Appendices and Data Collection

Recognition for ESG Initiatives

S&P/JPX Carbon Efficient Index

SEGA SAMMY HOLDINGS has been included in “S&P/JPX Carbon Efficient Index” by the Government Pension Investment Fund (GPIF), which is a global environmental stick index. The S&P/JPX Carbon Efficient Index emphasizes the investment weight of companies that are highly carbon efficient, that is, those that emit low greenhouse gas emissions relative to their , and those that actively disclose information about their greenhouse gas emissions.

SEGA SAMMY HOLDINGS Selected for Inclusion in the “Morningstar Japan ex-REIT Gender Diversity Tilt Index

SEGA SAMMY HOLDINGS was selected as a component of the Morningstar’s ESG Index “Morningstar Japan ex-REIT Gender Diversity Tilt Index (GenDi J) .”

As of March 2025, Holdings was rated Group 3. The selection was based on the ESG Index’s assessment of companies’ efforts with regard to gender diversity.

GenDi J was newly adopted by GPIF in April 2023 as an ESG index for domestic stocks.

Selection for Inclusion on the “FTSE JPX Blossom Japan Sector Relative Index”

SEGA SAMMY HOLDINGS has been selected for inclusion in the FTSE JPX Blossom Japan Sector Relative Index since March 2022.

The FTSE JPX Blossom Japan Sector Relative Index is designed as a sector neutral benchmark that reflects the performance of companies demonstrating specific Environmental, Social and Governance (ESG) practices in Japan. The index selects companies with higher ESG Ratings within the top 50% of each sector and supports climate transition to a low carbon economy by evaluating companies’ climate governance and climate change efforts via the Transition Pathway Initiative’s Management Quality Score.

FTSE Russell confirms that SEGA SAMMY HOLDINGS has been independently assessed according to the index criteria, and has satisfied the requirements to become a constituent of the FTSE JPX Blossom Japan Sector Relative Index. The FTSE JPX Blossom Japan Sector Relative Index is used by a wide variety of market participants to create and assess responsible investment funds and other products.

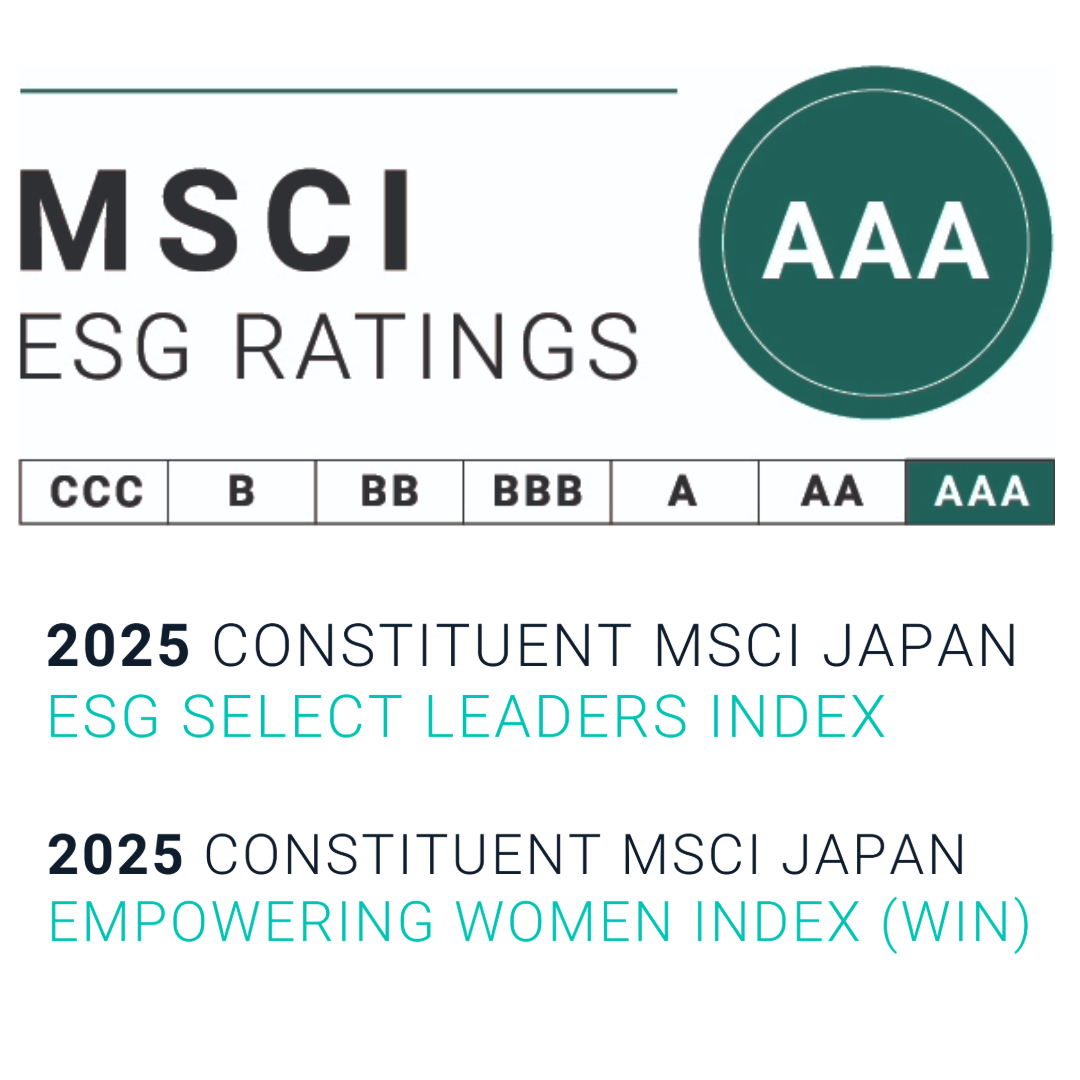

SEGA SAMMY HOLDINGS Received ”AAA” in the MSCI ESG Ratings and Included in the MSCI Japan ESG Select Leaders Index and the MSCI Japan Empowering Women Index (WIN)

Since June 2017, SEGA SAMMY HOLDINGS has been included in the MSCI Japan ESG Select Leaders Index, which is selected by MSCI (Morgan Stanley Capital International, Inc.). In 2023, the ESG rating of SEGA SAMMY HOLDINGS was revised from AA to AAA.

This is an investment index that evaluates the components of the MSCI Japan IMI Top 700 Index * in terms of ESG, and selects the stocks with the highest ratings within the industry. SEGA SAMMY HOLDINGS believe that this review is the result of the effort of our ESG activities and sharing them continuously.

The MSCI Japan ESG Select Leaders Index is a free float-adjusted market capitalization weighted index based on the MSCI Japan IMI Index, its parent index, which includes large, mid and small-cap securities in the Japanese markets. Overall the index targets coverage of 50% of the parent index.MSCI Japan Empowering Women Index (WIN) is designed to represent the performance of Japanese companies that exhibit a commitment towards promoting and maintaining high level of gender diversity among their workforce.

Level B Scores in the CDP Climate Change List

In January 2026, SEGA SAMMY HOLDINGS was rated “B” score in the climate change assessment by CDP (Carbon Disclosure Project).

CDP is an international Non-Profit Organization founded in the United Kingdom in 2000. Through questionnaires on topics such as climate change, protection of water resources, and forest conservation, CDP encourages companies to disclose environmental information, evaluates the disclosures on an eight-level scale from D- to A, and publishes the resulting scores.

“B” score ranks third from the top among the eight levels and is categorized as the “Management” level under CDP’s criteria. This indicates that the Company has been assessed as “understanding its environmental risks and impacts and taking action” and “monitoring those risks and impacts and working to mitigate or eliminate them.”

Based on these results, we will continue to advance our initiatives to move closer to best practices.