News Release

Notice regarding Company Split (Simplified Absorption-type Split) of SEGA SAMMY HOLDINGS INC.

- IR

2025/02/07

Link to see PDF ver.

Notice regarding Company Split (Simplified Absorption-type Split) of SEGA SAMMY HOLDINGS INC.

(Translation)

Dear all,

Name of Company: SEGA SAMMY HOLDINGS INC.

Name of Representative: Haruki Satomi,

President and Group CEO, Representative Director

(Code No. 6460, Tokyo Stock Exchange Prime)

Further Inquiry: Makoto Takahashi,

Executive Vice President, Executive Officer,

Managing Director of Corporate Planning Division

(TEL: 03-6864-2400)

Notice regarding Company Split (Simplified Absorption-type Split) of SEGA SAMMY HOLDINGS INC.

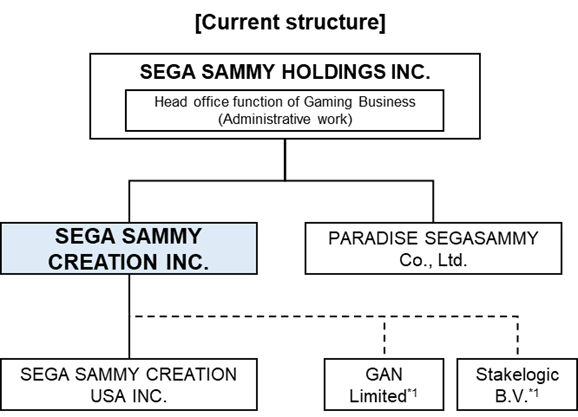

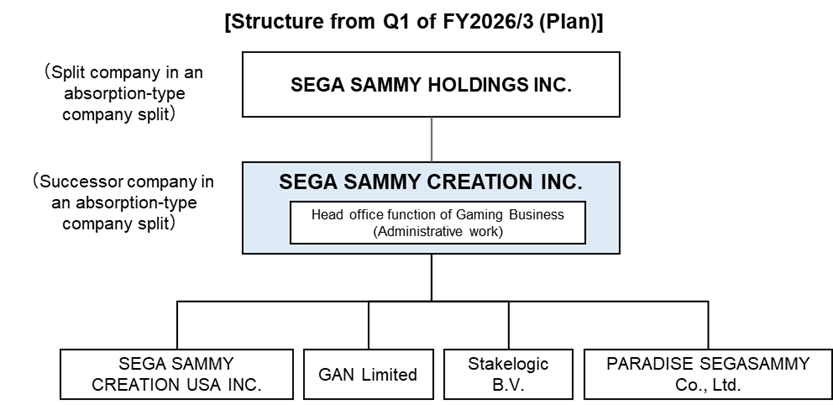

SEGA SAMMY HOLDINGS INC. (the “Company”) hereby notifies that it has resolved at its Board of Directors meeting today to transfer its Gaming Business to SEGA SAMMY CREATION INC. (“SSC”), a wholly owned subsidiary of the Company, through an absorption-type company split (“Company Split”).

The assets to be split as a result of this Company Split include all common shares of PARADISE SEGASAMMY Co., Ltd. (“PSS”), a joint venture between the Company and PARADISE. Co., Ltd., a South Korean company, which is an equity-method affiliate of the Company in which the Company holds a 45% of its shares.

Since this Company Split is a simplified absorption-type split between the Company and the wholly owned subsidiary of the Company, certain disclosure items and details have been omitted.

Description

- Background and objectives of the Company Split

The Company has set the establishment of the Gaming Business as a target in its medium-term plan announced in May 2024. In the gaming business, we are building a customer base through the development and provision of gaming machines and content by SSC and also accumulating know-how in casino operations that also can be used for online gaming by establishing direct customer contact through the operation of PARADISE CITY, a joint venture with PARADISE. Co., Ltd. We also announced the acquisition of GAN Limited (“GAN”) in November 2023 and Stakelogic B.V. (“Stakelogic”) in July 2024, with the aim of entering the online gaming market, particularly the US iGaming market, which is expected to expand in the future.

The Company has decided to implement organizational restructuring of the Company and its group companies in order to appropriately manage the strategy, financial status, risks, etc. of the Gaming Business and build a governance structure that can make quick decisions in response to changes in the environment by transitioning to a structure with SSC as the core operating company in line with the closing timing of the acquisition of GAN and Stakelogic, which is currently underway.

[Purpose of organizational restructuring]

1)Establish a system for centralized management of gaming licenses and other controls, and for collaboration, among the gaming business locations scattered around the world

2)Aim to improve our corporate value over the medium to long term by strengthen international competitiveness of the business through combining the strengths of each gaming-related company and maximizing segment synergies

- Summary of the Company Split

1)Schedule for Company Split

|

Date of resolution at the Board of Directors meeting |

February 7, 2025 |

|

Signing date of absorption-type company split agreement |

February 7, 2025 (Plan) |

|

Effective date of absorption-type company split |

June 1, 2025 (Plan) |

*Since this Company Split is simplified absorption-type split stipulated in Article 784, Paragraph 2 of the Company Act for the Company and Article 796, Paragraph 1 of the Company Act for SSC, approval at the general meeting of shareholders of the Company and SSC for the signing of the absorption-type company split agreement will be omitted.

2)Method of the company split

This is an absorption-type company split in which the Company will be a splitting company and SSC will be a successor company.

3)Details of allotments related to the company split

As this Company Split will be carried out between the Company and its wholly owned subsidiary, there will be no allocation of the Company’s shares or grant of other monetary compensation as a result of this Company Split.

4)Handling of subscription rights to shares and corporate bonds with subscription rights to shares associated with the company split

Not applicable.

5)Increase / decrease of capital through company split

There will be no change in the capital of the Company associated with this Company Split.

6)Rights and obligations to be succeeded by the successor company

Successor company will succeed the rights and obligations based on the assets, liabilities, and contractual status, etc. related to the Company’s Gaming Business on the split date.

7)Prospect of fulfillment of obligations

The Company has evaluated that there are no issues with the fulfillment of liabilities to be incurred by the successor company through this Company Split.

8)Overview of the companies involved in the Company Split (as of January 31, 2025)

|

|

Splitting company |

Successor company |

|

(1) Name |

SEGA SAMMY HOLDINGS INC. |

SEGA SAMMY CREATION INC. |

|

(2) Location |

Sumitomo Fudosan Osaki Garden Tower, 1-1-1, Nishi-Shinagawa, Shinagawa-ku, Tokyo |

|

|

(3) Job Title/Name of Representative |

Haruki Satomi President and Group CEO, Representative Director |

Naoki Kameda President and CEO |

|

(4) Details of business |

Business management and incidental operations of SEGA SAMMY group, as a holding company for a comprehensive entertainment corporate group |

Development, manufacturing, and sales of land-based and online/social casino gaming products and software |

|

(5) Capital stock |

JPY 29.9 billion |

JPY 10 million |

|

(6) Date of establishment |

October 1, 2004 |

June 3, 2013 |

|

(7) Number of shares outstanding |

241,229,476 shares |

1,000 shares |

|

(8) Fiscal year end |

March 31 |

March 31 |

|

(9) Major shareholders and share ratio (as of September 30, 2024) |

HS Company 18.12% The Master Trust Bank of Japan, Ltd. (Trust account) 12.25% STATE STREET BANK AND TRUST COMPANY 505001 6.76% FSC Co. 6.35% Custody Bank of Japan, Ltd. (Trust account) 4.63% KOREA SECURITIES DEPOSITORY-SAMSUNG 2.62% |

SEGA SAMMY HOLDINGS INC. 100% |

|

(10) Financial status and operating results for the previous fiscal year (Unit: million yen unless otherwise indicated) |

||

|

Net assets |

357,702 |

-9,505 |

|

Total assets |

653,994 |

6,451 |

|

Net assets per share (yen) |

1,652.29 |

-9,505,394.72 |

|

Net Sales |

468,925 |

1,948 |

|

Operating income |

57,865 |

-75 |

|

Ordinary income |

59,778 |

400 |

|

Profit attributable to owners of parent |

33,055 |

400 |

|

Earnings per share (yen) |

150.75 |

400,308.85 |

9)Overview of the business to be transferred through company split

ⅰ. Details of the business to be split

Head office function of the Company’s Gaming Business (Administrative work)

ⅱ.Operating results of the business to be split (as of the end of FY2024/3)

As the business to be split serves the management work, sales are not recorded.

ⅲ.Assets and liabilities to be split (as of May 31, 2025)

(Unit: million yen)

|

Assets |

Liabilities |

||

|

Item |

Book value |

Item |

Book value |

|

Current assets |

51,233 |

Current liabilities |

29 |

|

Non-current assets |

47,329 |

Non-current liabilities |

155 |

|

Total assets |

98,562 |

Total liabilities |

184 |

(Note 1) The above is an estimate calculated as of today, assuming May 31, 2025, and the actual amount of assets and liabilities to be split may differ from the above amount.

(Note 2) The part of the assets to be split, which are listed above, include all common shares of PSS. PSS will become an equity-method affiliate of SSC as a result of this Company Split.

- Status after the Company Split

There will be no change to the names, addresses, business activities, capital or fiscal year-end of the Company or SSC as a result of this Company Split.

- Future Outlook

The impact of this acquisition on the Company’s consolidated financial results will be immaterial as this Company Split will be carried out between the Company and wholly owned subsidiary of the Company.

(Reference: Conceptual diagram of the change in the structure of the Gaming Business, including the organizational restructuring)

*1 Expected closing schedule for the acquisition of GAN Limited and Stakelogic B.V. is Q1 of FY2026/3

-END-