shareholder benefits program. | |

| Articles of Incorporation/ Share Handling Regulations |

Articles of Incorporation(PDF : 235KB) Share Handling Regulations (JAPANESE)(PDF : 58KB) |

|

Composition of Major Shareholders

(As of September 30, 2024)

| Name of shareholder | No. of shares held (thousand share(s)) |

Shareholding ratio (%) |

|---|---|---|

| HS Company | 39,008 | 18.12% |

| The Master Trust Bank of Japan, Ltd. (Trust account) | 26,372 | 12.25% |

| STATE STREET BANK AND TRUST COMPANY 505001 | 14,552 | 6.76% |

| FSC Co. | 13,682 | 6.35% |

| Custody Bank of Japan, Ltd.(Trust account) | 9,986 | 4.63% |

| KOREA SECURITIES DEPOSITORY-SAMSUNG | 5,647 | 2.62% |

| JP MORHGAN CHASE BANK 385632 | 4,569 | 2.12% | Hajime Satomi | 4,178 | 1.94% |

| Haruki Satomi | 3,921 | 1.82% |

| JP MORHGAN CHASE BANK 385864 | 3,231 | 1.50% |

*1 The Company holds 25,974 thousand shares of treasury stock, but this is excluded from the above list of major shareholders.

*2 Shareholding ratio is the ratio of the number of shares held to the total number of shares issued and outstanding excluding treasury stocks.

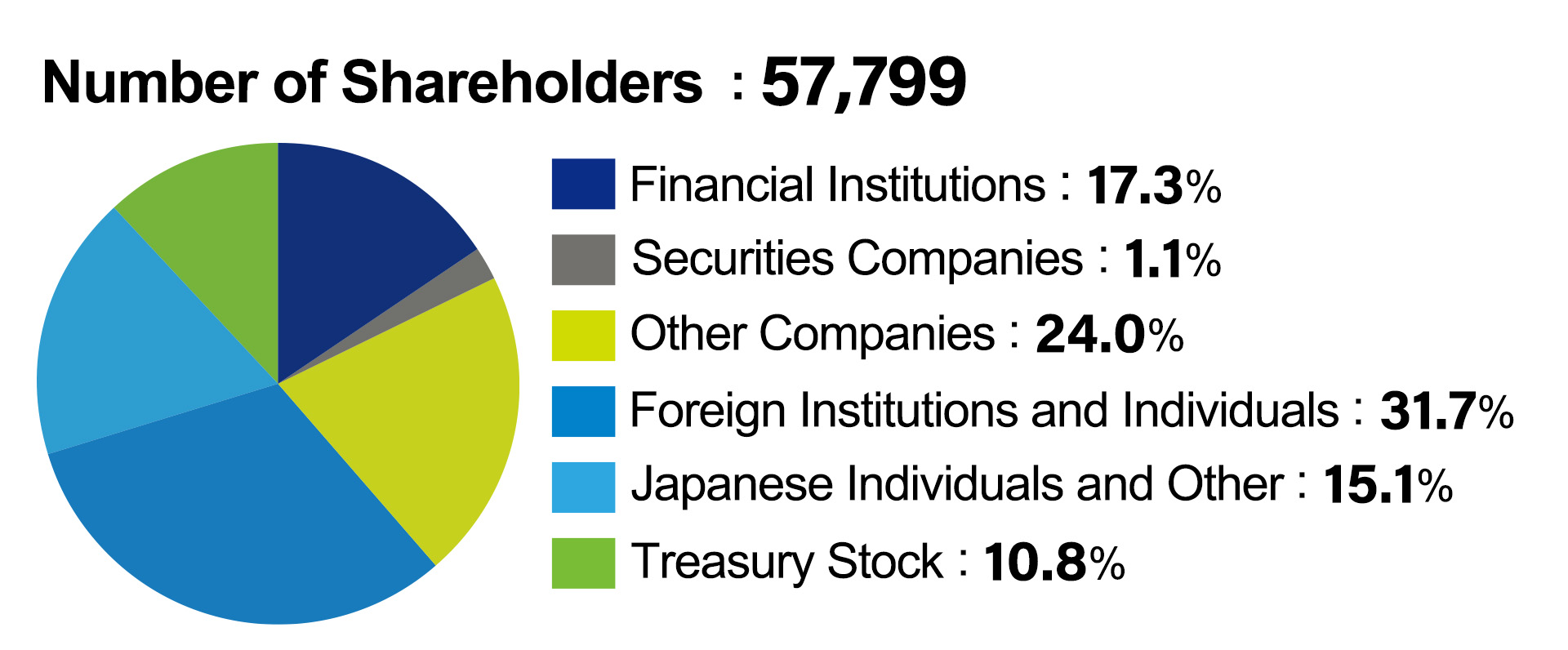

Distribution by Attribute

2024/9/30

(As of September 30, 2024)

| 2021/ 3/31 |

2021/ 9/30 |

2022/ 3/31 |

2022/ 9/30 |

2023/ 3/31 |

2023/ 9/30 |

2024/ 3/31 |

2024/ 9/30 |

|

|---|---|---|---|---|---|---|---|---|

| Number of Shareholders | 63,903 | 65,379 | 59,244 | 59,757 | 60,659 | 58,435 | 68,796 | 57,799 |

| Financial Institutions | 15.8% | 18.8% | 19.6% | 20.9% | 18.3% | 17.7% | 16.5% | 17.3% |

| Securities Companies | 2.1% | 2.6% | 1.7% | 1.5% | 2.4% | 2.0% | 3.3% | 1.1% |

| Other Companies | 21.0% | 21.1% | 20.9% | 23.0% | 23.1% | 23.0% | 24.3% | 24.0% |

| Foreign Institutions and Individuals |

31.5% | 27.9% | 25.0% | 28.3% | 29.8% | 31.7% | 27.5% | 31.7% |

| Japanese Individuals and Other |

17.9% | 18.0% | 16.6% | 17.8% | 17.9% | 17.1% | 17.9% | 15.1% |

| Treasury Stock | 11.7% | 11.6% | 16.3% | 8.5% | 8.5% | 8.5% | 10.5% | 10.8% |

ADR (American Depository Receipt) Information

Ratio: 4:1

Exchange: OTC(Over the counter)

Symbol: SGAMY

CUSIP: 815794102

BNYMellon Shareowner Services

P.O. Box 43006

Providence, RI 02940

U.S. toll Free : 888-BNY-ADRS (888-269-2377)

International Callers : 201-680-6825

Email: shrrelations@cpushareownerservices.com

Website: https://www.adrbnymellon.com/

Shift in Capital and Outstanding Shares

(As of March 31, 2024)

| Total shares issued and outstanding | Capital | |

|---|---|---|

| FY2005/3 | 140,551,522 | 27,291 |

| FY2006/3 | 283,229,476 | 29,953 |

| FY2007/3 | 283,229,476 | 29,953 |

| FY2008/3 | 283,229,476 | 29,953 |

| FY2009/3 | 283,229,476 | 29,953 |

| FY2010/3 | 283,229,476 | 29,953 |

| FY2011/3 | 283,229,476 | 29,953 |

| FY2012/3 | 266,229,476 | 29,953 |

| FY2013/3 | 266,229,476 | 29,953 |

| FY2014/3 | 266,229,476 | 29,953 |

| FY2015/3 | 266,229,476 | 29,953 |

| FY2016/3 | 266,229,476 | 29,953 |

| FY2017/3 | 266,229,476 | 29,953 |

| FY2018/3 | 266,229,476 | 29,953 |

| FY2019/3 | 266,229,476 | 29,953 |

| FY2020/3 | 266,229,476 | 29,953 |

| FY2021/3 | 266,229,476 | 29,953 |

| FY2022/3 | 266,229,476 | 29,953 |

| FY2023/3 | 241,229,476 | 29,953 |

| FY2024/3 | 241,229,476 | 29,953 |

Stock Splits/Stock Swap Ratio

| Effective Month | Split Ratio | |

|---|---|---|

| TAIYO ELEC Co., Ltd. | 2011/8 | 1:0.4 |

| TMS ENTERTAINMENT, LTD. | 2010/12 | 1:0.26 |

| Sammy Networks Co., Ltd. | 2010/12 | 1:333 |

| SEGA TOYS CO., LTD. | 2010/12 | 1:0.33 |

| SEGA SAMMY HOLDINGS INC. | 2005/11 | 1:2 |

Before business integration in October 2004

Joint holding company “SEGA SAMMY HOLDINGS INC.” was established on October 1, 2004 through the business integration of the two companies and was listed on the first section of the Tokyo Stock Exchange on the same day. SEGA and Sammy currently operate as wholly owned subsidiaries of SEGA SAMMY HOLDINGS.

| Effective Month | Split Ratio | |

|---|---|---|

| Sammy | 2004/2 | 1:1.5 |

| 2001/11 | 1:2 | |

| 2000/11 | 1:2 | |

| SEGA | 1993/5 | 1:1.2 |

| 1992/5 | 1:1.3 | |

| 1991/5 | 1:1.4 | |

| 1990/6 | 1:1.1 | |

| 1989/12 | 1:1.3 | |

| 1989/6 | 1:1.1 | |

| 1988/6 | 1:1.3 | |

| 1987/6 | 1:1.5 |

Status of Large-shareholdings Report Submission

Information on increase/decrease of 1% or more in the Company’s shareholding ratio confirmed based on alteration reports pertaining to the large-shareholdings report submitted to the Kanto regional bureau of the Ministry of Finance since 2008

| Date of the Change | Name | Shareholding Ratio after the Change |

Shareholding Ratio before the Change |

|---|---|---|---|

| 2015/4/6 | BlackRock Japan Co., Ltd. | 5.07% | – |

| 2015/4/6 | Mitsubishi UFJ Financial Group, Inc. | 2.88% | 5.37% |

| 2015/3/30 | Mitsubishi UFJ Financial Group, Inc. | 5.37% | – |

| 2013/3/15 | Mackenzie Financial Corporation | 4.82% | 6.46% |

| 2011/8/5 | BlackRock Japan Co., Ltd. | 4.08% | 5.13% |

| 2011/3/28 | Mitsubishi UFJ Financial Group, Inc. | 2.91% | 8.18% |

| 2011/3/15 | BlackRock Japan Co., Ltd. | 5.13% | 6.17% |

| 2011/3/14 | Mitsubishi UFJ Financial Group, Inc. | 8.18% | 6.73% |

| 2011/2/14 | Mitsubishi UFJ Financial Group, Inc. | 6.73% | 5.34% |

| 2011/1/24 | Mitsubishi UFJ Financial Group, Inc. | 5.34% | – |

| 2010/11/15 | BlackRock Japan Co., Ltd. | 6.17% | 5.03% |

| 2010/10/15 | BlackRock Japan Co., Ltd. | 5.03% | – |

| 2010/10/1 | Tradewinds Global Investors, LLC | 4.42% | 5.83% |

| 2010/8/31 | Fidelity Investments Japan Limited | 4.50% | 5.76% |

| 2010/2/15 | Fidelity Investments Japan Limited | 5.76% | 6.91% |

| 2009/1/30 | Fidelity Investments Japan Limited | 6.91% | 7.25% |

| 2009/1/29 | Tradewinds Global Investors, LLC | 5.83% | 6.86% |

| 2008/12/31 | Mackenzie Cundill Investment Management Ltd. | 6.42% | 7.50% |

| 2008/10/31 | Mackenzie Cundill Investment Management Ltd. | 7.50% | 8.83% |

| 2008/9/15 | Fidelity Investments Japan Limited | 7.25% | 9.74% |

| 2008/8/15 | Fidelity Investments Japan Limited | 9.74% | 6.40% |

| 2008/8/14 | Tradewinds Global Investors, LLC | 6.86% | 7.93% |

| 2008/8/6 | Mackenzie Cundill Investment Management Ltd. | 8.83% | 10.07% |

| 2008/7/31 | Fidelity Investments Japan Limited | 6.40% | – |

| 2008/7/23 | Mackenzie Cundill Investment Management Ltd. | 10.07% | 11.07% |

| 2008/7/10 | Mackenzie Cundill Investment Management Ltd. | 11.07% | 11.95% |

| 2008/6/30 | Morgan stanley MUFG Securities Co., Ltd. | 4.05% | 5.05% |

| 2008/5/7 | Mackenzie Cundill Investment Management Ltd. | 11.95% | 10.91% |

| 2008/4/30 | Morgan stanley MUFG Securities Co., Ltd. | 5.05% | 6.17% |

| 2008/3/31 | Capital Research and Management Company | 4.38% | 5.46% |

| 2008/3/14 | Capital Research and Management Company | 5.46% | 7.71% |

| 2008/1/30 | Mackenzie Cundill Investment Management Ltd. | 10.91% | 9.91% |

| 2008/1/17 | Tradewinds Global Investors, LLC | 7.93% | 6.88% |

- The Alteration Reports pertaining to the large-shareholdings report submitted by Fidelity include shares owned by FMR LLC indicated as a joint name

- The Alteration Reports pertaining to the large-shareholdings report submitted by Mackenzie Cundill Investment Management Limited include shares owned by Mackenzie Financial Corporation indicated as a joint name

- The Alteration Reports pertaining to the large-shareholdings report submitted by Morgan Stanley on June 30, 2008 include shares owned by Morgan Stanley & Co. Incorporated, Morgan Stanley & Co. International PLC, Morgan Stanley Investment Management Limited, and Morgan Stanley Investment Management Inc. indicated as joint names

- The Alteration Reports pertaining to the large-shareholdings report submitted by BlackRock Japan include shares owned by BlackRock Asset Management Australia Limited, BlackRock Asset Management Ireland Limited, BlackRock Advisors (UK) Limited, BlackRock Fund Advisors and BlackRock Institutional Trust Company N.A. indicated as joint names

- The Alteration Reports pertaining to the large-shareholdings report submitted by Mitsubishi UFJ Financial Group include shares owned by Bank of Tokyo-Mitsubishi UFJ, Mitsubishi UFJ Trust and Banking Corporation, Mitsubishi UFJ Asset Management Co., Ltd. and Mitsubishi UFJ Morgan Stanley Securities indicated as joint names