News Release

Notice Regarding Introduction of “Stock-granting ESOP Trust”

- IR

2024/05/10

Link to see PDF ver.

Notice Regarding Introduction of “Stock-granting ESOP Trust”

(Translation)

Dear all,

Name of Company: SEGA SAMMY HOLDINGS INC.

Name of Representative: Haruki Satomi,

President and Group CEO, Representative Director

(Code No. 6460, Tokyo Stock Exchange Prime)

Further Inquiry: Makoto Takahashi,

Executive Vice President, Executive Officer,

Managing Director of Corporate Planning Division

(TEL: 03-6864-2400)

Notice Regarding Introduction of “Stock-granting ESOP Trust”

SEGA SAMMY HOLDINGS INC. (the “Company”) hereby notifies that it has resolved to introduce an employee incentive plan “Stock-granting ESOP Trust” (“System”) targeting for employees of the Company (“Employees”) at a Board of Directors meeting today. Details of the total amount of shares to be acquired under the plan, etc., will be announced as soon as they are determined.

Description

1.Purpose for the introduction of this system

(1)The Company launched a new medium-term plan, “WELCOME TO THE NEXT LEVEL!” (FY2025/3-FY2027/3) from April 2024, and are working toward achieve its goals. We decided to introduce the System with the aim of raising the awareness of the Employees to participate in the management of the Company to improve our corporate value over the medium to long-term, as well as to further enhance the sharing of value with shareholders and to further increase morale and willingness to contribute to performance improvement.

We also plan to introduce the System to employees of group companies of the Company. In addition, for some group companies of the Company, not only for employees enrolled in each group company, we plan to introduce the incentive plan similar to the System for officers to officers.

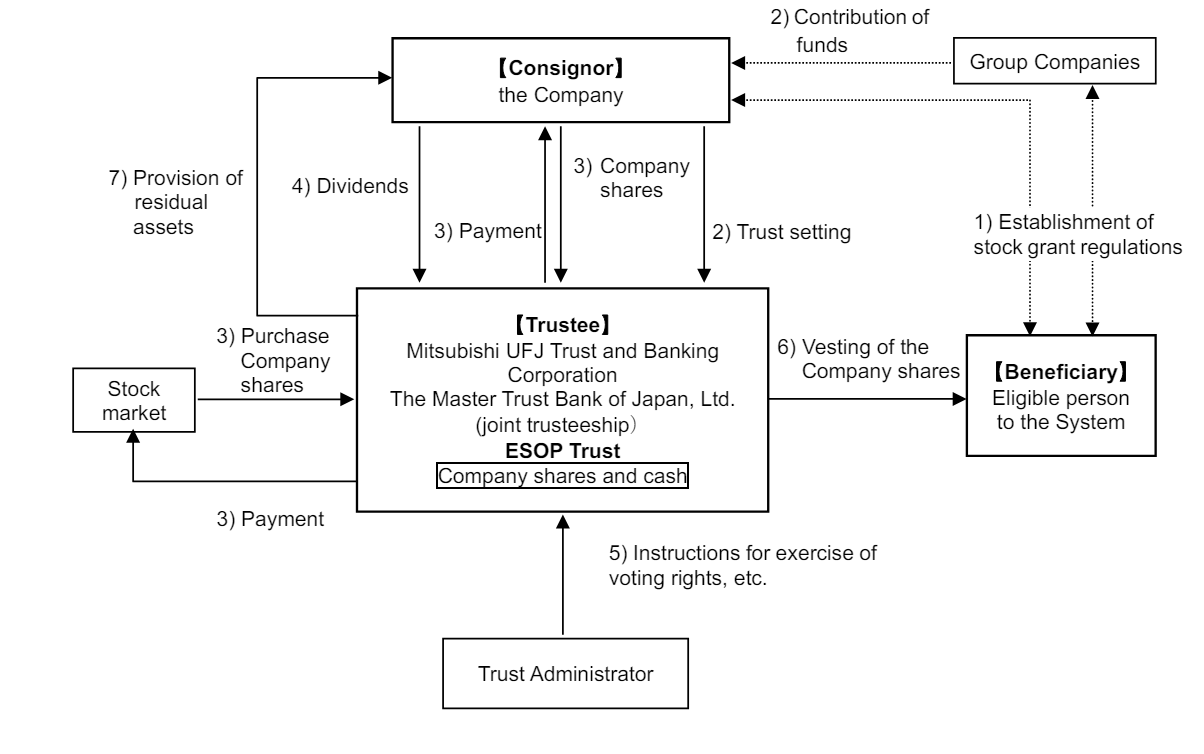

(2)The System adopts a mechanism called Stock-granting ESOP (Employee Stock Ownership Plan) Trust (“ESOP Trust”). The ESOP Trust is an incentive plan for employees based on the ESOP plan in the U.S., under which the Company’s shares acquired by the ESOP Trust are vested to Employees who fulfill certain requirements in accordance with predetermined stock grant regulations. Since all funds for the acquisition of the Company’s shares to be acquired by the trust will be contributed by the Company and group companies of the Company, there will be no burden on employees.

(3)The introduction of the ESOP Trust will enable employees to receive economic benefits from increases in the Company’s stock price, which is expected to encourage employees to perform their duties with an awareness of the stock price and to motivate employees to work harder. Since, the exercise of voting rights for the Company’s shares belonging to the trust assets of the ESOP Trust applies a mechanism that reflects the intentions of Employees, who are candidate of Beneficiary, the System is also effective as a plan to enhance corporate value that encourages Employees’ participation in management.

- Outline of the System

|

1) |

The Company and group companies of the Company will establish stock grant regulations at the time of the introduction of the System. |

|

2) |

The Company will set up the ESOP Trust, whose Beneficiaries will be Employees of the Company and group companies of the Company who satisfy the requirements for Beneficiaries (“Eligible Person to the System”) by placing the money in trust together with money contributed by the group companies. |

|

3) |

ESOP Trust will acquire the number of the Company’s shares expected to be vested to the Beneficiaries from the Company (the Treasury stock disposal) or stock market during the trust period, using the money contributed in (2) above as the source of funds, in accordance with the instructions of the Trust Manager. |

|

4) |

Dividends are paid to the Company’s shares in the ESOP Trust in the same manner as other Company shares. |

|

5) |

With respect to the Company’s shares in the ESOP Trust, the Trust Administrator will provide instructions for the exercise of voting rights and other rights as a shareholder throughout the trust period, and the ESOP Trust will exercise its rights as a shareholder in accordance with such instructions. |

|

6) |

During the trust period, a certain number of points will be granted to the Eligible Person to the System in accordance with the stock grant regulations, based on the degree of achievement of the performance targets set forth in the Medium-term Plan over the eligible period of three years. In addition, Eligible Person to the System who fulfill certain requirements will, in principle, receive a grant of shares of the Company’s stock equivalent to a certain percentage of such points after the end of the eligible period of three years and the Company shares corresponding to the remaining points will be converted into cash within the ESOP Trust in accordance with the provisions of the trust agreement, and will receive a cash payment equivalent to the amount of the conversion price. |

|

7) |

Upon termination of the ESOP Trust, the residual assets after distribution to the Beneficiaries will belong to the Company to the extent of the trust expense reserve, which is the trust fund minus the funds for stock acquisition. |

(Note)

During the trust period, if there is a possibility that the number of shares in the ESOP Trust may fall short of the number of shares corresponding to the accumulated points granted to Eligible Person to the System, or that the money in the trust assets may be insufficient to pay trust fees and trust expenses, additional money may be placed in the ESOP Trust.

[Reference] Details of the Trust agreement

|

(1) Types of trusts |

Monetary trusts other than specified solely managed monetary trusts (other-benefit trusts) |

|

(2) Purpose of the trust |

Provision of incentives for Employees of the Company and the group companies of the Company |

|

(3) Consignor |

the Company |

|

(4) Trustee |

Mitsubishi UFJ Trust and Banking Corporation (Co-Trustee: Japan Master Trust Bank, Ltd.) |

|

(5) Beneficiary |

Eligible person to the System who meet the requirements for Beneficiaries |

|

(6) Trust administrator |

Third parties who have no interest in the Company |

|

(7) Trust agreement date |

August 2024 (Plan) |

|

(8) Duration of the trust |

August 2024 ~ September 2027 (Plan) |

|

(9) System start date |

September 2024 (Plan) |

|

(10) Exercise of voting rights |

The Trustee will exercise the voting rights of the Company’s shares in accordance with the instructions of the Trust administrator reflecting the voting status of the candidate of Beneficiary. |

|

(11) Type of acquiring stock |

Common stock of the Company |

|

(12) Total amount of acquiring stock |

TBD (Details to be disclosed once determined) |

|

(13) Method of acquiring stock |

TBD (Details to be disclosed once determined) |

|

(14) Holder of vested rights |

the Company |

|

(15) Residual assets |

Residual assets can be received by the Company, the holder of vested rights shall be within the extent of the trust expense reserve, which is the trust fund minus the funds for stock acquisition. |

-End-