For Individual Investors

Financial Results Overview / Performance Trends / Return

Financial Results Overview(Quarterly)

FY2026/3

Q3

For the nine months ended December 31, 2025, the Group recorded net sales of ¥335,232 million, operating income of ¥19,844 million, and adjusted EBITDA of ¥3,482 million. In the Entertainment Contents Business, regarding Rovio Entertainment Ltd, the Group recognized impairment losses on goodwill and other intangible assets of ¥31,380 million as an extraordinary loss. As a result, loss attributable to owners of parent amounted to ¥16,894 million.

With respect to the outlook, please refer to “Notice of Recording of Extraordinary Losses (Impairment Losses) and Revision of Operating Results Forecast” announced on February 13, 2026.

| (billion) | FY2025/3 3Q (previous FY) |

FY2025/3 Thru 3Q (previous FY) |

FY2026/3 3Q (this FY) |

FY2026/3 Thru 3Q (this FY) |

|---|---|---|---|---|

| Sales | 110.7 | 322.3 | 134.1 | 335.2 |

| Operating Income | 10.9 | 43.7 | 9.8 | 19.8 |

| Ordinary Income | 16.4 | 49.4 | 13.0 | 23.8 |

| Adjusted EBITDA | 19.7 | 54.5 | -12.5 | 3.4 |

| Profit attributable to owners of parent | 11.4 | 41.7 | -19.5 | -16.8 |

Q2

For the six months ended September 30, 2025, the Group recorded net sales of ¥201,108 million, operating income of ¥10,064 million, and adjusted EBITDA of ¥15,959 million, all of which fell short of expectations.

The primary factors behind this shortfall from expectations include lower-than-expected sales of Full Game and the shortfall from expectations of Rovio Entertainment Ltd in the Entertainment Contents Business. In the Pachislot & Pachinko Machines Business, the release schedule was adjusted due to the approval status for pachislot machines. In the Gaming Business, although existing operations showed a strong performance, the Group recorded losses due to factors such as the impact of incorporating the results of newly acquired companies Stakelogic B.V. and GAN Limited.

| (billion) | FY2025/3 2Q (previous FY) |

FY2025/3 Thru 2Q (previous FY) |

FY2026/3 2Q (this FY) |

FY2026/3 Thru 2Q (this FY) |

|---|---|---|---|---|

| Sales | 106.9 | 211.6 | 120.1 | 201.1 |

| Operating Income | 13.5 | 32.8 | 10.5 | 10.0 |

| Ordinary Income | 11.2 | 33.0 | 12.9 | 10.8 |

| Adjusted EBITDA | 9.0 | 34.8 | 14.5 | 15.9 |

| Profit attributable to owners of parent | 5.8 | 30.3 | 6.0 | 2.7 |

Q1

In the first quarter for the fiscal year ending March 31, 2026, the Group started off with net sales of ¥81,026 million, an operating loss of ¥519 million, and adjusted EBITDA of ¥1,461 million. Although the number of newly released titles was limited, net sales were in line with expectations, while the operating loss was narrower than expected. Despite the recording of foreign exchange losses as non-operating expenses, adjusted EBITDA met expectations.

| (billion) | FY2025/3 1Q (previous FY) | FY2026/3 1Q (this FY) |

|---|---|---|

| Sales | 104.7 | 81.0 |

| Operating Income | 19.3 | -0.5 |

| Ordinary Income | 21.8 | -2.1 |

| Adjusted EBITDA | 25.8 | 1.4 |

| Profit attributable to owners of parent | 24.5 | -3.3 |

FY2025/3

Q4

In the fiscal year ended March 31, 2025, the impact of decline due to the rebound by the Pachislot and Pachinko Machines Business was significant, resulting in a decrease in both sales and each stage of profit up to ordinary income on a consolidated basis compared to the prior fiscal year. In contrast, in the Entertainment Contents Business, positioning as a growth area, the animation and merchandising of the Group’s major IPs progressed in line with the transmedia strategy, a priority item in the Medium-term Management Plan “WELCOME TO THE NEXT LEVEL!”. Notably, the “Sonic” IP has contributed to an increase in both game and character licensing revenue, thereby boosting the operating income of this business.

In addition, the Group is reviewing and optimizing its business portfolio. In the fiscal year ended March 2025, the Group recorded an extraordinary loss on business restructuring due to the transfer of the overseas development studio, Amplitude Studios SAS, through a management buyout. However, due to the recording of extraordinary gains by transfer of shares in Phoenix Resort Co., Ltd., and the rebound from the business restructuring loss recorded in the prior fiscal year at the Group’s European base, net income attributable to owners of the parent increased compared to the prior fiscal year.

| (billion) | FY2024/3 4Q (previous FY) |

FY2024/3 Thru 4Q (previous FY) |

FY2025/3 4Q (this FY) |

FY2025/3 Thru 4Q (this FY) |

|---|---|---|---|---|

| Sales | 118.4 | 468.9 | 106.6 | 428.9 |

| Operating Income | 2.7 | 57.8 | 4.4 | 48.1 |

| Ordinary Income | 2.4 | 59.7 | 3.7 | 53.1 |

| Adjusted EBITDA | -0.1 | 54.7 | 7.7 | 62.2 |

| Profit attributable to owners of parent | -2.3 | 33.0 | 3.3 | 45.0 |

Q3

For the nine months ended December 31, 2024, although sales and ordinary income in the Entertainment Contents Business significantly increased, net sales and ordinary income fell from the same period in the prior year when “Smart Pachislot Hokuto No Ken” was a huge hit in the Pachislot and Pachinko Machines Business.

The Group recorded an extraordinary loss of approximately ¥6.1 billion in the second quarter for the fiscal year due to the sale of overseas development studio, Amplitude Studios SAS through a management buyout. In contrast, as the Group was influenced by the rebound effect from the restructuring loss occurred in the prior year, and the Company recorded an extraordinary income by transfer of the shares of Phoenix Resort Co., Ltd., in the first quarter for the fiscal year, the profit attributable to owners of the parent resulted in an increase from the same period in the prior year.

| (billion) | FY2024/3 3Q (previous FY) |

FY2024/3 Thru 3Q (previous FY) |

FY2025/3 3Q (this FY) |

FY2025/3 Thru 3Q (this FY) |

|---|---|---|---|---|

| Sales | 128.9 | 350.5 | 110.7 | 322.3 |

| Operating Income | 15.1 | 55.1 | 10.9 | 43.7 |

| Ordinary Income | 15.3 | 57.3 | 16.4 | 49.4 |

| Adjusted EBITDA | 17.3 | 54.8 | 19.7 | 54.5 |

| Profit attributable to owners of parent | 12.4 | 35.5 | 11.4 | 41.7 |

Financial Results Overview(Full-year)

FY2025/3

In the fiscal year ended March 31, 2025, the impact of decline due to the rebound by the Pachislot and Pachinko Machines Business was significant, resulting in a decrease in both sales and each stage of profit up to ordinary income on a consolidated basis compared to the prior fiscal year. In contrast, in the Entertainment Contents Business, positioning as a growth area, the animation and merchandising of the Group’s major IPs progressed in line with the transmedia strategy, a priority item in the Medium-term Management Plan “WELCOME TO THE NEXT LEVEL!”. Notably, the “Sonic” IP has contributed to an increase in both game and character licensing revenue, thereby boosting the operating income of this business.

In addition, the Group is reviewing and optimizing its business portfolio. In the fiscal year ended March 2025, the Group recorded an extraordinary loss on business restructuring due to the transfer of the overseas development studio, Amplitude Studios SAS, through a management buyout. However, due to the recording of extraordinary gains by transfer of shares in Phoenix Resort Co., Ltd., and the rebound from the business restructuring loss recorded in the prior fiscal year at the Group’s European base, net income attributable to owners of the parent increased compared to the prior fiscal year.

| (billion) | FY2024/3 (previous FY) | FY2025/3 (this FY) |

|---|---|---|

| Sales | 468.9 | 428.9 |

| Operating Income | 57.8 | 48.1 |

| Ordinary Income | 59.7 | 53.1 |

| Adjusted EBITDA | 54.7 | 62.2 |

| Profit attributable to owners of parent | 33.0 | 45.0 |

Performance Trends

For those who would like to know more details

Return

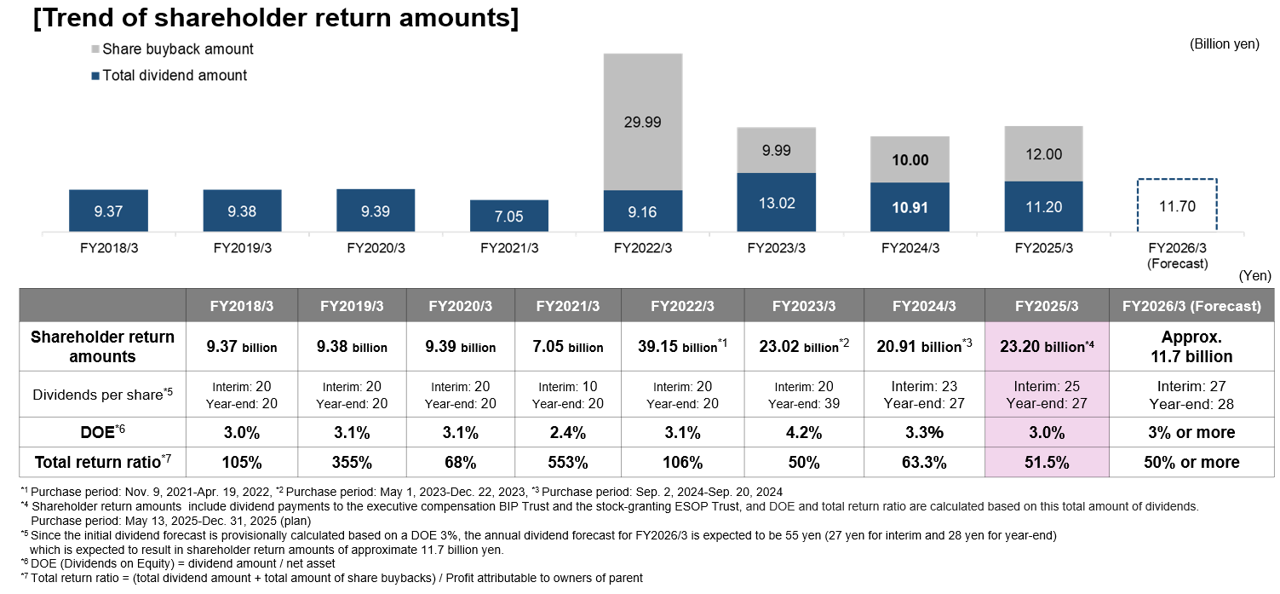

By investing in SEGA SAMMY Holdings as a shareholder, you can receive a portion of the company profits as dividends.

Basic Policy on Profit Distribution Including Dividends

The Company positions the return of profits to shareholders as an important management issue.

We aim to maximize corporate value through the management focusing on capital efficiency in its medium-term financial strategy until the fiscal year ending March 2026 and while promoting aggressive investment for growth, we will also provide appropriate shareholder returns. The basic policy for shareholder returns is to apply DOE (Dividend on equity ratio) 3% or more, or the total return ratio of 50% or more, whichever is higher and implement shareholder returns through dividends or share buybacks.