News Release

Notice regarding the Organizational Restructure in the Entertainment Contents Business (Absorption-type Demerger between consolidated subsidiaries and change of trade name of subsidiary)

- IR

2024/01/09

Link to see PDF ver.

Notice regarding the Organizational Restructure in the Entertainment Contents Business

(Translation)

Dear all,

Name of Company: SEGA SAMMY HOLDINGS INC.

Name of Representative: Haruki Satomi,

President and Group CEO, Representative Director

(Code No. 6460, Tokyo Stock Exchange Prime)

Further Inquiry: Makoto Takahashi,

Executive Vice President, Executive Officer,

Managing Director of Corporate Planning Division

(TEL: 03-6864-2400)

Notice regarding the Organizational Restructure in the Entertainment Contents Business

(Absorption-type Demerger between consolidated subsidiaries and change of trade name of subsidiary)

SEGA SAMMY HOLDINGS INC. (the Company) hereby notifies that it has resolved to transfer Amusement Machine business of SEGA CORPORATION (SEGA), a consolidated subsidiary of the Company, to SEGA TOYS CO., LTD. (SEGA TOYS), also a consolidated subsidiary of the Company, through an absorption-type demerger and to change the trade name of the successor company, SEGA TOYS at its Board of Directors meeting held today as described below.

Description

- Background and Purpose of Organizational Restructure

The Group has established its Medium-term Plan, “Beyond the Status Quo -Breaking the Current Situation and Becoming a Sustainable Company-“, which position the fiscal year ending March 2024 as the final year, and has been working to expand its corporate value.

In the Entertainment Contents Business, mainly in the Consumer area, we promoted the Pillar Strategy, which focuses on multi-platform roll-out and simultaneous global launch of major titles such as Sonic the Hedgehog series, Persona series, Like a Dragon series and others, and we have steadily implemented that strategy.

In the next Medium-term Plan, which is currently under the formulation, we set strengthening of transmedia as one of the key strategies for the Entertainment Contents Business in order to expand the Pillar Strategy and move on to the next stage. In Sonic the Hedgehog series, one of our core IPs, we have achieved significant growth in the game, animation, merchandising, licensing and other businesses, starting with the blockbuster success of the movie, and has been accumulating expertise in transmedia development in the global market. Going forward, the Group will seek to further enhance its main IPs by maximizing the use of its expertise under the transmedia strategy and by steering the Group towards a policy of maximizing Group synergies by combining the strengths of each business, such as Amusement Machines, Animation / Toy and others.

As part of the promotion of the transmedia strategy, we have decided to establish a new business unit by integrating the Amusement Machine business and Toy businesses, prior to the announcement of the next Medium-term Plan. In the various entertainment scenes of modern society, the value of seamless experiences from the digital to the physical and real world is expanding greatly, and the community of people fostered there is showing unique development as pop culture symbolizing Japan, as represented by the term “oshi-katsu (actions supporting one’s fave)”. Such trend is also expected to expand at a global level in the future.

In the midst of the great business opportunities presented by these megatrends, we integrate our Amusement Machine business and Toy business, aiming to provide people with new entertainment based on the strengths of the mutual businesses and to offer a comfortable time and place in many scenes, and create new experiential value. In addition, in order to proceed the integration of both businesses in stages, the integrated company will initially adopt an In-House Company System for its organizational structure.

- Summary of This Absorption-type Demerger

(1)Schedule of this absorption-type demerger

|

Resolution at the Director of the Board meeting (the Company) |

January 9, 2024 |

|

Signing of the absorption-type demerger agreement (company concerned) |

January 9, 2024 |

|

Effective date of the absorption-type demerger |

April 1, 2024 (plan) |

*This absorption-type demerger will be carried out without a resolution by the General Meeting of Shareholders, as the absorption-type demerger company falls under a simplified absorption-type demerger as defined in Article 784(2) of the Companies Act, and the successor company in absorption-type demerger company falls under a summary form absorption-type demerger as defined in Article 796(1) of the Companies Act for the successor company in an absorption-type demerger.

(2)Method of this absorption-type demerger

An absorption-type demerger, with SEGA TOYS as the successor company and SEGA as the demerged company in absorption-type demerger.

(3)Details of allocation in relation to this absorption-type demerger

No shares or other money, etc. will be allocated as a result of the absorption-type demerger since this absorption-type demerger will take place between wholly-owned subsidiaries of the Company.

(4)Handling of subscription rights to shares and corporate bonds with subscription rights to shares upon this absorption-type demerger

Not applicable.

(5)Capital to be increased or decreased by this absorption-type demerger

There is no increase or decrease in our capital due to this absorption-type demerger.

(6)Rights and obligations to be succeeded to by the successor company

SEGA TOYS will succeed the assets, liabilities and contractual status, as well as the rights and obligations associated therewith, of the business concerned, which are necessary to carry out the business subject to the absorption-type demerger to the extent provided in the absorption-type demerger agreement.

.

(7)Prospects of fulfillment of obligations for the debt

We believe that there are no issues with the certainty of prospect of fulfillment of the obligations for the debt incurred by each of the succeeding and splitting companies after this absorption-type demerger.

- Overview of the company concerned in this absorption-type demerger (as of December 31, 2023)

|

|

Demerged company in absorption-type demerger |

Successor company in absorption-type demerger |

|

(1) Company name |

SEGA CORPORATION |

SEGA TOYS CO., LTD. |

|

(2) Location |

Sumitomo Fudosan Osaki Garden Tower, 1-1-1, Nishi-Shinagawa, Shinagawa-ku, Tokyo |

Sumitomo Fudosan Osaki Garden Tower, 1-1-1, Nishi-Shinagawa, Shinagawa-ku, Tokyo |

|

(3) Job title and name of representative |

Yukio Sugino, President and COO, Representative Director |

Naoko Miyazaki, President and CEO |

|

(4) Details of business |

Planning, development and sales of game-related contents for mobile phones, PCs, smart devices and home video game consoles, and development and sales of Amusement Machines |

Development, manufacturing and sales of toys |

|

(5) Capital |

100 million yen |

100 million yen |

|

(6) Date of establishment |

June 3, 1960 |

February 1, 1991 |

|

(7) Total number of shares outstanding |

174,945,700 shares |

21,906,655 shares |

|

(8) Fiscal year end |

March 31 |

March 31 |

|

(9) Major shareholders and share ratio |

SEGA SAMMY HOLDINGS INC.: 100% |

SEGA CORPORATION: 100% |

|

(10) Financial status and results of operations for business of previous fiscal year (fiscal year ended March 2023) (unit: million yen unless otherwise indicated) |

||

|

Net assets |

102,905 |

2,519 |

|

Total assets |

193,145 |

5,090 |

|

Net assets per share |

588.21 yen |

115.02 yen |

|

Net sales |

191,678 |

13,104 |

|

Operating income |

17,539 |

358 |

|

Ordinary income |

17,190 |

446 |

|

Profit attributable to owners of parent |

11,488 |

366 |

|

Earnings per share |

65.67 yen |

16.72 yen |

- Status after this Organizational Restructure (including the change of trade name of SEGA TOYS)

|

(1) Company Name |

SEGA FAVE CORPORATION |

|

Former Company Name |

SEGA TOYS CO., LTD. |

|

(2) Planned date of change |

April 1, 2024 |

|

(3) Location |

Sumitomo Fudosan Osaki Garden Tower, 1-1-1, Nishi-Shinagawa, Shinagawa-ku, Tokyo |

|

(4) Name and job title of representative |

Yukio Sugino, President, Representative Director |

|

(5) Details of business |

Development, manufacturing and sales of toys, and development and sales of Amusement Machines |

|

(6) Capital |

100 million yen |

|

(7) Fiscal year end |

March 31 |

*Change of the trade name and management system will be implemented subject to a resolution at the General Meeting of Shareholders of SEGA TOYS. Please refer to “6. Management System of SEGA FAVE CORPORATION After This Organizational Restructure” for the management system from April 1.

*There are no changes to the company name, location, capital and financial year end for SEGA. Please refer to “Notice of Changes of Directors at Major Subsidiaries of SEGA SAMMY HOLDINGS INC. (SEGA CORPORATION and Sammy Corporation)” for the management system of SEGA from April 1.

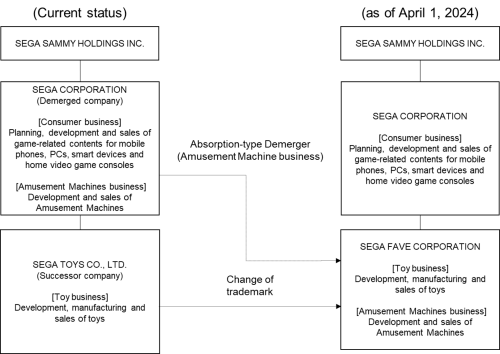

- Conceptual diagram of this matter

- Management System of SEGA FAVE CORPORATION After This Organizational Restructure

|

Name |

New title |

|

Yukio Sugino |

President, Representative Director |

|

Taketo Oshima |

Executive Vice President, Director of the Board President of Amusement Contents Company |

|

Naoko Miyazaki |

Executive Vice President, Director of the Board President SEGA TOYS Company |

|

Shigeru Yamashita |

Executive Vice President, Director of the Board |

|

Shuji Utsumi |

Senior Vice President, Director of the Board |

|

Takashi Mori |

Senior Vice President, Executive Officer |

|

Genichiro Yajima |

Senior Vice President, Executive Officer |

|

Yasuhiko Hamada |

Senior Vice President, Executive Officer |

|

Mikio Ina |

Senior Vice President, Executive Officer |

|

Takashi Shirai |

Senior Vice President, Executive Officer |

|

Shinya Sase |

Vice President, Executive Officer |

|

Kenji Otsuji |

Vice President, Executive Officer |

|

Hiroshi Kataoka |

Vice President, Executive Officer |

|

Kei Ishikawa |

Vice President, Executive Officer |

|

Yoshihito Kojima |

Vice President, Executive Officer |

|

Koji Ueda |

Vice President, Executive Officer |

|

Hidehiko Kato |

Vice President, Executive Officer |

|

Minoru Hayashi |

Vice President, Executive Officer |

|

Yoichiro Seto |

Vice President, Executive Officer |

- Future Outlook

This organizational restructure will be carried out between the wholly-owned subsidiaries of the Company with the aim of expanding corporate value over the medium- to long-term, and therefore the impact on the Company’s consolidated results for the fiscal year ending March 2024 is minimal. We will promptly announce any matters that need to be disclosed arise in the future.

-End-