Management Policy

Business Strategies

Business Summary

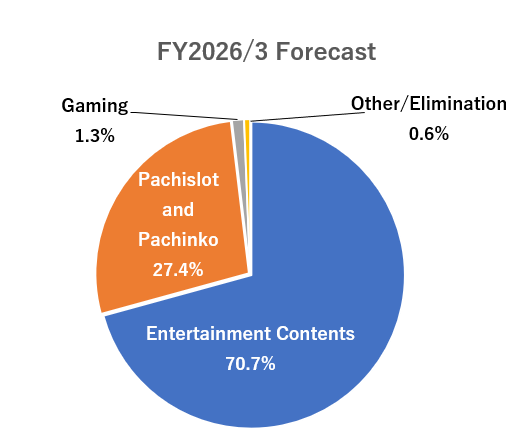

The SEGA SAMMY Group is mainly comprised by the Entertainment Contents Business, which offers a diversity of fun through consumer and arcade game content, toys and animation; the Pachislot and Pachinko Machines Business, which conducts everything from development to sales of Pachinko/Pachislot machines; and the Gaming Business, which operates integrated resorts and develops casino gaming products and software.

Business Plan

| FY2025/3 Results | FY2026/3 Forecast | |||

|---|---|---|---|---|

| Net sales | Overall | 428.9 | 475.0 | |

| Entertainment Contents | 321.5 | 336.0 | ||

| Pachislot and Pachinko Machines | 97.1 | 130.0 | ||

| Gaming | 5.4 | 6.0 | ||

| Other / Elimination | 4.9 | 3.0 | ||

| Adjusted EBITDA | Overall | 62.2 | 67.5 | |

| Entertainment Contents | 48.1 | 50.0 | ||

| Pachislot and Pachinko Machines | 24.2 | 33.0 | ||

| Gaming | 1.0 | -2.5 | ||

| Other / Elimination | -11.1 | -13.0 | ||

(Billion yen)

Sales Composition

Business Plan by Segment / External Environment

1. Entertainment Contents Business

Business Plan

| FY2025/3 Results | FY2026/3 Forecast | |

|---|---|---|

| Net Sales | 321.5 | 336.0 |

| Operating Income | 40.8 | 39.5 |

| Ordinary Income | 41.8 | 40.0 |

| Adjusted EBITDA | 48.1 | 50.0 |

(Billion yen)

FY2025/3 Results

Significant increase in profit compared to FY2024/3 as a result of strong performance in CS and Animation

- Strong performance of high-margin repeat sales, DLC sales and license revenue (CS)

- While sales of new mainstay titles performedwell, development of onetitle was canceled (CS)

- Revenue of Sonic’s cinematic releases increased (Animation)

FY2026/3 Forecast

Sales and adjusted EBITDA increase as a whole

- In Full Game, sales of new titles expected to be at the same level as FY2025/3 and repeat sales expected to increase (CS)

- Launch mainstay IP titles, etc. in F2P (CS)

- Advertising expenses expected to increase (CS)

- Allocated revenue of Sonic’s cinematic releases expected to decline reactively from the strong performance in the previous fiscal year (Animation)

- Strengthen the overseas sales of prizes (AM&TOY)

External Environment

Consumer area

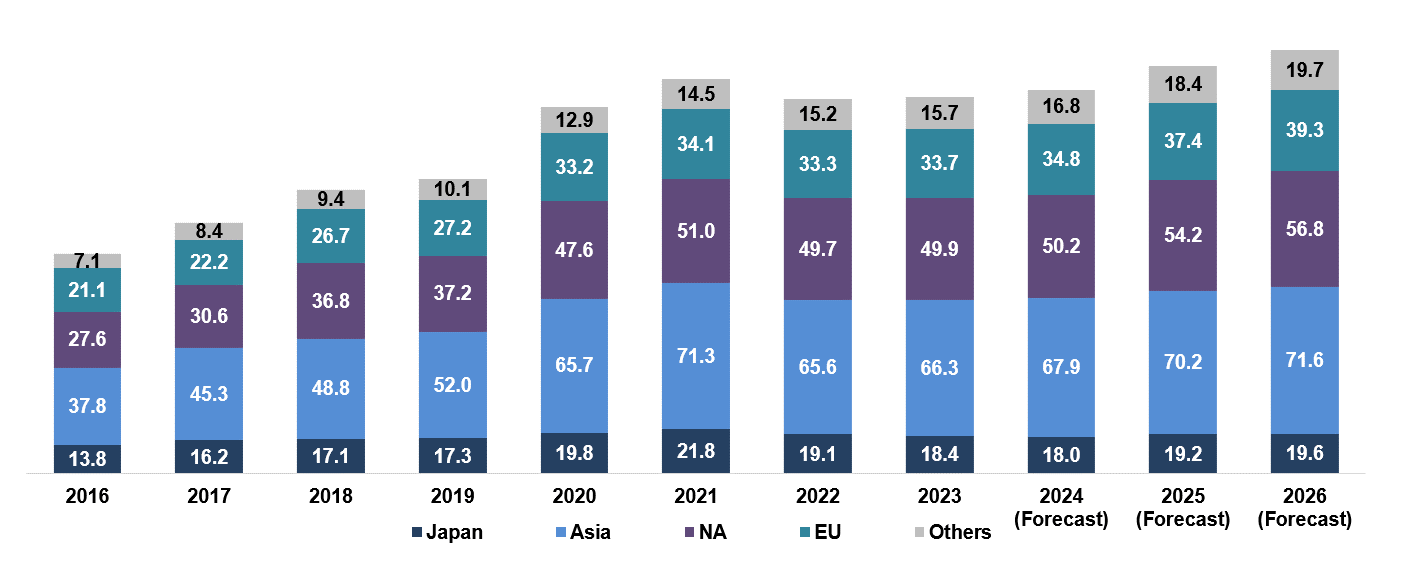

Strong ongoing growth expected in the global video games market

The global game content market continues to grow against the backdrop of rising download sales and the proliferation of game distribution platforms. Although the Amusement Machine Sales and Amusement Center Operations markets were hard hit by COVID-19, the prizes began to rally in 2021 and the market is recovering gradually.

Diversification of the way to interact with games and expansion of eco system

The acceleration of Digital Transformation (DX) and the emergence of new technologies such as 5G and cloud services have greatly influenced and shaped the entertainment industry. Traditionally, games and other kinds of entertainment-related content were distributed separately by device and by region in a form of package. Nowadays however, it is easier than ever for our products and services to reach users all over the world via digital distribution channels.

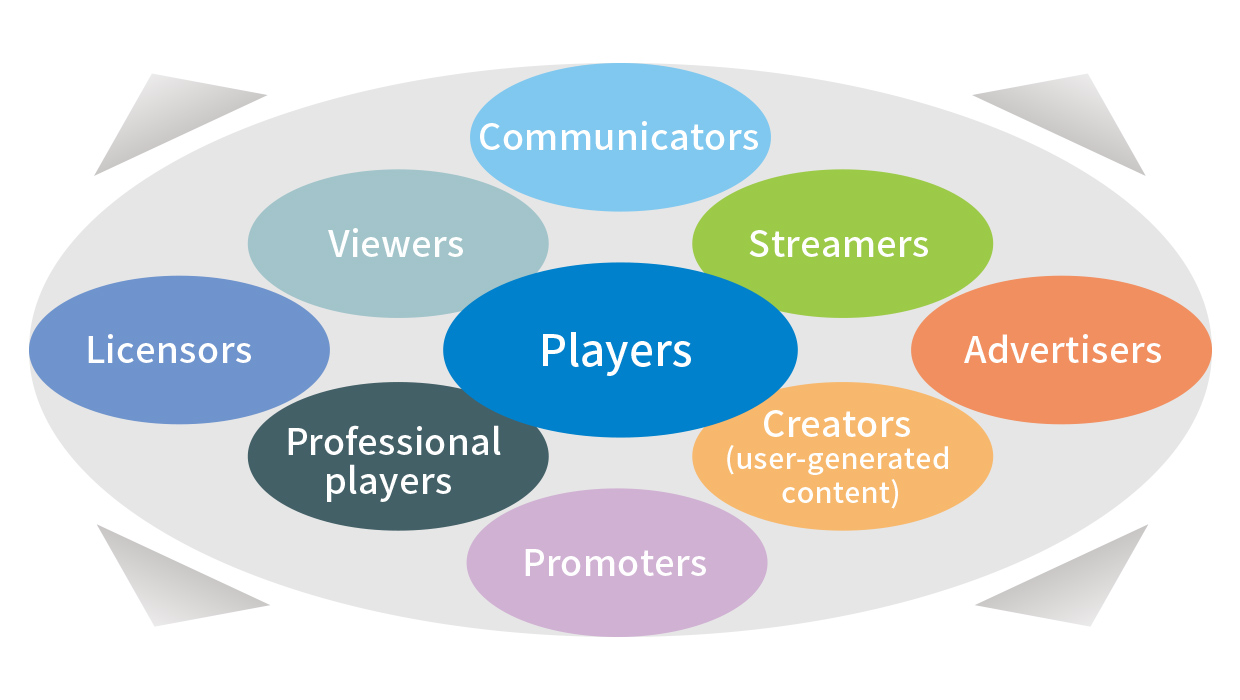

The way people interact with games is also becoming far more diverse than in the past. Game players are naturally at the center of the ecosystem. The broader ecosystem is also expanding, though, as games draw together many people on a global scale, to encompass not only game players but also, for example, streamers who broadcast their games and their viewers. These factors are also expected to fuel growth in the game population going forward.

Example of an ecosystem based on video game

Amusement Machine Area

| FY2014 | FY2021 | |

|---|---|---|

| Amusement machine sales | ¥161.1 billion | ¥152.0 billion |

| FY2014 | FY2021 | |

|---|---|---|

| Revenues from amusement center operations | ¥422.2 billion | ¥449.2 billion |

The Amusement Machine and Amusement Center Operations markets were in tough situation as they were hard hit by COVID-19, but they are in gradual recovery trend due to the strong performance of prizes since 2021. On the other hand, the impact of supply chain disruptions and raw material price hikes becomes apparent recently.

2. Pachislot and Pachinko Business

Business Plan

| FY2025/3 Results | FY2026/3 Forecast | |

|---|---|---|

| Net Sales | 97.1 | 130.0 |

| Operating Income | 20.0 | 28.5 |

| Ordinary Income | 20.9 | 33.0 |

| Adjusted EBITDA | 24.2 | 33.0 |

(Billion yen)

FY2025/3 Results

Decrease in sales and profits compared to FY2024/3

- Reactionary decline of Smart PachislotHokuto No Ken,which performed strongly in FY2024/3

- Postponed launch of mainstay titles, etc., to improve product competitiveness

- Main titles sold:

eHokutono Ken 10

Smart PachislotShin Hokuto Muso, etc.

FY2026/3 Forecast

Increase in sales and profits compared to FY2025/3

- Expect a significant increase in unit sales by launching multiple mainstay titles for Pachislot

- Introduce new Pachislotcabinet

External Environment

Along with the slow decline of the player population since 1995, there has been a long-term downtrend in the overall number of pachinko halls, as well as in the number of machines installed and in annual machine turnover. On the other hand, the opening of large pachinko halls and an increase in locations of major hall operators has caused a rise in the number of machines installed per pachinko hall.

Pachinko and Pachislot—Player Numbers and Market Size

Source: White Paper on Leisure Industry 2022, Japan Productivity Center

Pachinko and Pachislot Machines—Unit Sales and Market Size

Source: Yano Research Institute Ltd. “Pachinko Manufacturer Trends 2022” (Research of Japanese Market)

Annual Turnover* and Pachinko Hall Numbers

Source: Annual turnover is in-house calculation. Pachinko hall numbers are from the National Police Agency.

* Annual turnover = Annual unit sales ÷ Machine installations

Utilization Time*

Source: Daikoku Denki Co., Ltd., DK-SIS data

* Number of hours per business day that pachinko or pachislot machines are utilized

In the pachislot and pachinko industry, while the number of pachinko parlors is trending lower amid significant changes in regulatory and market environment, the size of pachinko parlors continues to become larger. As a result, the number of machines per parlor is growing. Removal of pachislot and pachinko machines comply with previous regulations was almost completed by the end of January 2022, as the market completed the migration to machines that comply with current regulation. In pachinko , a number of popular new pachinko machines that conply with new regulations were introduced and in pachislot, the relaxation of voluntary regulations continues intermittently. Concerns have emerged for rising raw materials prices due to the effects of factors such as the global chip shortage, logistics disruptions, and rising oil prices.

Given these circumstances, the Group must strive to maintain and grow its market share by developing and supplying products that offer innovative gameplay; meet market needs; and comply with regulations. Another management issues is the need to improve profitability in various ways, including promoting the standardization of pachislot and pachinko machine components, reducing costs through reuse of components and other measures, and more efficient development.

3.Gaming Business

| FY2025/3 Results | FY2026/3 Forecast | |

|---|---|---|

| Net Sales | 5.4 | 6.0 |

| Operating Income | -0.7 | -1.5 |

| Ordinary Income | 2.1 | 0 |

| Adjusted EBITDA | 1.0 | -2.5 |

(Billion yen)

FY2025/3 Results

Sales increased compared to FY2024/3 and achieved profitability at the ordinary income level

Gaming machine sales:

- Sales of Railroad Riches, compatible with video slot machine cabinet Genesis Atmos®,has been strong in the U.S.

PARADISE SEGGASAMMY:

- Recorded highest level of sales ever in both casino and hotel

- Significant increase in equity-method earnings amount

FY2026/3 Forecast

Increase in sales and decrease in income compared to FY2025/3

- Expect the increase in unit sales, centered on Railroad Riches

- Expect increase in FA costs and other expenses due to M&A implementation

- Expect the contribution to profit in equity-method earnings (PARADISE SEGASAMMY)

- GAN and Stakelogicare not included in the forecast

©2025 GA/DCC

©SEGA

©ATLUS. ©SEGA.

©SEGA FAVE

© SEGA / © Colorful Palette Inc. / © Crypton Future Media, INC. www.piapro.net All rights reserved.

All rights reserved.

©SEGA

©SEGA

©Takashi Yanase/Froebel-kan,TMS,NTV

©Gosho Aoyama/Shogakukan・YTV・TMS 1996

Original comic books created by Monkey Punch

©Monkey Punch All rights reserved ©TMS/NTV All rights reserved

©SEGA FAVE

©2021 San-X Co., Ltd. All Rights Reserved.

©Buronson & Tetsuo Hara/COAMIX 1983, ©COAMIX 2007 Approved No.YSS-324 ©Sammy

©Sammy

©Tetsuo Hara & Buronson/COAMIX 2001, ©Souten no ken 2018 Approved No.YRJ-515 ©Sammy

©Buronson & Tetsuo Hara/COAMIX1983, Approved No.KOW-225 ©2010-2013 Koei Tecmo Games Co., Ltd. ©Sammy

©Sammy

©SOTSU・SUNRISE ©Sammy

©SEGA SAMMY CREATION INC.