SS Report Archive

SS Report Archive(FY2022/3 Summer)

FY2022/3 Summer

(From October 1, 2021 to March 31, 2022 / Date of Issue: Jun. 1, 2022)

What is “SS Report (SEGA SAMMY Report)”?:

To increase accessibility of the information about SEGA SAMMY for individual investors and all other stakeholders, we have moved the content that we previously delivered as the Business Report to this page. Changing the name to “SS Report (SEGA SAMMY Report)”, we will further enhance the contents. The feature articles will be continued on the “Interviews” page of this website.

Business Report from the CEO

Pursuing sustainable management and continuing to create experiences that move the heart

President and Group CEO, Representative Director

Haruki Satomi

In the Group operating results for the fiscal year ended March 31, 2022, the Consumer area of the Entertainment Contents Business remained solid. We also saw a turnaround in profits in the Pachislot and Pachinko Machines Business and the Amusement Machine Sales area, both of which had been hit hard by the COVID-19 pandemic. As a result, net sales were 320.9 billion yen (277.7 billion yen in the previous fiscal year) and ordinary income was 33.3 billion yen (1.7 billion yen). In addition, due to the recording of gain on sales of investment securities and a decrease in tax expenses, profit attributable to owners of parent was 37.0 billion yen (1.2 billion yen) and ROE was 12.7%. These results far exceeded our targets for the first year of our medium-term plan, which called for ordinary income of 20.0 billion yen and ROE of 5%. Moreover, as a measure to return profits to shareholders, we bought back approximately 30.0 billion yen of treasury stock. (*The actual acquisition period was from November 9, 2021 to April 19, 2022, and some acquisitions were shifted into the current fiscal year.)

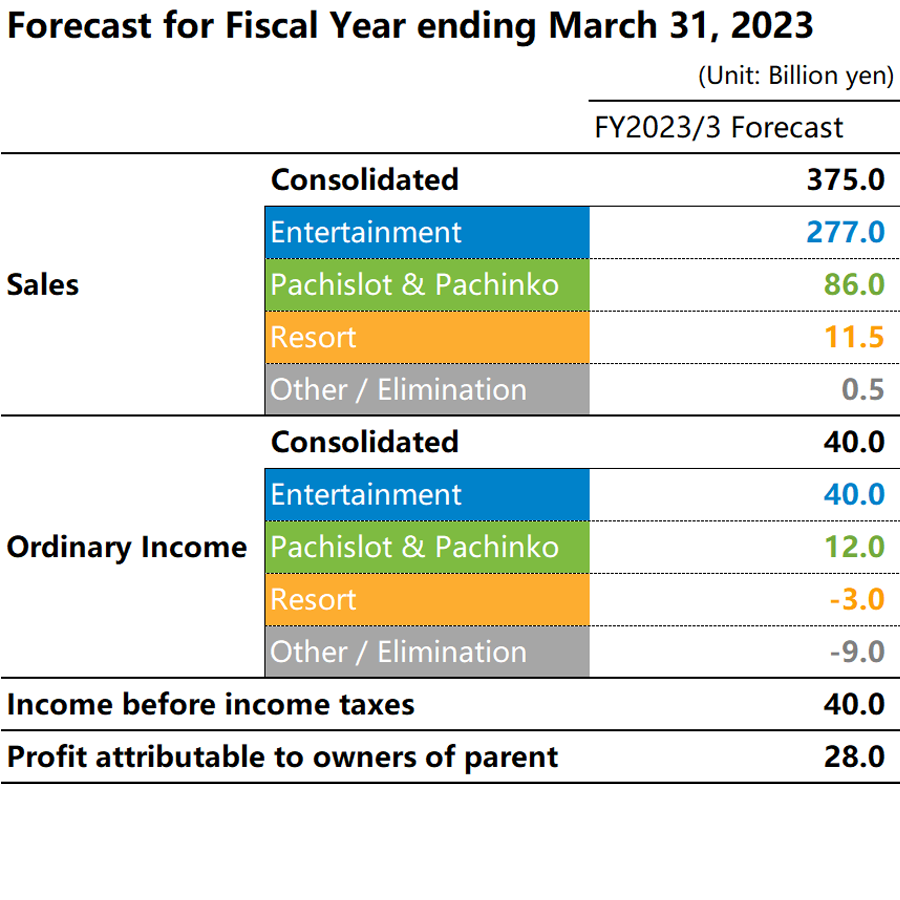

In the fiscal year ending March 31, 2023, we expect higher sales and profits in each business area, for several reasons. We are looking for continued growth in the Consumer area, and are also planning to launch several new titles in line with our three strategies for the global branding of existing IPs. In the Pachislot and Pachinko Machines Business, we are targeting higher unit sales by launching new titles that take advantage of relaxation of regulation. In addition, we expect smaller losses in the Resort Business in line with the easing of restrictions on movement associated with COVID-19. Consequently, we revised our ordinary income target for the second year of the medium-term plan upward to 40.0 billion yen (compared to an initial forecast of 30.0 billion yen). Last year, we set policies on shareholder return for a DOE of 3% or more or a total return ratio of 50% or more. Based on DOE of 3%, our initial forecast is for an interim dividend of 20 yen and a year-end dividend of 21 yen (for an annual dividend of 41 yen). However, we will decide the final amount of the year-end dividend by adopting the higher of the above two policies when full-year results are finalized.

Over the medium to longer term, we are looking to further accelerate global earnings expansion and the growth of the Group. To achieve this, we will undertake aggressive investments to the Consumer area, where we anticipate expansion in markets worldwide, and to the gaming area, which promises future growth.

We also announced a sustainability vision for SEGA SAMMY HOLDINGS this time. We set targets and milestones going forward for the five categories of materiality the Group should address—human resources, products and services, environment, addiction, and governance—with the goal of achieving these targets in 2030. With regard to our response to the global issue of climate change, we will seek to achieve carbon neutrality for Scope 1 and 2 greenhouse gas emissions in all of our business segments by 2050.

We will pursue sustainable management even as we pursue our long-term vision—Constantly Creating, Forever Captivating—Making Life More Colorful—to continue to grow the SEGA SAMMY Group. I would like to ask all our stakeholders for their continued support as we do so.

Results Highlights

Consolidated Results

| (Billion yen) | FY2022/3 (Full year) | Year on year |

|---|---|---|

| Net sales | 320.9 | +16% |

| Operating Income | 32.0 | +392% |

| Ordinary Income | 33.3 | +1859% |

| Profit Attributable to Owners of Parent |

37.0 | +3058% |

Results by Business Segment

| (Billion yen) | FY2022/3 (Full year) | Year on year | |

|---|---|---|---|

| Net sales | Entertainment | 235.9 | +8% |

| Pachislot & Pachinko | 75.8 | +43% | |

| Resort | 8.6 | +37% | |

| Ordinary Income | Entertainment | 36.8 | +32% |

| Pachislot & Pachinko | 10.2 | - | |

| Resort | -6.7 | - | |

- Entertainment

-

Strong performance of new titles in Consumer area and strong performance in the prize category in Amusement Machine Sales area

- Pachislot & Pachinko

-

V-shaped recovery from deficit of the previous fiscal year and secured stable earnings

- Resort

-

Individual customers are recovering despite the negative impact of COVID-19 in domestic but continued to be affected by the restriction of foreign visitors in oversea. Cancellation of Yokohama IR.

Initiatives for sustainability

Under our mission “Constantly Creating, Forever Captivating, – Making Life More Colorful -”, we have created the SEGA SAMMY Sustainability Vision. We set targets and milestones going forward for the five categories of materiality the Group should address—human resources, products and services, environment, addiction, and governance—with the goal of achieving these targets in 2030. Please see “Fiscal Year Ended March 2022 Results Presentation” for the details of initiatives for sustainability.

For those who would like to know more details

Latest Topics

Latest Topics (Updated on Oct. 24, 2022)

Hit Sequel “Sonic the Hedgehog 2” Tops the First Movie! (Updated on Jun. 1, 2022)

Released in 2020, “Sonic the Hedgehog” set the record for the highest grossing video game-based film ever in the U.S., making its mark in movie history. Following its global release starting at the end of March 2022, the sequel “Sonic the Hedgehog 2” surpassed the performance of the first film, grossing over US$350 million in worldwide box office revenues (as of May 12) within roughly a month of release—and setting the new box office record in this category in the U.S. which exceeds the record of the previous movie. The sequel has been a huge success around the world, debuting as the top film in 47 markets, including the U.K., France, and Australia, also drawing huge audiences in Mexico and Brazil.

In the sequel, Sonic, boasting the fastest speed in the universe, goes up against rival Knuckles, touted to have the most dangerous power in the galaxy, in a race to find the Master Emerald, which possesses the most destructive power in history, for the destiny of the earth. The movie hits theaters in Japan on August 19. Don’t miss the fastest, biggest battle ever!

A String of No. 6.5 Model-Compliant Pachislot Machines Hit the Market! (Updated on July. 28, 2022)

Pachislot machines complying with the No. 6.5 model, the revised pachislot machine regulation, began to hit the market in June 2022. In No.6.5 model, upper limits on medal pay-out and on the number of games during advantageous section are reviewed, which have led to user dissatisfaction in previous models. With the revision of regulations this time, pachislot market is expecting No. 6.5 model machines to bring new vitality to the market by drawing in new users and encouraging the return of dormant users.

Sammy is also bringing an array of new machines to market, offering groundbreaking gameplay that fully capitalizes on No. 6.5 model performance. With the launch of “Pachislot Kabaneri of the Iron Fortress” in July as a start, we are slated to introduce “Pachislot Persona 5”, based on the “Persona” series, the Group’s overwhelmingly popular mainstay IP, in September. Stay tuned for more exciting developments.