News Release

Notice regarding the Acquisition of Stakelogic B.V.

- IR

2024/07/26

Link to see PDF ver.

Notice regarding the Acquisition of Stakelogic B.V.

(Translation)

Dear all,

Name of Company: SEGA SAMMY HOLDINGS INC.

Name of Representative: Haruki Satomi,

President and Group CEO, Representative Director

(Code No. 6460, Tokyo Stock Exchange Prime)

Further Inquiry: Makoto Takahashi,

Executive Vice President, Executive Officer,

Managing Director of Corporate Planning Division

(TEL: 03-6864-2400)

Notice regarding the Acquisition of Stakelogic B.V.

SEGA SAMMY HOLDINGS INC. (the “Company”) hereby notifies that at the Board of Directors meeting of the Company and SEGA SAMMY CREATION INC. (“SSC”), a subsidiary of the Company, on July 26, 2024 (Japan Standard Time), it resolved to enter into a definitive agreement to acquire Stakelogic B.V. (“Stakelogic”), a company which operates a B2B iGaming content supplier business headquartered in Netherlands, through SSC (the “Acquisition”). Stakelogic and SSC have agreed to enter into the definitive agreement on the same date.

The closing of the Acquisition is subject to the receipt of regulatory approvals in relevant jurisdictions, and the satisfaction of other customary conditions. The Acquisition is expected to close by the 1st quarter of the fiscal year ending March, 2026.

- Background and Purpose of the Acquisition

(1)Positioning of Gaming business in the Company

The Company set the establishment of the Gaming business as a target in its medium-term plan announced in May 2024. In the Gaming business, we are working on development and operation of integrated resorts (IR) through Paradise City, which is a joint venture with the Paradise Group of South Korea, and development of gaming machines and content through SSC. In November 2023, with the aim of entering the online gaming market, especially the U.S. iGaming market, which is expected to grow in the future, we announced the acquisition of GAN Limited (“GAN”), a SaaS provider (providing a B2B platform) for casino operators in the United States and B2C online gaming operator in Europe and South America.

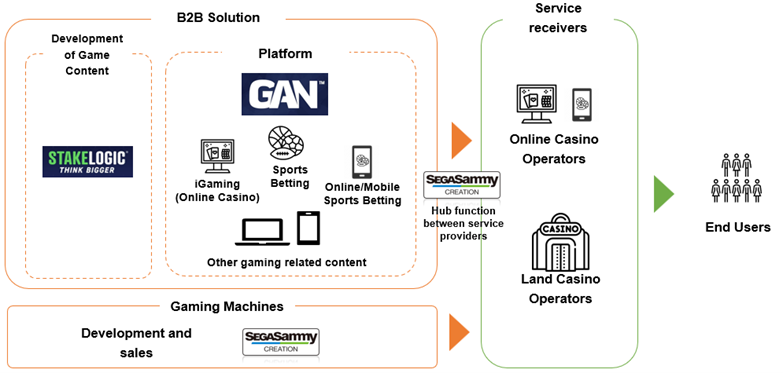

Stakelogic’s strength lies in the development of iGaming content, a market we are targeting, and we believe this acquisition will further enhance the competitiveness of GAN’s B2B platform and contribute to the expansion of our Gaming business.

(2)U.S. online gaming market overview

The U.S. online gaming market, which consists of sports betting (including retail) and iGaming, had a market size of approximately $12.0 billion in 2022, and is expected to reach approximately $16.5 billion in 2023 and $27.1 billion in 2027. The sports betting and iGaming markets are expected to grow at a CAGR of 15% and 11%, respectively, to 2027. The sports betting and iGaming markets are forecast to reach a size of approximately $17.0 billion and $10.1 billion, respectively, by 2027 (Source: MVB Bank “U.S. Online Gaming Report Spring 2023”).

Sports betting, which has been legalized in many states, is a high-profile market with increasing competition, a growing user base, high customer acquisition costs, and diverse needs. On the other hand, while the U.S. iGaming market is still limited to seven states, there are ongoing discussions around legalizing iGaming in additional states. If we can enter the U.S. iGaming market before broad legalization, it could provide a promising opportunity to grow our presence in the U.S. iGaming market.

(3)Aim of the acquisition

Stakelogic is a Netherlands-based B2B iGaming content provider operating in 100% locally regulated markets and holding Game Certifications across 17 territories. In addition to “Slot Games,” it develops and offers “Live Table Games” and “Hybrid Games,” which allow players to play roulette, blackjack, baccarat, and live game shows online.

The distinct feature of Stakelogic’s “Live Table Games” from traditional operators is a “Chromakey Studio”. Stakelogic can prepare dedicated tables for each client using this feature, enabling the simultaneous delivery to multiple clients and – at the same time – significantly reducing the setup costs and studio operations.

In addition, “Hybrid Games” combine traditional slot games with live casino technology, which allow operators to provide live game show experiences when a bonus game or jackpot are triggered. This new game content has been successful in providing players with new experiences and increasing their engagement.

Stakelogic has built an organization which develops this content completely in-house, in a short time frame and under the highest quality standards. We recognize that Stakelogic is a company that is capable of continuously reinventing itself; rapidly developing and releasing new and innovative content.

Stakelogic has achieved the top share of sales in the growing Dutch market against the backdrop of the October 2021 legislation on iGaming, and is rapidly expanding its business scale by providing high quality content to major operators. It is also working to expand its market share in major European markets, such as the United Kingdom and Italy, by offering unique hybrid games, centered on major operators. In addition, from 2024, it has begun full-scale entry into the fast-growing North American market, and has already obtained licenses in Rhode Island, Michigan, and Pennsylvania. It aims to expand the scale of its business in the future by providing content sequentially to the regions where it has acquired licenses.

In November 2023, through SSC, we entered into the acquisition agreement with GAN, which is developing a B2B platform in the U.S. in order to enter the North American iGaming market, which we have positioned as our target market. GAN is an integrated online gaming platform provider with a B2B and B2C business. GAN’s B2B business’ core offerings include its market leading Player Account Management System (PAM)*1 that comprehensively manages end users’ data and its Remote Gaming Server (RGS)*2 that is the core of its iGaming solution. After the integration of GAN, we believe that the addition of Stakelogic’s unique gaming content to the GAN B2B platform, which is their strength, will enable it to become a gaming service provider that can offer a comprehensive range of services. This will accelerate the speed of our growth in the gaming market and create an even greater competitive edge than GAN’s stand-alone development.

We believe that the combination of these outstanding technologies and gaming content with the customer network of SSC, which has been providing quality gaming content and equipment to North American land casino operators, is expected to create synergies and contribute significantly to the expansion of our gaming business. Therefore, we have decided to proceed with the Acquisition. The video slot machine “Railroad Riches,” which SSC began offering in January 2024, has been well received, with two titles ranked in the Top 3 of the game performance report*3 issued by Eilers & Krejcik Gaming, LLC, a U.S. gaming research company and this machine has strengthened its relationship with a number of casino operators.

*1 – A platform that comprehensively manages users, transactions, and player loyalty.

*2 – A server that aggregates and distributes online game features and content.

*3 – ”Top Indexing NEW Games-Core, Video Ranking” in “U.S. & Canada Game Performance Report July 2024” issued by Eilers & Krejcik Gaming, LLC

【Conceptual diagram of business areas of Stakelogic, GAN and SSC】

- Method of Acquisition

SSC will acquire 100% of Stakelogic’s shares, making Stakelogic a wholly owned subsidiary of SSC.

- Overview of SEGA SAMMY CREATION INC.

|

(1) Name |

SEGA SAMMY CREATION INC. |

|

(2) Address |

Sumitomo Fudosan Osaki Garden Tower, 1-1-1 Nishi-Shinagawa, Shinagawa-ku, Tokyo 141-0033, Japan |

|

(3) Title and name of the representative |

President and CEO, Naoki Kameda |

|

(4) Business overview |

Development, manufacturing, and sales of land-based and online/social casino gaming products and software |

|

(5) Capital |

10,000,000 JPY |

- Overview of Stakelogic (as of June 30, 2024)

|

(1) Name |

Stakelogic B.V. |

|||||

|

(2) Address |

Dr Holtroplaan 9, 5652 XR Eindhoven, Netherland |

|||||

|

(3) Title and name of the representative |

CEO, Stephan van den Oetelaar |

|||||

|

(4) Business overview |

iGaming content supplier business |

|||||

|

(5) Capital |

1.73 Euros |

|||||

|

(6) Establishment |

August 15, 2013 |

|||||

|

(7) Major shareholders and their ownership percentage ratio |

Triple Bells B.V. |

58% |

||||

|

VC Investors |

42% |

|||||

|

(8) Relationship between the Company and Stakelogic |

Capital relationship |

N/A |

||||

|

Human relationship |

N/A |

|||||

|

Business relationship |

N/A |

|||||

|

Applicability to Related Parties |

N/A |

|||||

|

(9) Consolidated performance and financials of Stakelogic for the last three years |

|||

|

Fiscal year (Units: thousand Euro) |

FY2021/12 |

FY2022/12 |

FY2023/12 |

|

Consolidated net assets |

4,584 |

(5,217) |

10,654 |

|

Consolidated total assets |

14,408 |

25,294 |

31,886 |

|

Consolidated net sales |

9,334 |

12,218 |

28,958 |

|

Consolidated operating income |

969 |

(12,215) |

(1,484) |

|

Net income |

541 |

(9,368) |

(1,629) |

* The above figures for consolidated performance and financials are unaudited and are subject to change in the future.

- Overview of the counterparties of the Acquisition

The details are not disclosed due to the strong intention of counterparties, but the main parties are SPC and investment funds. The capital, human, and business relationships between the Company and the counterparty, as well as the applicability to related parties, are all nonapplicable.

- Acquisition price and ownership of shares before and after the Acquisition

|

(1) Ownership of shares before the Acquisition |

0 % of outstanding shares |

|

(2) Acquisition Price |

The final sale price will be determined based on the enterprise value of €130M, which will be adjusted based on Stakelogic’s net debt, working capital and other factors. |

|

(3) Intended ownership of shares after the Acquisition (expected) |

100% of outstanding shares |

*The Earn-out method is adopted, and if the conditions stipulated in the share transfer agreement are achieved, consideration may be incurred in addition to the above acquisition price.

- Schedule

|

Resolution of the Board of Directors |

July 26, 2024 |

|

Signing |

July 26, 2024 (Plan) |

|

Expected Acceptance Offer Period |

During the 1st quarter of the fiscal year ending March 2026 (Forecast) |

- Impact on our Company’s financial results

The impact of the Acquisition on the Company’s consolidated financial results for the fiscal year ending March, 2025 will be immaterial as Stakelogic will become a consolidated subsidiary of the Company after the completion of the Acquisition. We will promptly disclose, if there will be any future events that should be disclosed.

- Advisor

SMBC Nikko Securities Inc. is acting as SEGA SAMMY HOLDINGS’ sole financial advisor and Greenberg Traurig, LLP. is acting as SEGA SAMMY HOLDINGS’ legal counsel for the Acquisition.

Morgan Stanley & Co. International plc and Partis Solutions are acting as Stakelogic’s financial advisors and DeBreij is acting as Stakelogic’s legal counsel for the Acquisition.

*The earnings forecasts and other forward-looking statements contained in this document are based on information currently available to the Company and certain assumptions deemed reasonable by the Company. Therefore, the Company is not intended to commit the achievement to them. Actual results may differ significantly due to various factors.

– END –