Management Policy

Message from Management

Message from CEO

Utilizing Our Four Strengths and Pursuing the Maximization of Corporate Value

President and Group CEO, Representative Director

In the fiscal year ended March 2025 (FY2025/3), mainly the Pachislot & Pachinko Machines Business was significantly impacted by the reactionary decline from strong performance in previous fiscal year when Smart Pachislot Hokuto No Ken became a big hit, and sales and profits at the ordinary income level declined YoY. However, there adjusted EBITDA, which is a key management indicator for our company, increased YoY due to the absence of large “extraordinary losses of business” (an adjustment item) recorded in the previous fiscal year as a result of the reorganization of our European business in the Consumer area.

In the Entertainment Contents Business, adjusted EBITDA significantly increased YoY due to continued strong sales both in the Consumer and Animation areas as well as the absence of extraordinary losses due to the reorganization of our European business in the previous fiscal year. With regard to the Pachislot & Pachinko Machines Business, although decreased YoY, we launched multiple new titles during the fourth quarter and were able to secure adjusted EBITDA of 24.2 billion yen. Furthermore, the Gaming Business saw increases in sales YoY due to strong gaming machine sales, etc. and adjusted EBITDA also achieved profitability.

Regarding shareholder returns, we paid an annual dividend of 52 yen per share for FY2025/3 in accordance with our basic policy and decided to acquire up to 12.0-billion-yen worth of treasury stocks. As a result, the total amount returned to shareholders was 23.2 billion yen, with a total return ratio of 51.5%.

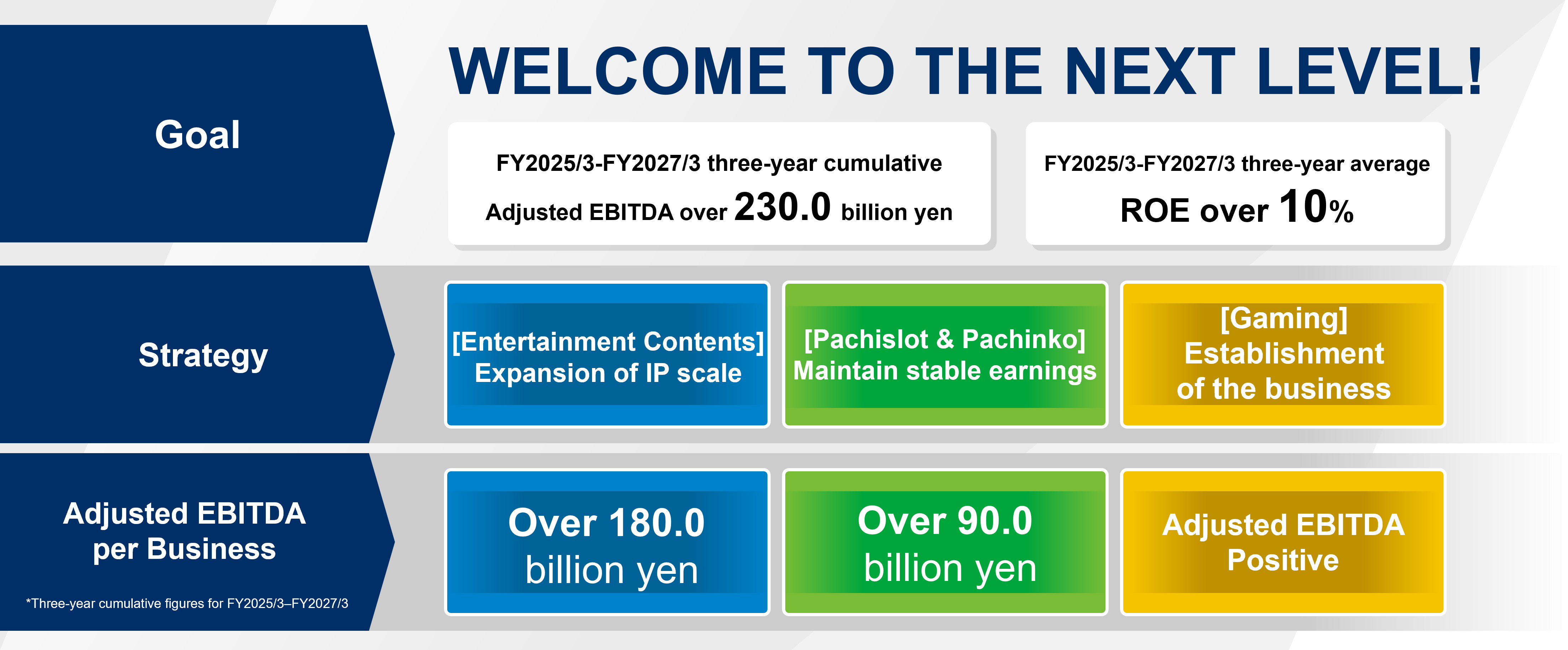

Progress of the Medium-Term Plan

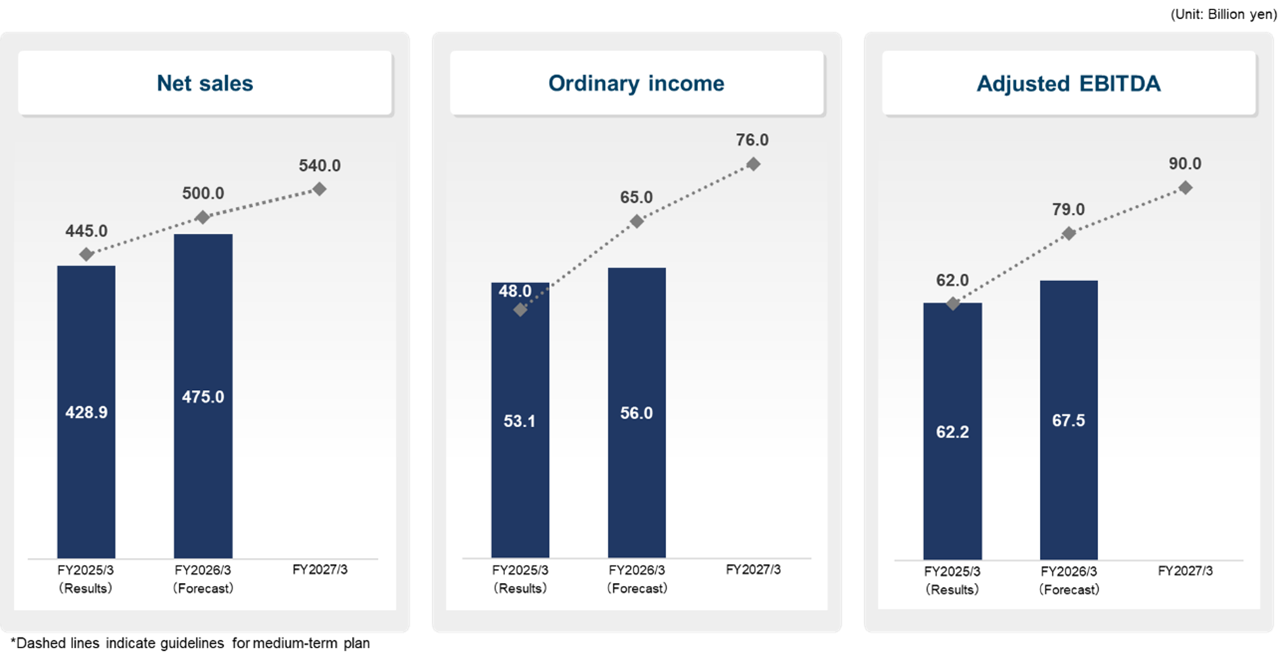

The first year of our Medium-Term Plan—themed “WELCOME TO THE NEXT LEVEL!”—got off to a smooth start, with adjusted EBITDA exceeding our initial target to reach 62.2 billion yen and ROE reaching 12.2% in FY2025/3.

We worked on expanding our transmedia strategy, which is a key focus of this Medium-Term Plan, and made progress in the video adaptation, merchandizing development and other initiatives of our mainstay IPs. For “Sonic IP” in particular, those initiatives has led to an increase in not only game sales but also licensing revenue and contributed to profit growth for the Entertainment Contents Business.

In addition, as part of measures aimed at optimizing our business portfolio, we have transferred the PHOENIX RESORT and Amplitude Studios (an overseas development studio). Conversely, in the Gaming Business, which was newly launched as this fiscal year, we moved forward with the acquisition of two companies: GAN and Stakelogic.

Key Indicators in the Medium-Term Plan

For FY2026/3, the second year of the Medium-Term Plan, we expect our results to fall below guidelines mainly due to factors such as the impact of delayed launch of new F2P titles and changes to the scheduled launch dates of Full Games of our mainstay IP titles. However, we will aim to achieve our targets for the final year of the Medium-Term Plan through the full-year revenue contribution of new F2P titles, launch of major new titles of Full Game, continued steady growth in licensing revenues, and accumulation of repeat sales.

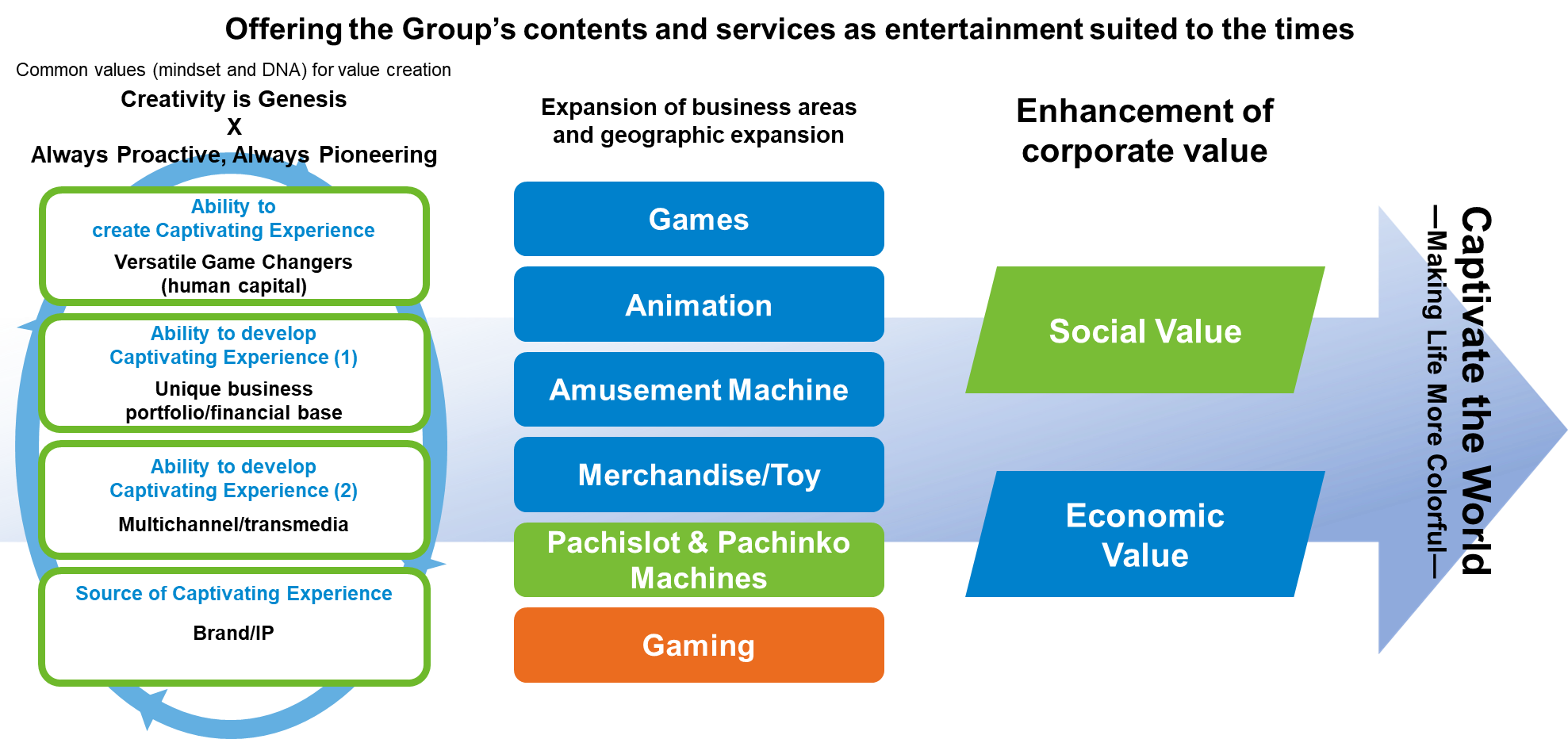

Value Creation Process

In addition, last year we publicly announced our “Value Maximization Cycle” and “Value Creation Process” which is linked to it.

Powerfully driving this cycle built on these four strengths enables us to expand both business area and region, which in turn leads to further reinforcement of each of these strengths. We believe this virtuous cycle to be the basis for creating our “social value” and “economic value.”

In terms of “social value,” we have set targets for “human capital” (one of our four strengths) using four key indicators—“Cultural diversity,” “Career development for women,” “Training of core personnel,” and “Improvement of the work environment”—and all of them are showing consistent improvement. We will continuously develop even more human resources that support the continuous creation of captivating experiences.

Going forward, we will continue to capitalize on our strengths to create captivating experiences and maximize our corporate value.

Message from CFO

Committed to an optimal capital structure, we will pursue proactive investment and expand the equity spread

Senior Executive Vice President and Group CFO, Director of the Board

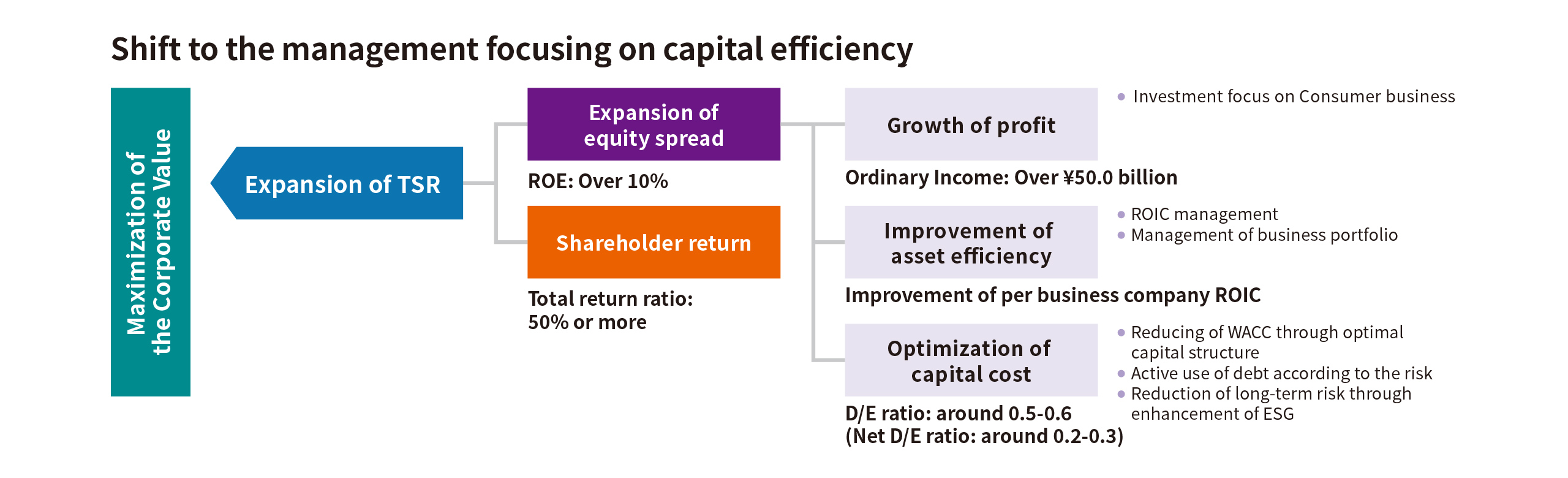

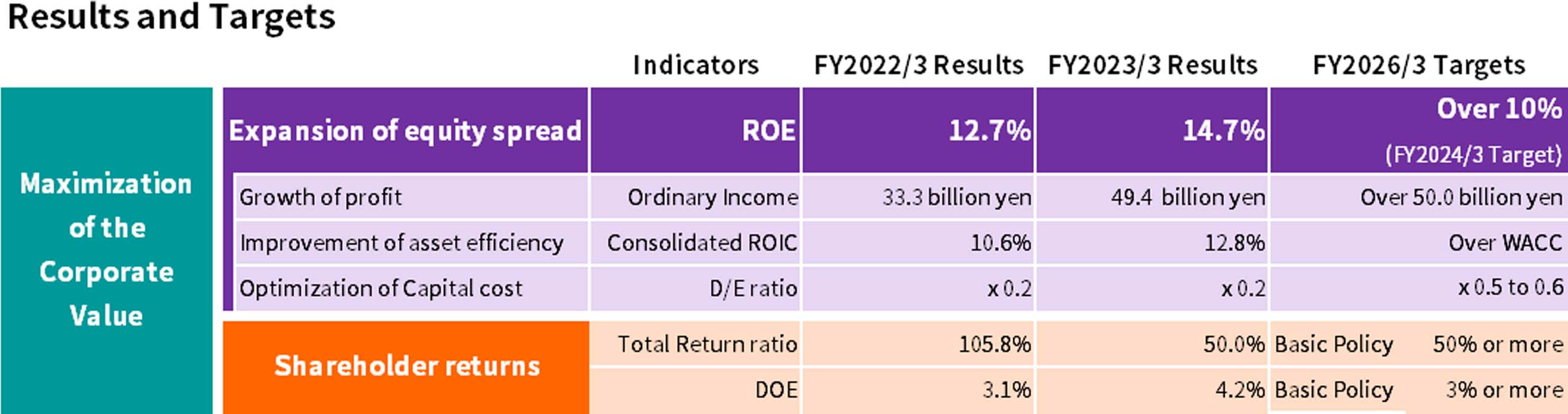

Based on a management framework focusing on capital efficiency with the objective of maximizing corporate value we introduced in fiscal year ended March 2022, we are working on expanding total shareholder return (TSR) by expanding the equity spread and proactively returning capital to shareholders. There are three elements involved in widening the equity spread: growth of profit, improvement of asset efficiency, and the optimization of capital cost. I believe my role as CFO is to allocate management resources and profits and take effective steps to effect improvements in each of these elements.

We expect to make steady headway in growing profits by maintaining the expansion of profit in the Group’s main businesses. In Consumer area of Entertainment Contents business, we aim to establish a framework for stable profit growth through the global branding of existing IPs, along with continuing to expand earnings by investing aggressively to prepare for future changes in the business environment. Meanwhile in Pachislot and Pachinko Machine business, we will build a stable earnings structure by increasing market share through the introduction of products with a competitive advantage in response to the regulatory review while improving business efficiency. We are seeking to improve asset efficiency by introducing ROIC as a management index for each business division, with the aim to engender a strong management focus on asset efficiency and cash earnings in each business division. Also, we intend to optimize the capital cost by reducing WACC through an optimal capital structure, raising debt to fund investment in growth businesses, and reducing long-term risks by strengthening ESG.

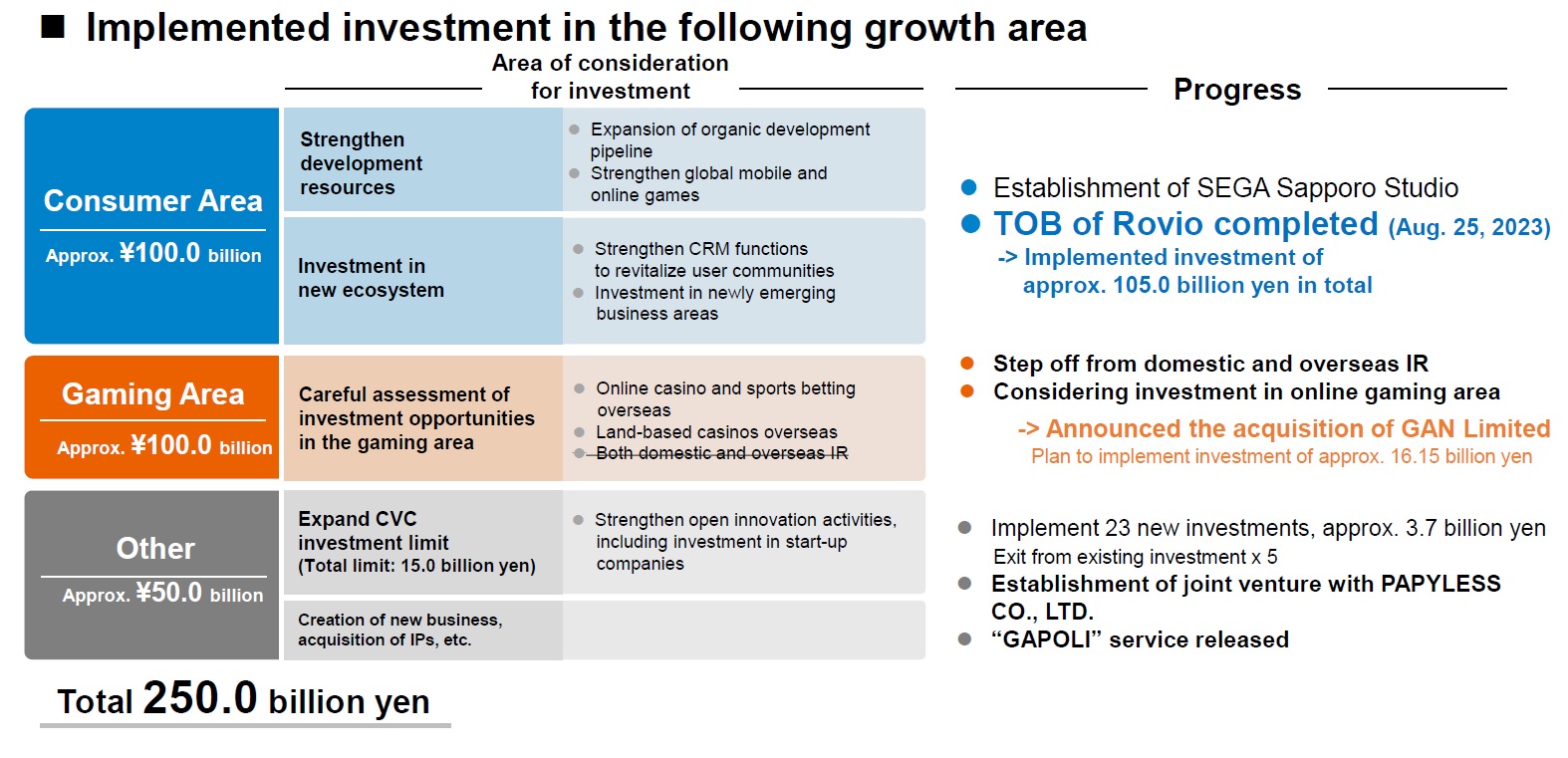

As for investment, we plan to invest a total of ¥250.0 billion in the Consumer area, Gaming area, and other growth areas by the fiscal year ending March 2026. In the Consumer area, we will invest aggressively to the enhancement of development pipeline and etc. to achieve organic growth. In addition, we will consider the acquisition of portfolio companies that fit our strategies. For gGaming area, we will keep exploring entry into integrated resort projects in Japan and overseas as well as overseas land-based casinos. We will also explore investments that eye overseas online casinos, sports betting, and other gaming ventures. Our thinking, in positioning the Gaming area as the third driver of earnings, goes along these lines: Because the Gaming area has high barriers to entry and the potential for hefty profit margins, substantial growth in this area will put the Group on a solid standing for the future.

I want to aggressively implement an audacious, forward-thinking financial strategy to capitalize while emphasizing capital efficiency and fiscal discipline in line with the approaches I’ve explained. The Group, which has stepped out boldly into an era of change, will meet the expectations of investors by continuing to embrace challenges.