Corporate Information

Corporate Governance

- Stance

- System

- Board and Committee Functions

- Assessed Effectiveness of the Board of Directors

- Evaluation of the efficacy of the Audit and Supervisory Committee

- Election and Dismissal Policies for Directors

- Skill Matrix

- Reasons for Appointment of Directors /Attendance at Board Meetings

- Compensation Amount for Officers

- Strategic Shareholdings

- Internal Control Systems

- "Human Capital Development Goals" as a group human resource strategy

Basic Stance

The Company and the Group position corporate governance as the most important foundation for facilitating good corporate behavior. The Company and the Group uphold “improving efficiency,” “securing soundness,” and “enhancing transparency” of corporate management as its basic policy for corporate governance. On this basis, the Company and the Group make determinations on important management issues, including the appointment of director candidates, determining director and auditor remuneration, and management oversight.

Improving Efficiency

By establishing a prompt and appropriate decision-making process and improving the efficiency of corporate management, the Company aims to maximize its corporate value, thereby striving to provide appropriate returns to various stakeholders, including shareholders.

Securing Soundness

Amid significant changes in the business environment, to maximize the Company’s corporate value, the Company and the Group will appropriately recognize and manage the various risks surrounding the Company and the Group. The Company and the Group will strive to secure sound management by establishing a system (compliance system) to ensure compliance not just with laws and regulations, but with ethical standards and societal norms.

Enhancing Transparency

With the growing importance of information disclosure for companies, the Company and the Group will fulfill their accountability to all stakeholders, including shareholders, and further improve disclosure through proactive engagement in IR activities, thereby cultivating highly transparent management.

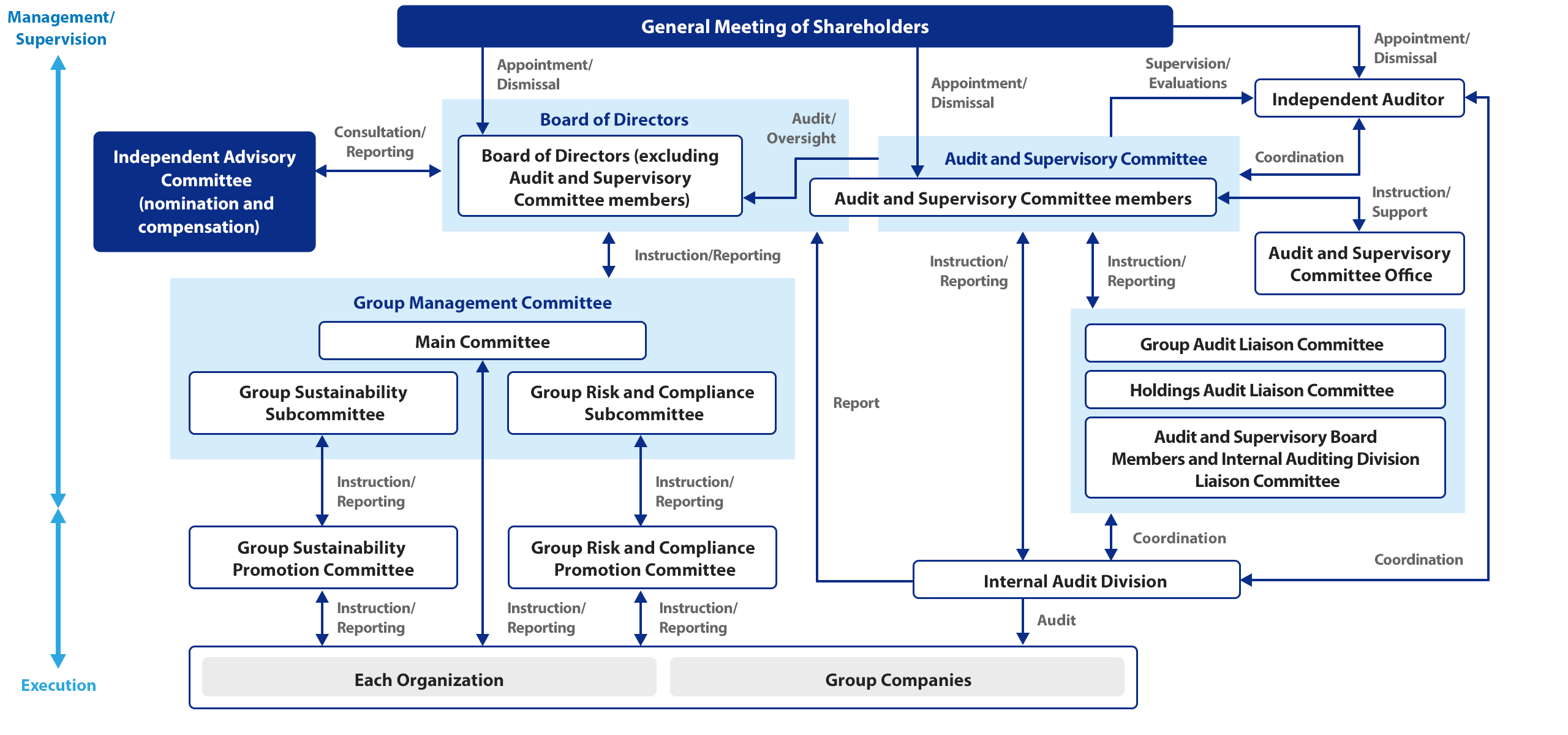

Corporate Governance System

To further promote productive discussions by the Board of Directors and to strengthen its oversight functions, the Company has chosen the structure of a company with an Audit and Supervisory Committee.

This will allow it to delegate a considerable portion of important decisions on business execution to executive directors. In addition, by considering that directors with a wealth of knowledge and experience regarding the industry, market trends, products, merchandise, services, etc. can generate prompt and optimal management decisions, the Group companies have chosen the structure of a company with company auditors. The Company and the Group also appoint external directors and strengthen the executive officer and internal auditing systems, thereby improving corporate governance from the aspects of both oversight and execution.

Schematic Diagram of Corporate Governance System

Board and Committee Functions

Board of Directors

At ordinary Board of Directors meetings held once a month in principle and extraordinary Board of Directors meetings held as appropriate, the Board of Directors aims to achieve flexible management through the current level of 13 directors. Certain important managerial matters at each business company are also resolved or reported at various bodies, including the Company’s Board of Directors.

Audit and Supervisory Committee

The Audit and Supervisory Board consists of 4 Audit and Supervisory Committee members and holds its meetings generally once a month, or when otherwise necessary. The Audit and Supervisory Committee assigns duties to respective Audit and Supervisory Committee members, and deliberates on key matters for consideration such as those involving the status of establishing and operating the Group’s corporate governance and internal control systems, and evaluations of the independent auditor.

Voluntary Committees

Voluntary Committees are the bodies that discuss and inspect the specified matters regarding the management of the Group which are specifically referred by the Board of Directors, and report and submit the results of such discussions and inspections to the Board of Directors. The following 2 Voluntary Committees have also been established: an Independent Advisory Committee and a Group Management Committee. In addition, the Group Sustainability Subcommittee and the Group Risk and Compliance Subcommittee are established as bodies that discuss and inspect further specialized matters.

Assessed Effectiveness of the Board of Directors

Purpose of evaluation

The Company shall perform analyses and evaluations of the effectiveness of the Board of Directors each year to ensure that the Board of Directors effectively fulfills its roles and responsibilities to “improve efficiency,” “secure soundness,” and “enhance transparency” of the Company’s corporate management.

Method of evaluation

For the fiscal year ended March 31, 2025, the Company evaluated the effectiveness of the Board of Directors via questionnaires sent to all directors to ascertain the expectations and issues identified by each Director in his or her efforts to enable the Board to better contribute to the Company’s sustained growth.

These questionnaires were used to confirm various matters deemed important in the Board’s roles and responsibilities, including Board composition, management, and the status of deliberations concerning strategy, as well as the effects of initiatives to address issues identified during the previous fiscal year. To ensure objectivity, the Company had an external organization design the questionnaire and analyze and evaluate the responses. Additionally, the Company confirmed performance of each external director.

Based on the report on the results of the questionnaire prepared by the external organization, deliberations took place at meetings of the Board of Directors on various topics, including the effectiveness of the Board of Directors during the fiscal year, where issues might lie, and responses to such issues.

Summary of evaluation results

Based on these deliberations, the Board of Directors was judged, overall, to function effectively. Its free and open deliberations, based on a Groupwide perspective, were recognized as a key strength. The independent external directors participate in constructive deliberations from medium- to long-term points of view. The composition of the Board ensures diversity.

Reviewed and evaluated below are efforts to address issues recognized last fiscal year:

(1) Intensified efforts and more thorough reporting to the Board of Directors required to refine the risk management structure for the entire Group

(Review and evaluation of initiatives) In the current fiscal year, the Board of Directors and the Group Management Committee found that risk management structures, including the activities of the Risk Governance Division, showed steady improvements, as indicated by the establishment of monitoring opportunities. The need for continuing efforts was acknowledged, given the importance of strengthening risk management for the entire Group.

(2) Further deliberations on resource allocation within the entire Group and on other key issues at the Board of Directors; deepening understanding throughout the Board of the current business environment and related matters, particularly in the Gaming Business, a core Group business

(Review and evaluation of initiatives) During this fiscal year, the Board of Directors and the Group Management Committee created opportunities for deliberations on resource allocation within the Group and on other key issues. They also established opportunities to deepen understanding of the business environment for the Gaming Business. These efforts led to steady improvements. Also recognized was the need for improved deliberations on matters such as capital profitability as a target for the entire Group, given the inherent diversity of revenue structures between individual businesses.

(3) Need to enhance deliberations to reflect awareness of business portfolio management issues, including the need to confirm consistency of individual mergers and acquisitions with Groupwide strategic policies, with the aim of contributing to the sustained growth of the entire Group

(Review and evaluation of initiatives) This fiscal year, the Board of Directors and the Group Management Committee sought to achieve consistency between M&A initiatives and strategic policies for the entire Group. However, the need for continuing efforts to improve deliberations on and understanding of such matters was acknowledged.

In addition, the Board of Directors and the Group Management Committee acknowledged the need to monitor the allocation of human capital for the purpose of effective implementation of strategies across the Group, given the differing characteristics and strategies of the Group’s individual businesses.

Evaluation of the efficacy of the Audit and Supervisory Committee

Purpose of evaluation

The Audit and Supervisory Committee evaluates and improves the effectiveness through the plan-do-check-act (PDCA) cycle. This is intended to make the governance system more transparent and to continually improve audit functions, among other goals.

Method of evaluation

Effectiveness was evaluated through qualitative evaluations based on materials from the Japan Audit & Supervisory Board Members Association on evaluations of Audit and Supervisory Committee effectiveness. The main items evaluated were the propriety of audit plans, the efficacy of governance, internal controls, business audits, and Group audits, attendance at important meetings, selection of key audit matters (KAMs), and coordination with the accounting auditor and internal audit sections.

The Committee is chaired by a standing Audit and Supervisory Committee member. Opinions were exchanged on the evaluation of each item, of various issues, and of the potential for further improvements. The findings were reviewed by the Audit and Supervisory Committee, which also deliberated on matters like efficacy, issues, and measures to address the issues in question.

Summary of evaluation results and reporting to the Board of Directors

The Audit and Supervisory Committee was judged to demonstrate satisfactory effectiveness. New business handling, information sharing, and response to risks were identified as issues to be tackled for further enhancement. The report to the Board of Directors noted the intention to cooperate with the Board and other parties to achieve further improvements.

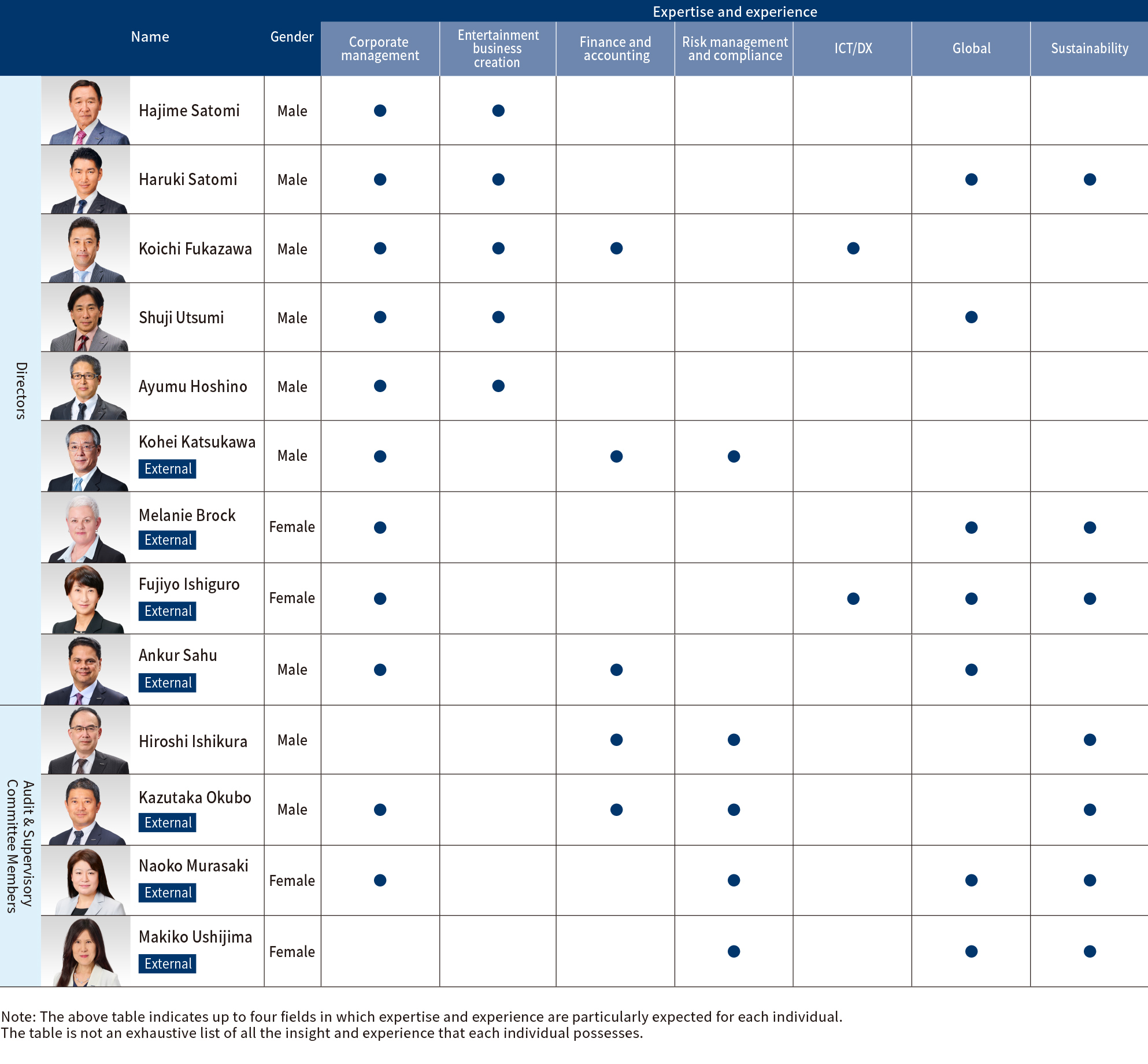

Election and Dismissal Policies and Procedures for Directors

The Company has formulated a skills matrix based on the experience and knowledge required for management of a listed company and the experience and knowledge required to achieve the Company’s long-term vision. The basic policy calls for selecting and determining director candidates based on comprehensive assessment of both character and fit with the skills matrix. The Independent Advisory Committee examines a proposal for such candidates submitted by the President (Representative Director), conducts interviews and the like with such candidates, and submits the evaluation results as its opinion to the President (Representative Director). Based on these evaluation results, the President (Representative Director) judges the director candidates in accordance with the above-mentioned policy. The Board of Directors then discusses and approves such judgment. The same applies when the Independent Advisory Committee recommends director candidates to the President (Representative Director).

If a director is deemed unable to perform his or her duties due to mental or physical incapacity or if a material fact such as misconduct or violation of laws, regulations, or the Articles of Incorporation is recognized in the performance of his or her duties, the Independent Advisory Committee shall deliberate to determine the appropriate action in a timely manner. Base on the results of such deliberation compiled in a report to the Board of Directors, the appropriate action with regard to the director shall be determined by the Board of Directors.

Director Skill Matrix

Reasons for Appointment of Directors and Attendance at Board Meetings

Reasons for Appointment of Directors and Attendance at Board Meetings for the 20th Ordinary General Meeting of Shareholders is as follows.

Directors (excluding Directors serving as Audit and Supervisory Committee Members)

| Name | Attendance at Board of Directors’ Meetings |

Reasons for Appointment | |

|---|---|---|---|

| Hajime Satomi | 12/12 100% |

Mr. Hajime Satomi has served as a corporate manager of the Company and Group companies, demonstrated leadership over many years and contributed to the development of the Group. He has been elected as a director as we expect he will continue to benefit the decision making of the Company’s Board of Directors with such wealth of experience, career record and hard-earned insight, and contribute to improving the corporate value of the Company. |

|

| Haruki Satomi | 12/12 100% |

Mr. Haruki Satomi has served as a corporate manager of the Company and Group companies and contributed to the improvement of corporate earnings. He currently serves as President, Representative Director of the Company and demonstrates leadership as a Chief Executive Officer of the Group. He has been elected as a director as we expect he will continue to benefit the decision making of the Company’s Board of Directors with such experience, career record and leadership, and contribute to improving the corporate value of the Company. |

|

| Koichi Fukazawa | 12/12 100% |

Mr. Koichi Fukazawa has served as a corporate manager of the Company and Group companies in various fields including corporate planning, administration and new businesses. He currently serves as CFO of the Group and promotes the gaming business. He has been elected as a director as we expect he will continue to benefit the decision making of the Company’s Board of Directors with such wealth of experience and career record, and contribute to improving the corporate value of the Company. |

|

| Shuji Utsumi | 10/10 100% |

Mr. Shuji Utsumi has served as a corporate manager for entertainment companies operating globally. He currently serves as President and COO, Representative Director of SEGA CORPORATION and leads the business growth of the SEGA Group on a global stage. He has been elected as a director as we expect he will benefit the decision making of the Company’s Board of Directors with such wealth of experience and career record, and contribute to improving the corporate value of the Company. |

|

| Ayumu Hoshino | 10/10 100% |

Mr. Ayumu Hoshino has long led the pachinko/pachislot machine business at the forefront of development and is currently the President and COO, Representative Director of Sammy Corporation. He has been also appointed Councilor of The Nikkoso Research Foundation for Safe Society, and has extensive knowledge and a wealth of experience in the Company’s core business. He has been elected as a director as we expect he will benefit the decision making of the Company’s Board of Directors with such wealth of experience and career record, and contribute to improving the corporate value of the Company. |

|

| Kohei Katsukawa | External | 12/12 100% |

Mr. Kohei Katsukawa has appropriately fulfilled the roles of an External Director to determine important management matters and oversee the execution of business from a fair standpoint. We have appointed Mr. Kohei Katsukawa again as External Director based on expectations that he will continue to provide valuable input on Company management, based on his wealth of experience and broad-ranging insight gained over many years as a corporate manager. |

| Melanie Brock | External | 12/12 100% |

Ms. Melanie Brock has appropriately fulfilled the roles of an External Director to determine important management matters and oversee the execution of business from a fair standpoint. We have appointed Ms. Melanie Brock again as External Director based on expectations that she will continue to strengthen the Company’s corporate governance system and improve the quality of management decision-making, drawing on her diverse range of ideas and values and her extensive experience and career record as an international business leader. |

| Fujiyo Ishiguro | External | 12/12 100% |

Ms. Fujiyo Ishiguro has appropriately fulfilled the roles of an External Director to determine important management matters and oversee the execution of business from a fair standpoint. As a founder of Netyear Group Corporation, she brings with her a wealth of knowledge of corporate management and IT/DX fields, as well as experience serving as an external director of other listed companies. We have appointed Ms. Ishiguro again as External Director based on expectations that she will continue to provide valuable input on the management of the Company by drawing on this knowledge and experience. |

| Ankur Sahu | External | 9/10 90% |

Mr. Ankur Sahu brings with him broad experience in corporate investment and has made significant contributions to corporate growth and revitalization at Goldman Sachs. We have appointed Mr. Ankur Sahu again as External Director based on expectations that he will provide helpful views and insights on the Company’s future global business development and management, drawing on his wealth of knowledge and experience in finance governance and a track record of in-depth involvement with multiple international enterprises. |

Directors serving as Audit and Supervisory Committee Members

| Name | Attendance at Board of Directors’ Meetings |

Attendance at Audit & Supervisory Committee |

Reasons for Appointment | |

|---|---|---|---|---|

| Hiroshi Ishikura | - - |

- - |

Mr. Hiroshi Ishikura has a high level of expertise in corporate management and financial accounting through his auditing work as a certified public accountant and his experience as a director in charge of management divisions at a business corporation. Since joining the Company, he has been in charge of the internal audit, internal control, and CSR departments, and currently serves as a corporate auditor of the Company’s subsidiaries. He has been elected as a director serving as a new member of the Audit and Supervisory Committee as we expect that he will provide appropriate advice and recommendations to the management of the Company based on his broad understanding of the Company’s group in general and his knowledge of accounting and governance. |

|

| Kazutaka Okubo | External | 14/14 100% |

13/13 100% |

Mr. Kazutaka Okubo brings with him many years of experience in audit services as a certified public accountant and deep insights on finance and accounting. We have appointed him again as an External Director serving as an Audit and Supervisory Committee Member based on expectations that he will appropriately guide and oversee the Company’s management from an objective standpoint, drawing on a wealth of knowledge in governance gained through his experience as an External Director. |

| Naoko Murasaki | External | 14/14 100% |

13/13 100% |

Ms. Naoko Murasaki has a high degree of expertise in the field of the global risk and governance which she gained over many years in the National Police Agency, the Ministry of Foreign Affairs and risk consulting firms. We have appointed her again as an External Director serving as an Audit and Supervisory Committee Member based on expectations that she will appropriately guide and oversee the Company’s management from an objective standpoint, drawing on a wealth of knowledge in governance gained through her experience as an external director. |

| Makiko Ushijima | External | - - |

- - |

Ms. Makiko Ushijima is a licensed attorney at law (in Japan and New York State) and certified in the United States as a Certified Public Accountant. She combines a wealth of experience on topics like mergers and acquisitions and compliance at global firms with multifaceted perspectives on finance and law. We have appointed her again as an External Director serving as an Audit and Supervisory Committee Member based on expectations that she will effectively guide and oversee the Company’s management from an impartial perspective as it seeks to expand globally, drawing on a wealth of knowledge concerning governance. |

Compensation Amount for Officers and the Method for Calculating Such Compensation

The Company’s compensation system for directors and Audit & Supervisory Board members is designed to ensure transparency and provide greater incentive to increase corporate value. The compensation system for directors (excluding directors who are Audit and Supervisory Committee members and external directors) is determined based on the following basic policy.

- The system must increase management’s focus on shareholder interests and sharing value with shareholders.

- The system must clarify the responsibilities of management in improving the corporate value of the Group.

-

The system must function as an incentive to support the sustained growth of the Group.

- The system must have compensation levels for ensuring and maintaining excellent human resources appropriate for executing the roles and responsibilities of directors of the Company.

Based on the basic policy, the remuneration system for Directors of the Company (excluding Audit and Supervisory Committee Members and External Directors) includes fixed remuneration, Directors’ bonuses, and restricted stock units.

SEGA CORPORATION and Sammy Corporation have adopted similar remuneration structures. All remuneration for a Director serving concurrently as Representative Director, President, and CEO of both companies is paid in compliance with the respective officer remuneration systems of both companies.

Fixed Compensation

A compensation table shall be formulated specifying the compensation amounts for each component, namely, basic compensation and role-based compensation, and the Company shall provide the sum of these components as monthly fixed compensation.

Directors’ Bonuses

Directors’ bonuses are paid as performance-linked remuneration in the amount determined by multiplying the above fixed remuneration by coefficients calculated based on a bonus table that defines the number of months of Directors’ bonuses based on three elements: the level of the adjusted EBITDA; level of business plans achieved; and the year-on-year growth.

Restricted stock units

The Ordinary General Meeting of Shareholders held June 25, 2024 resolved to adopt a system of remuneration through restricted stock units for Directors (excluding Audit and Supervisory Committee Members and External Directors; “eligible Directors” hereinafter) to further align the long-term interests of Directors with long-term shareholder interests and to provide incentives for increasing corporate value over the medium to long term. This program will supplant the system of share-based remuneration with restrictions on transfer for eligible Directors; eligible Directors will be issued shares of Company common stock allotted over a certain period of time. Upon comprehensive consideration of the contributions and various other factors of the Eligible Directors, a limit for the total amount of compensation and the number of shares would be set for each Performance Share Units (PSU) and Restricted Share Units (RSU) in relation to the Plan for Eligible Directors. In addition, the Board of Directors will determine the ratio of fixed compensation, single-year performance-linked bonuses and restricted stock units for the three fiscal years if the targets of the Medium-term Management Plan are achieved, to be approximately 1:1:1.

Compensation for directors and Audit & Supervisory Board members for the fiscal year ended March 2025 is as follows.

| Position | Number of Directors / Audit & Supervisory Board members | Total compensation (Millions of yen) | Total compensation by type (Millions of yen) | |||||

|---|---|---|---|---|---|---|---|---|

| Basic compensation | Bonuses | Restricted stock units | Of the items on the left, non-monetary compensation, etc. | |||||

| PSU | RSU | |||||||

| Director of the Board (excluding Audit and Supervisory Committee Members and External Directors) | 7 | 1,313 | 555 | 365 | 304 | 88 | 392 | |

| Director of the Board (Audit and Supervisory Committee Member) (excluding External Directors) | 2 | 24 | 24 | - | - | - | - | |

| External officer | 8 | 97 | 97 | - | - | - | - | |

Notes:

- Both bonuses and remuneration under the post-delivery stock-based compensation system are recorded as expenses in FY2025/3 under review.

- Non-monetary remuneration, etc. consists of post-delivery restricted stock-based remuneration.

- Officers as of the end of FY2025/3 under review include nine Directors (excluding Directors serving as Audit and Supervisory Committee Members but including four External Directors) and four Directors serving as Audit and Supervisory Committee Members (including three External Directors).

- The differences in numbers of payees above reflect the inclusion of two Directors (excluding Directors serving as Audit and Supervisory Committee Members but including no External Directors) and two Directors serving as Audit and Supervisory Committee Members (including one External Director) who retired as of the end of the Ordinary General Meeting of Shareholders held June 25, 2024.

Directors who received ¥100 million or more in total compensation for the fiscal year ended March 2025 is as follows.

| Name | Position | Total compensation, etc. (Millions of yen) | Company | Total compensation, etc. by type (Millions of yen) | ||||

|---|---|---|---|---|---|---|---|---|

| Basic compensation | Bonuses | Performance-based shares with restriction on transfer | Continuous service-based shares with restriction on transfer | Of the items on the left, non-monetary compensation, etc. | ||||

| Hajime Satomi | Director | 530 | Reporting company (the Company) | 216 | 153 | 127 | 34 | 161 |

| Haruki Satomi | Director | 589 | Reporting company (the Company) | 240 | 170 | 141 | 38 | 179 |

| Koichi Fukazawa | Director | 153 | Reporting company (the Company) | 60 | 42 | 35 | 15 | 50 |

| Shuji Utsumi | Director | 123 | Reporting company (the Company) | 8 | - | - | - | - |

| SEGA CORPORATION | 32 | 42 | 31 | 8 | 40 | |||

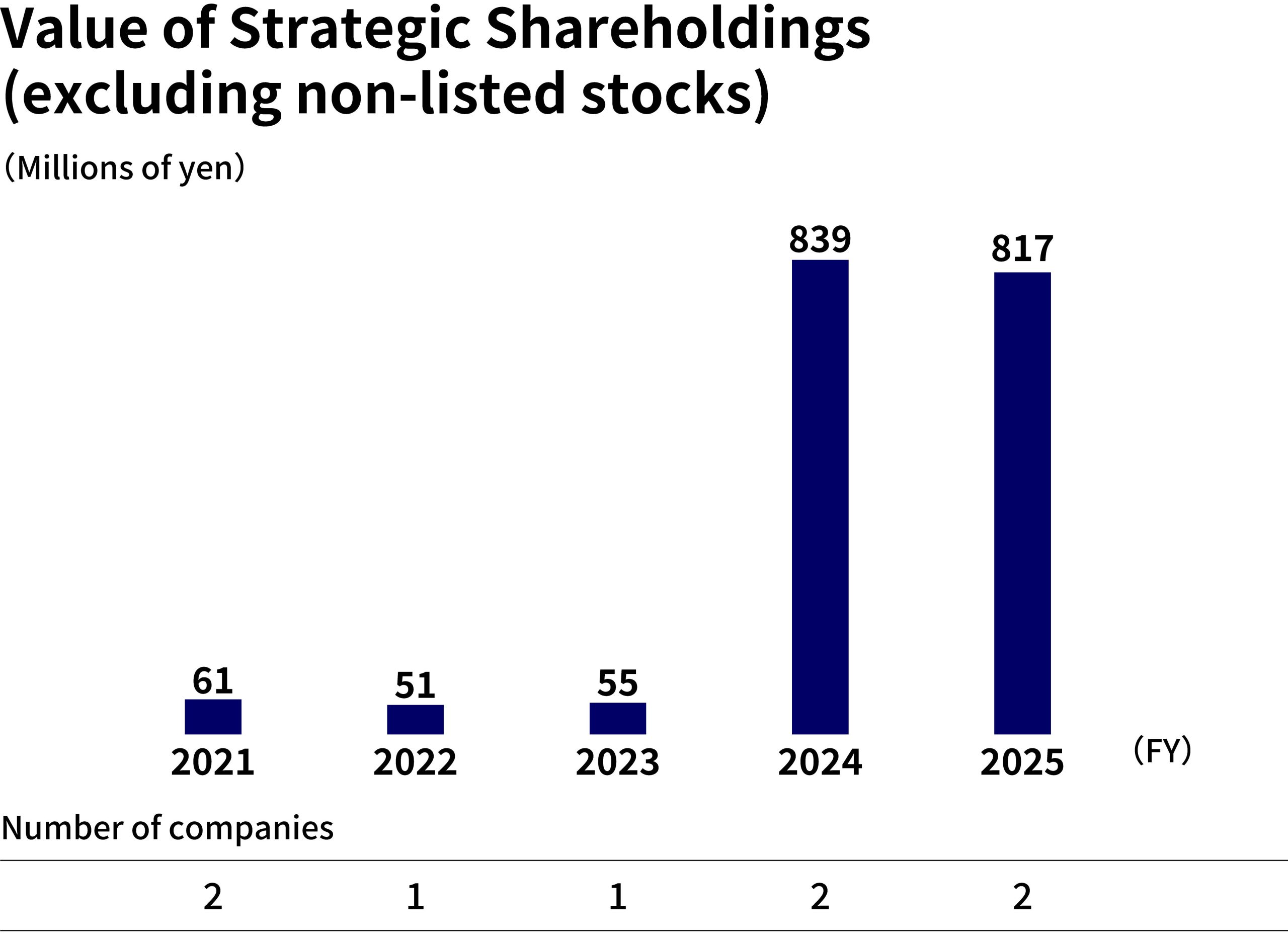

Strategic Shareholdings Policy

The Company possesses shares for purposes other than investment only in cases in which the Company believes the possession thereof will enable business alliances, expand transactions, and will lead to an improvement in corporate value, thereby benefitting shareholders.

The Company periodically examines the economic rationale, future outlook, and other aspects regarding the possession of such shares at its Board of Directors meetings and discusses whether the future possession thereof is justifiable.

In general, the Company exercises the voting rights corresponding to such shares on all proposals based on whether adopting such proposals will contribute to the sustainable growth and mid-to-long-term corporate value enhancement of both the Company and the investee.

| Security title | Current fiscal year | Prior fiscal year | Reason(s) for possession, quantitative possession effects, and reasons for increase in number of shares | The Company shareholdings |

|---|---|---|---|---|

| Number of shares (shares) | Number of shares (shares) | |||

| Balance sheet amount (millions of yen) |

Balance sheet amount (millions of yen) |

|||

| PAPYLESS CO., LTD. | 900,000 | 900,000 | These shares are held to expand the Group’s businesses by establishing JadeComiX Co., Ltd. and expanding into its webtoon business through a capital and business alliance. | None |

| 796 | 814 | |||

| NexTone Inc. | 180,000 | 18,000 | These shares are held to maintain a well-functioning business relationship with regard to the use of copyrights related to music licenses and other content used in games and other businesses. | None |

| 21 | 25 |

Internal Control Systems

To improve corporate governance in the Company and the Group as a whole, the Company has established a Group Risk and Compliance Promotion Committee, and deliberates and confirms any problems occurring in constructing internal control for the management of the Group and the progress thereof, and thus strive to maintain and improve the level of corporate governance.

In addition, the Group established a scheme for evaluating and reporting of the internal control system as required under the Internal Control Report System Relating to Financial Reporting (the Japanese Version of the “SOX Act”), as stipulated in the Financial Instruments and Exchange Act. The Group also addressed inadequacies discovered in the course of these evaluations.

The Company will continue to strive to assure continuing trust/reliability in our financial reporting and to maintain and develop our internal control system, taking into consideration issues such as improving efficiency and securing soundness.

"Human Capital Development Goals" as a group human resource strategy

The Group has established the mission and purpose articulated in the following slogan: Constantly Creating, Forever Captivating -Making Life More Colorful- with the vision to Be a Game Changer. The Group sees, as its reason for being, continuing to deliver fresh excitement by making life more colorful for people around the world and by inspiring sympathy, in an age of dramatic volatility, through its products and services.

Since consolidating the head office functions of the Group companies at Osaki in 2018, the Group has been a pioneering figure in moving forward with an agenda known today as human capital management. The goal has been to build human resources, a culture, and an environment that will help realize its vision. The current Mid-Term Plan (for the year ending March 2025 through the year ending March 2027) sets forth its Human Capital Development Goals as a group human resource strategy that identifies shared topics and goals to be addressed by each Group company. Progress on the important elements of these goals is monitored regularly based on proprietary and quantifiable 4 targets; ① Multicultural talent: No. (ratio) of persons, ② Female managers: No. (ratio) of persons, ③ Amount invested in education and ④ Workplace environment improvement (engagement score).

The Group strives to achieve sustainable growth by creating an environment and culture conducive to continual innovation through bringing together diverse human resources as creators of moving experiences who can demonstrate unique individual strengths in solidarity with their colleagues.