News Release

Notice Regarding Revision of the Compensation System Associated with the Introduction of a Compensation System for Post-Delivery Stock-Based Compensation

- IR

2024/05/10

Link to see PDF ver.

(Translation)

Dear all,

Name of Company: SEGA SAMMY HOLDINGS INC.

Name of Representative: Haruki Satomi,

President and Group CEO, Representative Director

(Code No. 6460, Tokyo Stock Exchange Prime)

Further Inquiry: Makoto Takahashi,

Executive Vice President, Executive Officer,

Managing Director of Corporate Planning Division

(TEL: 03-6864-2400)

Notice Regarding Revision of the Compensation System Associated with the Introduction of a

Compensation System for Post-Delivery Stock-Based Compensation

SEGA SAMMY HOLDINGS INC. (the “Company”) hereby notifies that it has resolved at a Board of Directors meeting today to propose a resolution requesting approval of the abolishment of the current compensation system with Restricted Stock and the introduction of a post-delivery stock-based compensation system to the 20th Ordinary General Meeting of Shareholders of the Company to be held on June 25, 2024 (the “20th OGM”).

In respect of the compensation system, there will be no change in the amount of compensation, which was approved at the Company’s 18th Ordinary General Meeting of Shareholders held on June 22, 2022 (Such annual compensation is up to 1.7 billion yen, including up to 0.1 billion yen for External Directors. Salaries for services, as employees, of Directors concurrently serving as employees are not included.), for the Company’s Directors (excluding Directors serving as Audit and Supervisory Committee members).

Description

- Reasons for the introduction of the System

At the Company’s 15th Annual General Meeting of Shareholders held on June 21, 2019, the Company introduced a compensation system with Restricted Stock for its Directors (excluding Directors serving as Audit and Supervisory Committee members, the “Eligible Directors”), and partially revised the system at its 17th Ordinary General Meeting of Shareholders held on June 24, 2021.

Reviewing the executive compensation system at the Company, with the aim of further aligning the Company’s long-term interests with those of the Company’s shareholders and Directors and providing incentives to enhance the Company’s corporate value over the medium to long term, the Company has decided to abolish the existing compensation system with Restricted Stock for Eligible Directors and to introduce a post-delivery stock-based compensation system (the “System”) under which shares of the Company’s common stock (the “Company’s Shares”) will be allotted to Eligible Directors after a certain period of time. Further, the total amount of compensation and numbers of shares to be delivered to the Eligible Director(s) under the System will be set at no more than 3.6 billion yen and 900,000 shares for performance share (“PSU”) and 0.3 billion yen and 75,000 shares per year for post-delivery restricted stock (“RSU”), as a separate line from the abovementioned amount of compensation, taking into consideration the degree of contribution and various other matters made by the Eligible Director(s).

This resolution seeks approval for the payment of monetary compensation receivables as compensation for PSU and RSU to be allocated to the payment in exchange for the Company’s Shares or the Company’s Shares, within the limit of the total amount of compensation for the System and the maximum number of shares, and the Company’s Board of Directors meeting will decide the details within this approved framework.

In making decisions on specific matters related to the System, the Company’s Board of Directors meeting will deliberate on such matters through the Independent Advisory Committee.

Further, delivery of the shares, etc. of the Company under the System is to be decided upon comprehensive consideration of various matters such as the contribution of the Eligible Director(s) to the Company, and the Company believes that the contents of such decision are considerable.

If the resolution regarding the System is approved at the 20th OGM as originally proposed, the Company plans to introduce a similar system for directors and executive officers of some of the Company’s group companies excluding the Company (“Officers, etc. of Group Companies”) and its executive officers, and in making decisions on specific matters, each company will obtain the approval at its shareholders’ meeting (however, if those do not require approval at its shareholders’ meeting, then at its Board of Directors meeting) after the deliberation on such matters through the Independent Advisory Committee.

- Conditions for introduction of the System

The introduction of the System is subject to approval by shareholders at the 20th OGM.

- Outline of the System

The “performance-based restricted stock”, in which the number of shares to be released from restrictions of transfer is determined based on the length of service as a director, etc. of the Company and the degree of achievement of the performance targets of the medium-term plan of the Company and the “Continuous service-based restricted stock,” in which the number of shares to be released from the restrictions of transfer is determined on the condition that the eligible person continues to serve as a director, etc. of the Company for a certain period of time, which are the existing compensation system with Restricted Stock, will be abolished in the System and they will consists of a PSU and RSU described below.

(i) PSU is a type of stock-based compensation which provides the Company’s Shares and cash in an amount calculated based on the achievement of performance targets for multiple fiscal years corresponding to the Company’s medium-term management plan (“Performance Evaluation Period”), and based on the period of service to the first annual shareholders’ meeting after the end of the Performance Evaluation Period (“Eligible Period”), and will be delivered after the end of the Eligible Period. The first Performance Evaluation Period after the introduction of the System shall be the period of three fiscal years from the fiscal year ending March 31, 2025 to the fiscal year ending March 31, 2027, which is the eligible period of the SEGA SAMMY Group medium-term management plan (“Medium-term Plan”) announced on May 10, 2024.

(ii) RSU is a type of stock-based compensation in which a pre-determined number of shares and cash of the Company’s stock are delivered after a period determined by the Company’s Board of Directors meeting as compensation for the period of service.

Regarding PSU and RSU, based on the calculation method set forth below in “Calculation method of the number of shares to be delivered under the System, etc.”, after the end of the Eligible Period for PSU and after the end of the period determined by Company’s Board of Directors meeting of the Company for RSU, shares of the Company will be delivered to the Eligible Director(s) using one of the following methods (Note 1).

(a) In order to deliver the Company’s Shares equivalent to PSU and RSU, a method in which monetary compensation receivables are provided to the Eligible Director as compensation, etc., and shares of the Company are allocated to each Eligible Director by contributing all such monetary compensation receivables by way of contribution-in-kind (“Delivery by Contribution-In-Kind”).

(b) A method for determining the number of PSU and RSU and allotting the Company’s Shares without requiring contribution for the issuance or disposal of such shares as compensation, etc. (“Delivery without Contribution”).

The breakdown of PSU and RSU within the System which uses the Medium-term Plan period as the Performance Evaluation Period is as described in “ Reference: Policy in the period of the Medium-term Plan.” (Note 2) (Note 3)

(Note 1) However, in the event that the Eligible Director dies during the Eligible Period, instead of delivery of the Company’s shares, the Company shall pay an amount of cash reasonably calculated by the Company’s Board of Directors meeting within the total amount of compensation, etc. for this Plan, to the heirs of such Eligible Director. In addition, if any agenda related to a merger agreement in which the Company becomes a dissolving company, a share exchange agreement or share transfer plan in which the Company becomes a wholly owned subsidiary or other reorganization, etc. is approved at the Company’s general meeting of shareholders (however, if the reorganization, etc. does not require approval at the Company’s general meeting of shareholders, then at the Company’s Board of Directors meeting of the Company) during the Eligible Period (however, this is limited to cases where the effective date of such reorganization, etc. is scheduled to fall prior to the date of delivery of shares under the System), and the Eligible Director resigns or retires from any of the positions of director, executive officer, or employee of the Company as a result of such reorganization, etc., the Company shall, prior to the effective date of such reorganization, etc., pay the Eligible Director an amount of cash reasonably calculated by the Company’s Board of Directors meeting within the total amount of compensation under the System instead of delivering the Company’s Shares.

(Note 2) Such number of shares includes stock-based compensation to be provided to the Eligible Directors as Final Cash Payment (as defined below) among Final Shares to be Delivered.

(Note 3) However, if the total number of shares issued by the Company increases or decreases due to a reverse stock split or stock consolidation (including gratis allotment of shares; the same shall apply hereinafter to the description of stock splits), the number of shares shall be reasonably adjusted in accordance with such ratio.

・Calculation method of the number of shares to be delivered under the System, etc.

(i) In case of Delivery by Contribution-In-Kind

The amount of monetary compensation receivables to be provided to each Eligible Director in order to receive allocation of the Company’s Shares and the amount of cash to be finally paid under the System ( the “Final Cash Payment”) shall be calculated based on the number of shares to be finally delivered to the Eligible Directors (the “Number of Final Shares to be Delivered”) under the System, multiplied by the closing price of the Company’s shares in regular trading on the Tokyo Stock Exchange on the business day immediately preceding the date of the resolution of the Company’s Board of Directors meeting to issue shares or dispose treasury stock for the purpose of such delivery (if no trading is conducted on the same day, it refers to the closing price on the most recent trading day prior to that day, “Company’s Closing Price”). The proportion of the number of shares and the Final Cash Payment to be provided under the System to shall be determined by the Company’s Board of Directors meeting, taking into consideration the tax payment burden of the Eligible Directors.

Further, the above monetary compensation receivables and the Final Cash Payment shall be delivered on the condition that the Eligible Directors have agreed to make a contribution in kind of the entire amount of such monetary compensation receivables in order to receive allocation of the Company’s Shares, and that an agreement concerning allocation of the Company’s shares, including the content specified in 4. below, has been executed with the Company.

(ii) In case of Delivery without Contribution

While contribution for issuance or disposition of the Company’s shares is not required, the amount of compensation (including Final Cash Payment) calculated by multiplying the Number of Final Shares to be Delivered by the Company’s Closing Price shall be within the limit of the total amount of compensation for the System approved in this Proposal. The proportion of the number of shares and the Final Cash Payment to be provided under the System to shall be determined by the Company’s Board of Directors meeting, taking into consideration the tax payment burden of the Eligible Directors.

Further, the Company’s Shares and the Final Cash Payment shall be delivered on the condition that the Eligible Directors have executed an agreement concerning allocation of the Company’s shares, including the content specified in 4. below, with the Company.

The Number of Final Shares to be Delivered to each Eligible Director shall be the total of (i) a number of shares equal to 60% and 20% of the number of shares (however, any fraction of less than one share resulting from the calculation shall be rounded down; the “Base Number of Shares to be Delivered”), each of which is calculated by dividing the base amount of stock compensation determined for each position of the Eligible Directors (“Base Amount of Stock Compensation by Position”) by the stock price determined by the Company’s Board of Directors meeting based on the closing price of the Company’s common stock on the Tokyo Stock Exchange on the business day immediately preceding the date of resolution of the first Company’s Board of Directors meeting after the beginning of the Eligible Period (if no trading is conducted on the same day, it refers to the closing price on the most recent trading day prior to that day, “Base Stock Price”), multiplied by the degree of achievement of performance targets (For the degree of achievement of performance targets, Financial Indicators shall be used for the 60% equivalent, and Future Financial Indicators shall be used for the 20% equivalent.), tenure ratio (Note 4) and position adjustment ratio (Note 5) (equivalent to PSU) and (ii) number of shares obtained by multiplying 20% of the Base Number of Shares to be Delivered by the tenure ratio and the service adjustment ratio (equivalent to RSU), and the proportion of the number of shares and the Final Cash Payment to be provided under the System to shall be determined by the Company’s Board of Directors meeting, taking into consideration the tax payment burden of the Eligible Directors. (Note 6) (Note 7)

(Note 4) Regarding tenure ratio, if there is a new Eligible Director who is appointed or resigned during the Eligible Period, the amount of monetary compensation (receivable) or the number of the Company’s Share to be provided to such Eligible Director will be adjusted according to the number of months the Eligible Director has been in office (see (C) below for the specific adjustment method). However, if there are Eligible Directors who resign or retire from any of the positions of director, executive officer, or employee of the Company or a subsidiary of the Company (limited to subsidiaries with a shareholding ratio of 50% or more.) for justifiable reasons in the middle of the Eligible Period, the Company will deliver in cash or the Company’s Shares as reasonably determined by the Company’s Board of Directors meeting in accordance with the number of months in office, etc. to such Eligible Director(s) within the total amount of compensation under the System.

(Note 5) As position adjustment ratio, in the event of a change in the position during the Eligible Period, the number of shares delivered will be adjusted so that the Number of Final Shares to be Delivered corresponding to the position during the Eligible Period will be delivered (see (D) below for the specific adjustment method).

(Note 6) In any calculation of the Number of Final Shares to be Delivered, any fraction of less than 100 shares resulting from the calculation shall be rounded down.

(Note 7) However, if the number of shares calculated as a result of the calculation exceeds the maximum number of shares, the Number of Final Shares to be Delivered shall be within the respective maximum limits. If the total number of shares issued by the Company increases or decreases due to a reverse stock split or stock consolidation, the Number of Final Shares to be Delivered to each Eligible Director will be reasonably adjusted in accordance with such ratio. Specifically, in the case of a reverse stock split or reverse stock consolidation, the Number of Final Shares to be Delivered after adjustment is calculated by multiplying the Number of Final Shares to be Delivered before adjustment by the ratio of the reverse stock split or consolidation.

- Conditions for payment of cash compensation or delivering of shares to the Eligible Directors

If an Eligible Director falls under the events of forfeiture of rights necessary to achieve the purpose of the stock compensation system (to be determined by the Company’s Board of Directors meeting), such as resignation from the Board of Directors, executive officers or employees of the Company without legitimate reasons and certain acts of misconduct, the monetary compensation will not be paid to the Eligible Director and no shares of the Company’s stock will be delivered to such Eligible Director under the System.

(Reference: Policy in the period of the Medium-term Plan)

Ⅰ.Policy for determining allocation

Within the limits of the monetary compensation receivables and the number of shares to be allocated as described below, the Company’s Board of Directors meeting will determine that the cumulative compensation over the three fiscal years of the Medium-term Plan, if achieved, will be approximately 1:1:1 in the ratio of fixed compensation, single-year performance-based bonuses, and post-delivery stock-based compensation. The proportion of PSU and RSU in the period of the Medium-term Plan is as follows.

|

(i) PSU (Financial Indicator) |

(ii) PSU (Future Financial Indicator) |

(iii) RSU |

|

60% |

20% |

20% |

Ⅱ.Upper limit of monetary compensation receivables and shares to be allotted

|

|

Number of eligible persons |

|

(i) and (ii) PSU (Note 10) |

(iii) RSU |

|

Eligible Directors |

3 persons (Note 8) |

Monetary compensation receivables |

3.6 billion yen or less |

0.3 billion yen or less |

|

Number of shares to be allocated |

900,000 shares or less |

75,000 shares or less |

||

|

Executive Officers of the Company Officers, etc. of Group Companies |

62 persons (Note 9) |

Monetary compensation receivables |

7.2 billion yen or less |

0.6 billion yen or less |

|

Number of shares to be allocated |

1,800,000 shares or less |

150,000 shares or less |

Note 8: The number of directors is based on the assumption that the director candidates announced on May 10, 2024 are elected at the 20th OGM. Also, those who concurrently serve as President and COO, Representative Director of SEGA CORPORATION or Sammy Corporation are not included in the Eligible Directors.

Note 9: The number of persons as of May 1, 2024.

Note 10: The amount of monetary compensation receivables and the number of shares to be allocated for PSU will be the total amount for the three fiscal years covered by the Medium-term Plan.

Ⅲ.Formula for calculating the Number of Final Shares to be Delivered (Note 11)

|

Number of Final Shares to be Delivered = (i) Base Number of Shares to be Delivered (A) × 60% × Degree of Achievement of the Performance Targets ((B): Financial Indicator) × Tenure Ratio (C) × Position Adjustment Ratio (D) + (ii) Base Number of Shares to be Delivered (A) × 20% × Degree of Achievement of the Performance Targets ((B): Future Financial Indicator) × Tenure Ratio (C) × Position Adjustment Ratio (D) + (iii) Base Number of Shares to be Delivered (A) × 20% × Tenure Ratio (C) × Position Adjustment Ratio (D) |

(Note 11) A portion of the Number of Final Shares to be Delivered shall be paid in cash in consideration of the tax payment burden on Eligible Directors and the percentage of which shall be determined by the Company’s Board of Directors meeting.

(A) Base Number of Shares to be Delivered

The base number of shares to be delivered is calculated by the following formula:

|

(a) Base Amount of Stock Compensation by Position of Eligible Directors

Regarding the Base Amount of Stock Compensation by Position, the Company’s Board of Directors meeting shall determine a specific amount for each position.

(b) Base Stock Price

The Base Stock Price shall be adjusted by a reasonable method determined by the Company’s Board of Directors meeting.

(B) Degree of Achievement of the Performance Targets

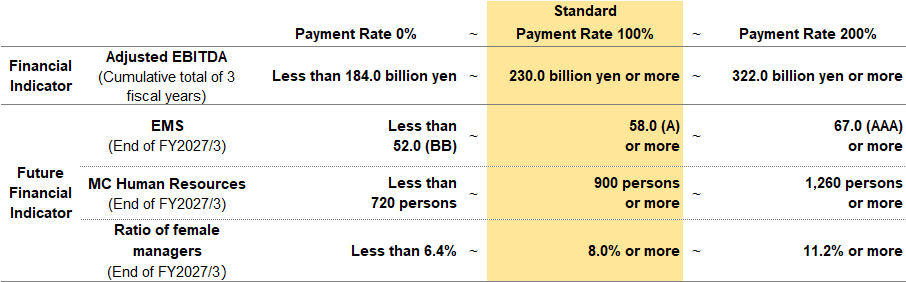

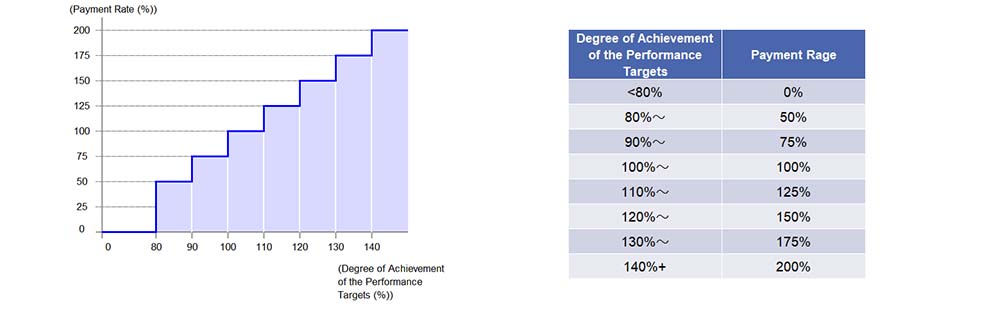

The degree of achievement of performance targets will be calculated using figures to be determined after the end of each Performance Evaluation Period, and the payment rate will be calculated in a stepwise manner according to the ratio of performance achieved, ranging from 0% to 200%. For the purpose of evaluating the performance of the Eligible Directors during the period of this Medium-term Plan, Adjusted EBITDA, which is the financial indicator, and EMS, the culturally diverse human resources (MC human resources) and ratio of female managers, which are the future financial indicators, will be used.

If the average of Group’s consolidated ROE for 3 fiscal years is less than 8%, no monetary compensation for PSU will be paid, and no shares of the Company’s stock will be delivered to Eligible Directors and executive directors of the Company

(Performance Indicators and Targets for the Company’s Eligible Directors and Executive Officers)

* Performance indicators and targets for Officers, etc. of Group Companies are set separately based on the medium-term management plans of each group company. A base ROIC will be set for each eligible company, and if the ROIC falls below the base, no monetary compensation will be paid as PSUs to the directors and executive officers of the eligible company, nor will any shares of the Company be delivered.

* Performance indicators and targets for Officers, etc. of Group Companies are set separately based on the medium-term management plans of each group company. A base ROIC will be set for each eligible company, and if the ROIC falls below the base, no monetary compensation will be paid as PSUs to the directors and executive officers of the eligible company, nor will any shares of the Company be delivered.

(Design of payment rate in the Financial Indicators)

(C) Tenure Ratio

In order to prorate the number of shares to be delivered according to the tenure of office, the following formula is used to calculate the number of shares to be delivered. If a new appointment or retirement occurs in the middle of a month, the calculation will be based on the assumption that the employee has been in office for the whole month.

|

(D) Position Adjustment Ratio

In case the position of Eligible Directors changed, in order to adjust the number of shares to be delivered to make them correspond to their new position, the number of shares to be delivered will be calculated using the following formula. In the event the change of position occurs in the middle of a month, the calculation will be based on the assumption that the new position is held for the whole month.

|

– End –